Investment Objective The objective of the Scheme is to generate long term capital appreciation by investing in a diversified portfolio. The scheme will be Investing in equity and equity related instruments, debt and money market instruments, Commodities including Exchange Traded Commodity Derivatives However, there is no assurance or…

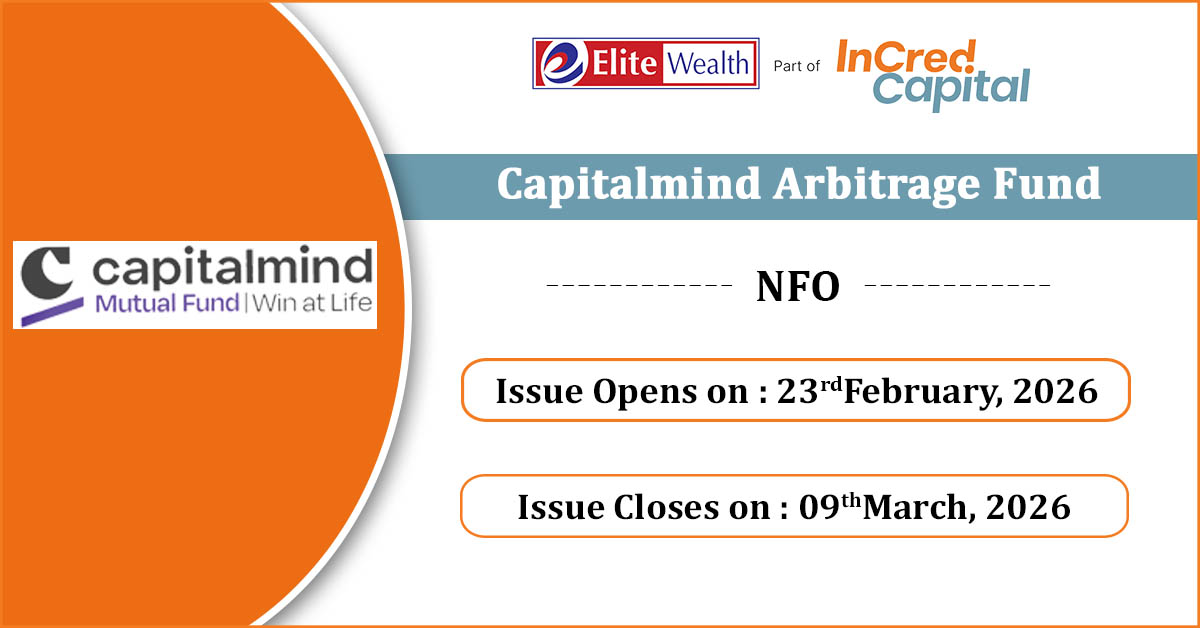

Investment Objective The investment objective of the scheme is to generate Income over short to medium term by predominantly investing in arbitrage opportunities in the cash & derivatives segment of the equity market The Scheme does not guarantee or assure any returns. There is no assurance that the…

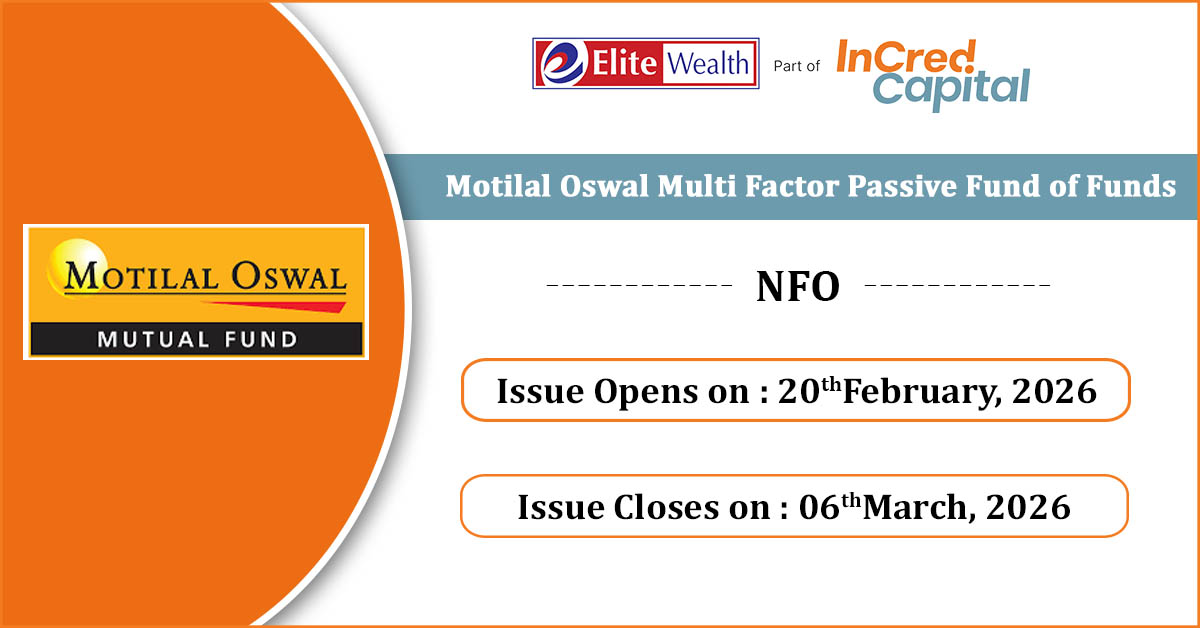

What are factors? Factors are the key drivers that determine a stock's long-term returns and risk characteristics Note: The selection of factors/strategy shall be at the discretion of the Fund Manager, in accordance with the Scheme’s investment objective as per SID. Source: MOAMC Internal. Disclaimer: The illustr... (source:…

Investment Objective The investment objective of the Scheme is to achieve long term capital appreciation by predominantly investing in equity and equity related instruments of technology & technology-related companies. Investment Strategy - T.I.D.E. Technology, Internet and Digital, Data Centers and ancillary and E -commerce/Q-commerce (source: licmf.com) Why LIC MF Technology Fund?…

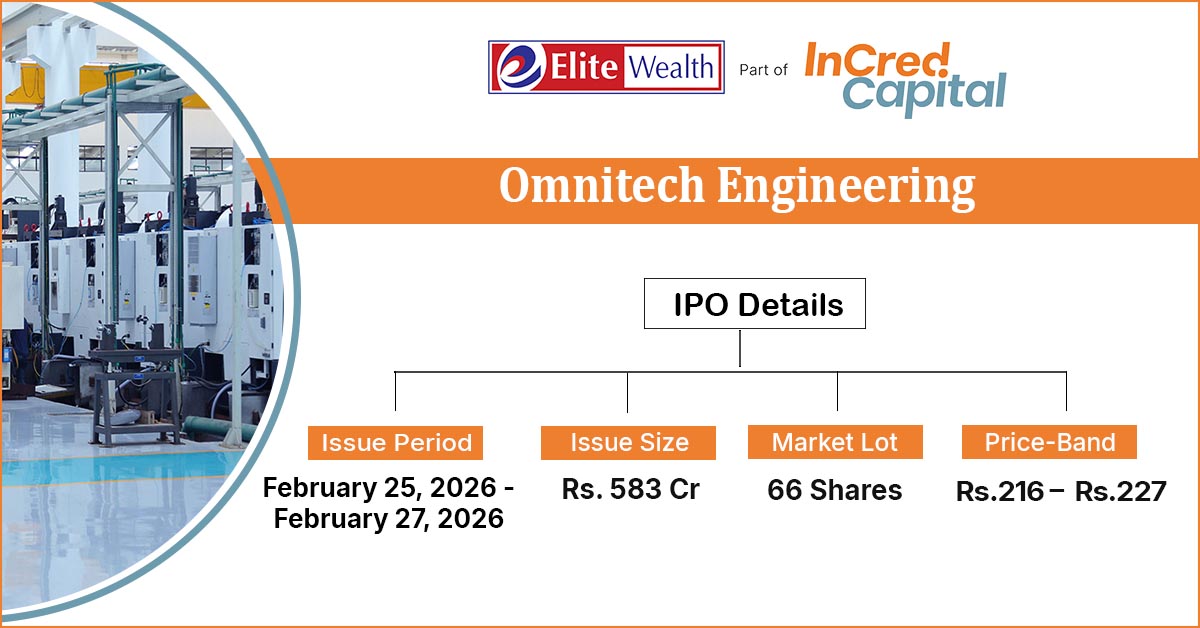

Omnitech Engineering IPO Details IPO Date 25 to 27 Feb, 2026 Listing Date Thu, Mar 5, 2026T Face Value ₹5 per share Price Band ₹216 to ₹227 Lot Size 66 Shares Sale Type Fresh Capital & OFS Issue Type Bookbuilding IPO Listing At BSE, NSE Employee Discount ₹11.00 Total Issue…

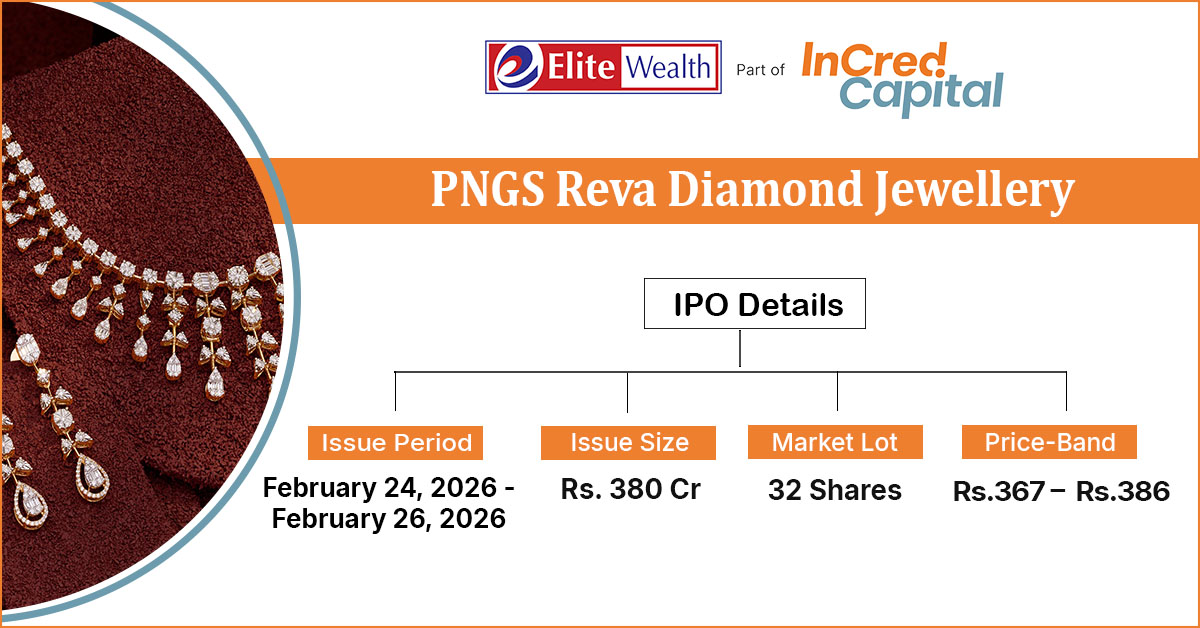

PNGS Reva Diamond Jewellery IPO Details IPO Date 24 to 26 Feb, 2026 Listing Date Wed, Mar 4, 2026T Face Value ₹10 per share Price Band ₹367 to ₹386 Lot Size 32 Shares Sale Type Fresh Capital Issue Type Bookbuilding IPO Listing At BSE, NSE Total Issue Size 98,44,559 shares (agg.…

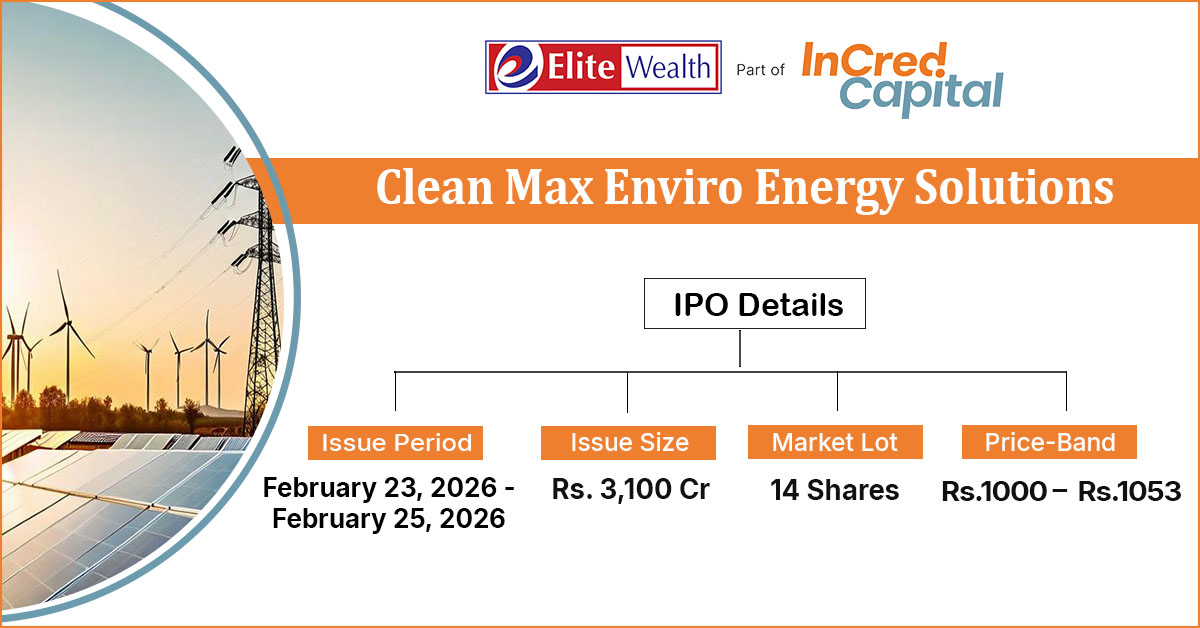

Clean Max Enviro Energy Solutions IPO Details IPO Date 23 to 25 Feb, 2026 Listing Date Mon, Mar 2, 2026T Face Value ₹1 per share Price Band ₹1000 to ₹1053 Lot Size 14 Shares Sale Type Fresh Capital & OFS Issue Type Bookbuilding IPO Listing At BSE, NSE Employee Discount…

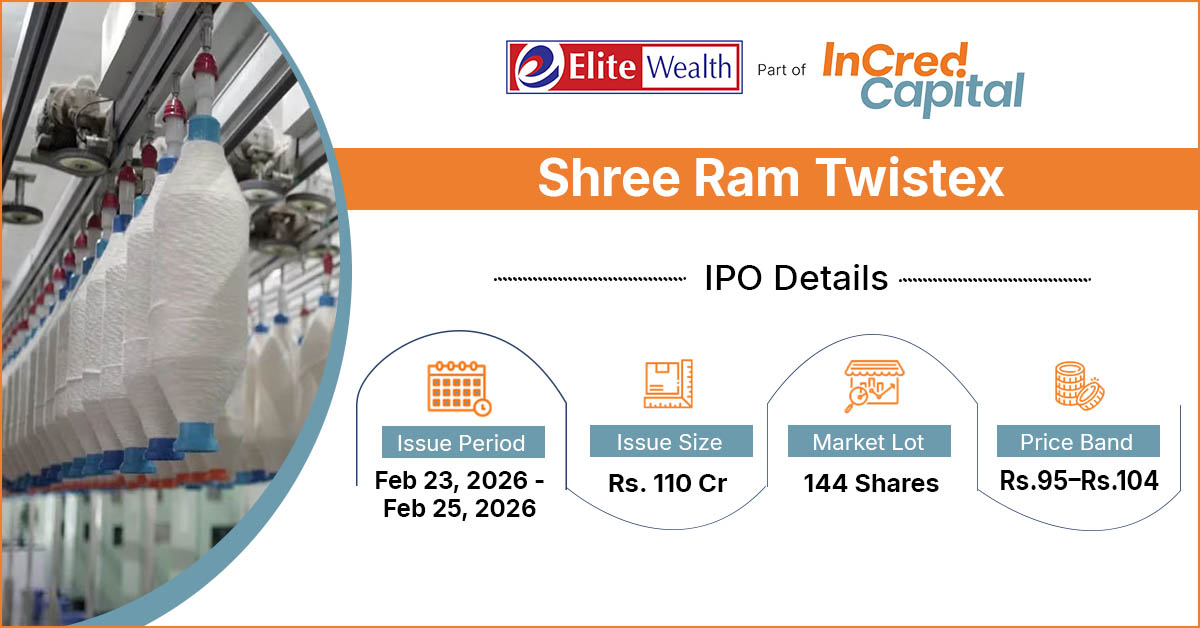

Shree Ram Twistex IPO Details IPO Date 23 to 25 Feb, 2026 Listing Date Mon, Mar 2, 2026T Face Value ₹10 per share Price Band ₹95 to ₹104 Lot Size 144 Shares Sale Type Fresh Capital Issue Type Bookbuilding IPO Listing At BSE, NSE Total Issue Size 1,06,00,000 shares (agg. up…

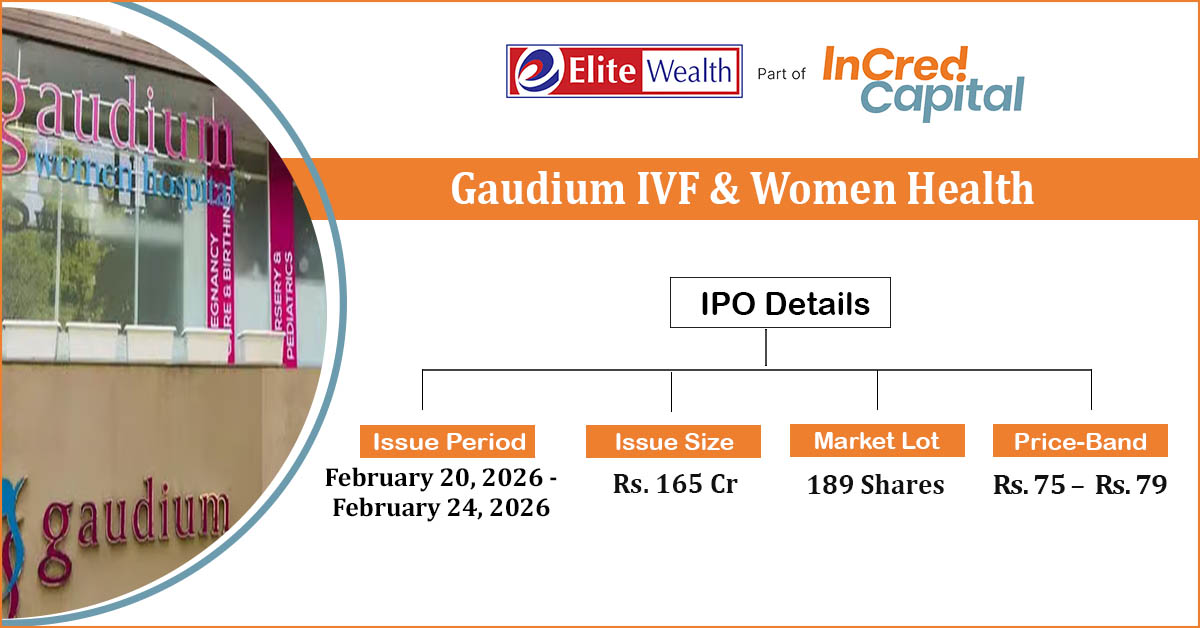

Gaudium IVF & Women Health Limited IPO Company Profile: Gaudium IVF and women health limited is a specialized fertility care provider offering assisted reproductive and women’s health services across India. It has expanded through a hub-and-spoke model, operating 30+ locations comprising 7 advanced hubs and 28 spoke centers…

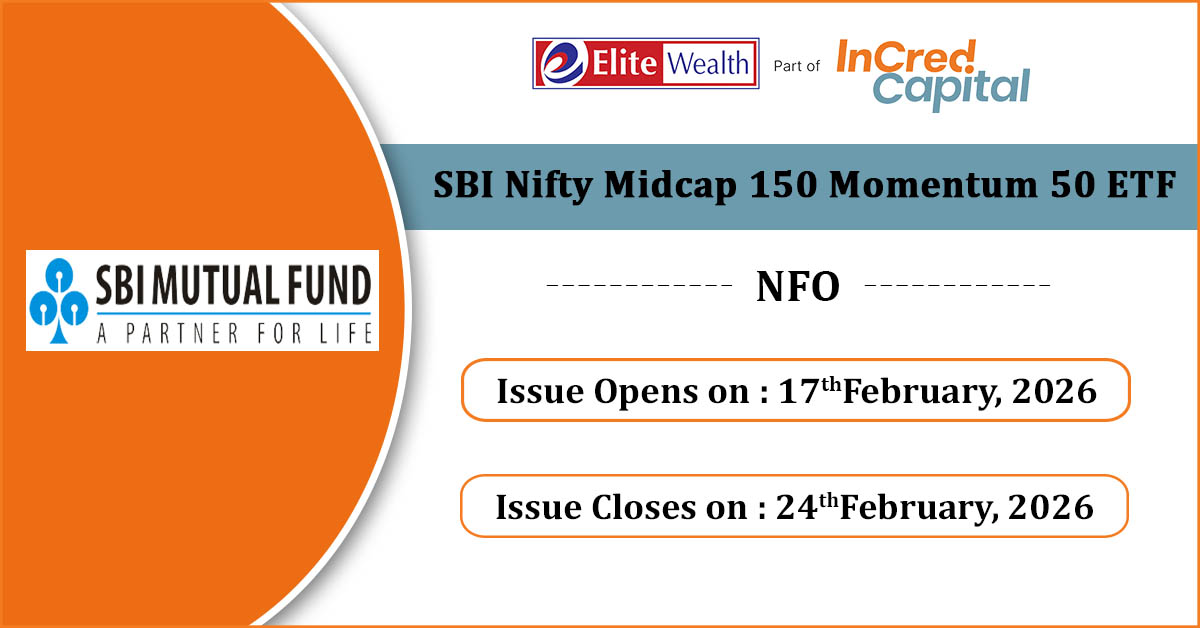

SBI Nifty Midcap 150 Momentum 50 ETF NFO Investment Objective: The investment objective of the scheme is to provide returns that, closely correspond to the total returns of the securities as represented by the underlying index, subject to tracking error. However, there is no guarantee or assurance that…