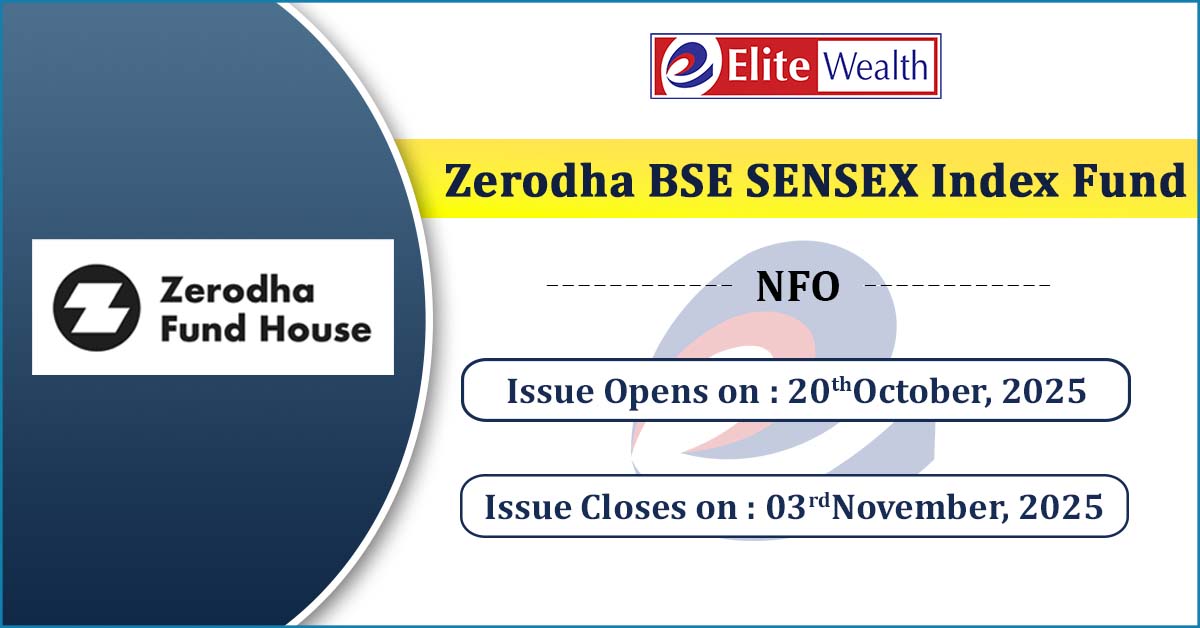

Zerodha BSE SENSEX Index Fund NFO About the fund: The Zerodha BSE SENSEX Index Fund offers a simple way to invest in India's first and oldest stock market index – the BSE SENSEX index. This single fund provides exposure to the top 30 companies in India by market…

SMC Global Securities Limited is a diversified financial services company in India offering brokerage services across the asset classes of equities (cash and derivatives), commodities and currency, investment banking, wealth management, distribution of third party financial products, research, financing, depository services, insurance broking (life & non-life), clearing services,…

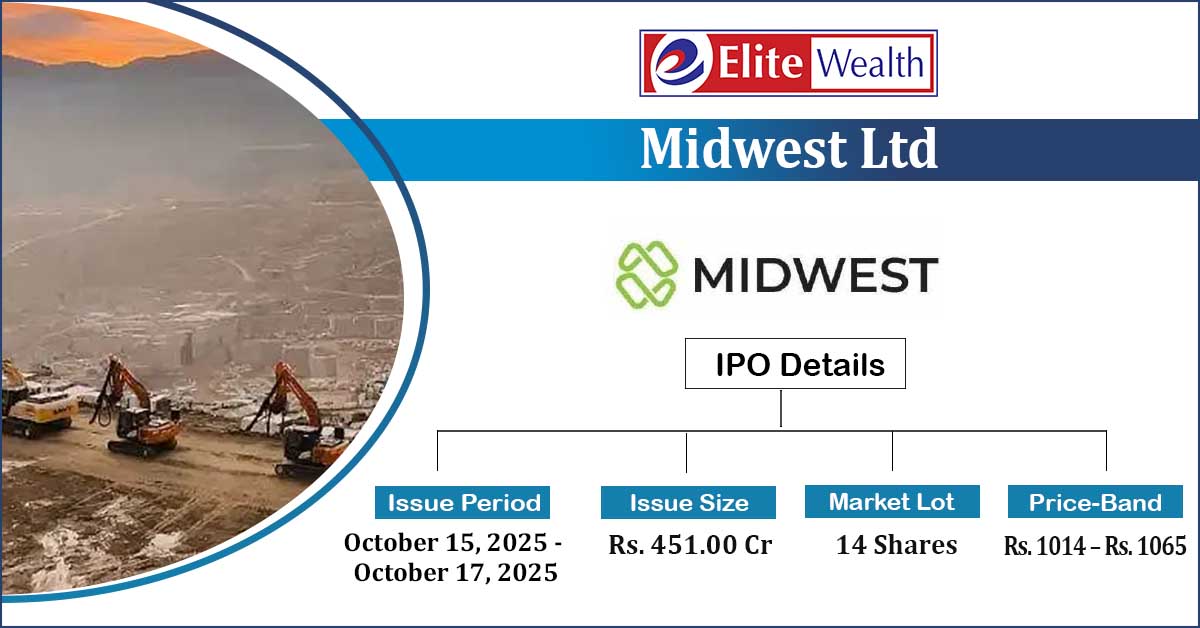

Midwest IPO Details IPO Date October 15, 2025 to October 17, 2025 Listing Date [.] Face Value ₹5 per share Issue Price Band ₹1014 to ₹1065 per share Lot Size 14 Shares Sale Type Fresh Capital-cum-Offer for Sale Total Issue Size 42,34,740 shares (aggregating up to ₹451.00 Cr) Fresh Issue 23,47,417 shares (aggregating…

Why consider the Groww Nifty Smallcap 250 ETF? Seeks exposure to India's small-cap universe The ETF seeks to replicate the Nifty Smallcap 250 Index - TRI¹, which represents 250 small-cap companies ranked 251-500 by market capitalisation within the Nifty 500 universe. Aims to capture India's growth and innovation…

What is Kotak Gold Silver Passive FOF? Kotak Gold Silver Passive FOF is An open-ended fund of fund scheme investing in units of Kotak Gold ETF and Kotak Silver ETF. Investment Objective:- To generate long-term capital appreciation from a portfolio created by investing in units of Kotak Gold…

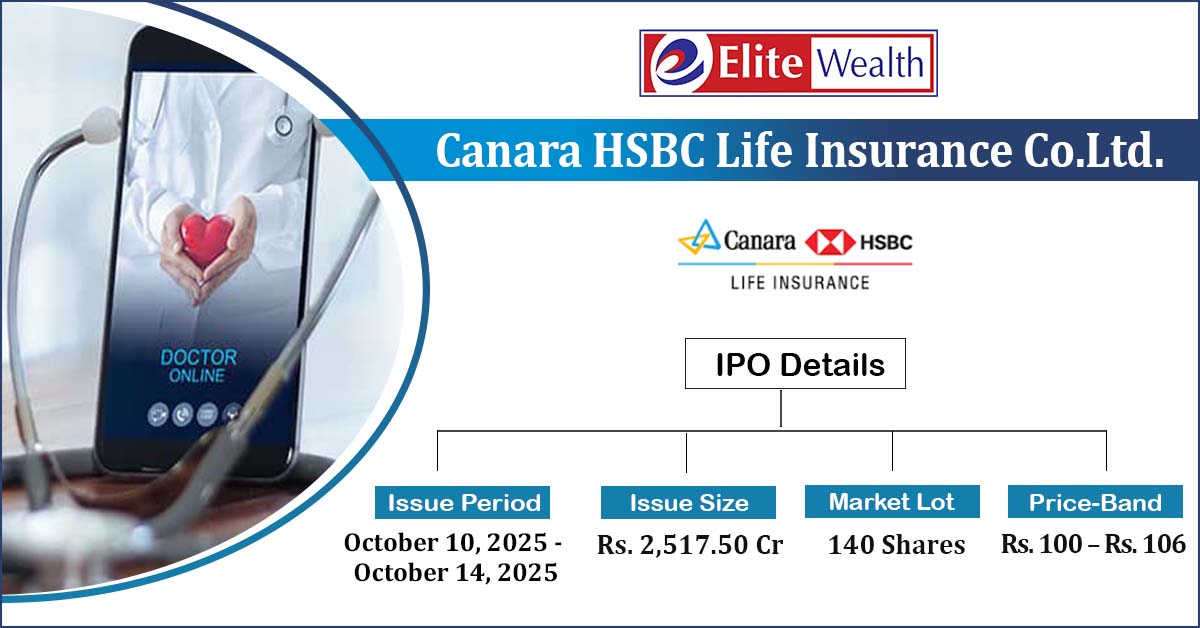

Canara HSBC Life IPO Details IPO Date October 10, 2025 to October 14, 2025 Listing Date [.] Face Value ₹10 per share Issue Price Band ₹100 to ₹106 per share Lot Size 140 Shares Sale Type Offer For Sale Total Issue Size 23,75,00,000 shares (aggregating up to ₹2,517.50 Cr) Employee Discount ₹10.00…

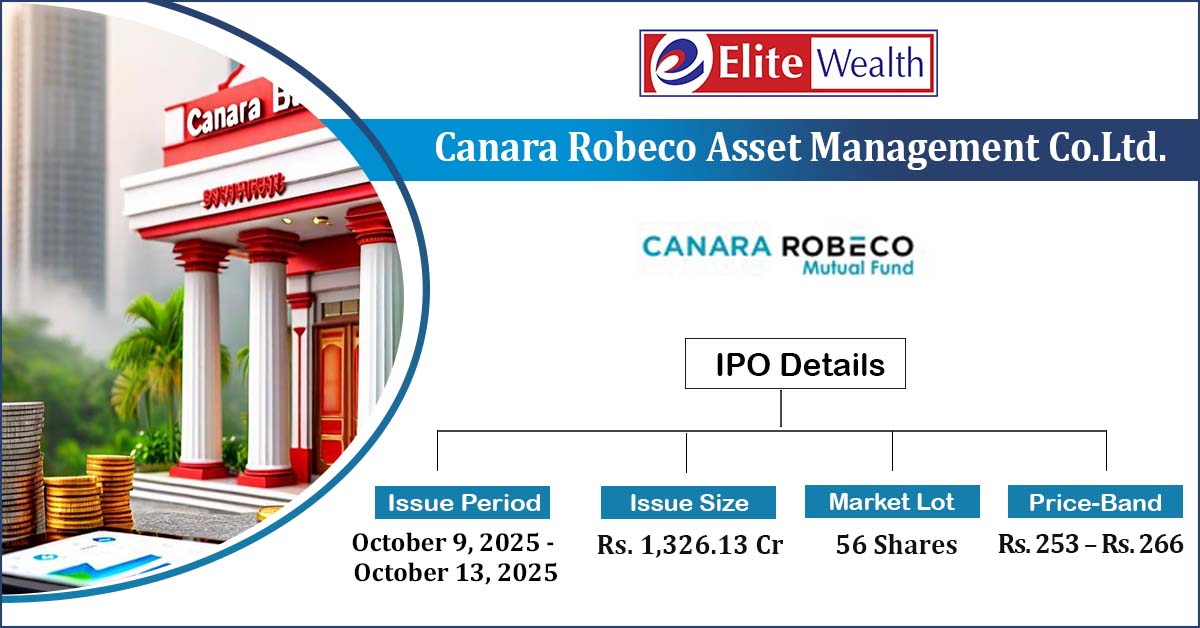

Canara Robeco IPO Details IPO Date October 9, 2025 to October 13, 2025 Listing Date [.] Face Value ₹10 per share Issue Price Band ₹253 to ₹266 per share Lot Size 56 Shares Sale Type Offer For Sale Total Issue Size 4,98,54,357 shares (aggregating up to ₹1,326.13 Cr) Issue Type Bookbuilding IPO Listing…

Rubicon Research IPO Details IPO Date October 9, 2025 to October 13, 2025 Listing Date [.] Face Value ₹1 per share Issue Price Band ₹461 to ₹485 per share Lot Size 30 Shares Sale Type Fresh Capital-cum-Offer for Sale Total Issue Size 2,84,02,040 shares (aggregating up to ₹1,377.50 Cr) Fresh Issue 1,03,09,278 shares…

ICICI Prudential Conglomerate Fund: Some of India’s biggest business groups operate across sectors/industries — from energy and infrastructure to telecom, retail and finance*. These are conglomerates: promoter-led entities with multiple listed companies under a single umbrella, which are diversified. As markets evolve, these groups are well-positioned to manage…

LG Electronics IPO Details IPO Date October 7, 2025 to October 9, 2025 Listing Date [.] Face Value ₹10 per share Issue Price Band ₹1080 to ₹1140 per share Lot Size 13 Shares Sale Type Offer For Sale Total Issue Size 10,18,15,859 shares (aggregating up to ₹11,607.01 Cr) Employee Discount ₹108.00 Issue…