Carraro India Limited IPO Company Profile:

Carraro India Limited, incorporated in 1997 specializes in the design and manufacturing of crucial mechanical components, primarily axles and transmission systems, for agricultural tractors and construction vehicles. The company also supply gears, shafts, and ring gears for industrial and automotive vehicles. Additionally, they provide spare parts, primarily individual components for agricultural tractors and construction vehicles, along with other non-essential parts for these vehicles. The company also has its own two manufacturing plants in Pune, Maharashtra.

| IPO-Note | Carraro India Limited |

| Rs.668– Rs.704 per Equity share | Recommendation: Apply |

Sanathan Textiles Limited IPO Details :

| Issue Details | |

| Objects of the issue |

· Entirely offer for sale |

| Issue Size | Total issue Size – Rs.1250 Cr

Offer for sale- Rs 1250 Cr |

| Face value |

Rs.10 |

| Issue Price | Rs.668 – Rs.704 per share |

| Bid Lot | 21 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | December 20, 2024 – December 24, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Carraro India Limited IPO Strengths:

-

The company offers wide array of products across various types of vehicles, ensuring that they meet the needs of different sectors (agriculture, construction, industrial, automotive). This diversity allows their customers to rely on a single manufacturer for multiple components, simplifying their procurement process.

-

The company is part of the Carraro Group, which has a strong global presence in countries such as Brazil, China, United States, and more. In FY24, the company itself generated 35.87% of its revenue from exports, reflecting its expanding international reach.

-

The industry in which the company operates holds significant potential both in India and internationally. In India, the demand for industrial products, agricultural tractors, and other vehicles is expected to grow due to the government’s focus on infrastructure development, increasing urbanization, and subsidies provided for agricultural equipment.

-

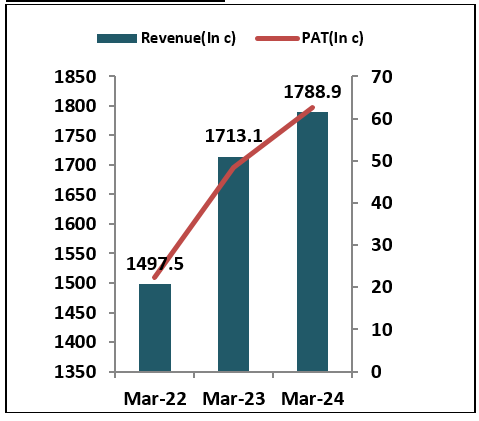

The company reported a revenue of ₹1788.9crores in FY24, reflecting a 4.5% increase compared to FY23. Additionally, the Profit after Tax (PAT) for the same period was ₹62.5 crores, marking a 29% growth over FY23. For period ended September 2024, company has revenue of Rs 914 crores.

Carraro India Limited IPO Risk Factors:

-

The industry in which the company operates is highly competitive, with key competitor like Escorts Kubota, Ramkrishna Forgings etc.

-

Compared with its peers, company has low PAT margin of just 3.5% in FY24.

-

The agricultural tractor component business is seasonal, with sales typically peaking during the monsoon season.

Carraro India Limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Carraro India Limited IPO Allotment Status

Carraro India Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Carraro India Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 100% | 68.76% |

| Others | – | 31.24% |

Carraro India Limited IPO Outlook:

Carraro India Limited is a prominent player in the mechanical components industry, benefiting from the strong brand reputation of its parent company, Carraro Group, which has a global presence. The industry itself is expected to experience significant growth, driven by the increasing demand for infrastructure and industrial products. In terms of valuation, the company’s post IPO P/E ratio stands at 40.2, based on the estimated FY25 annualized EPS of Rs 17.5, which seems slightly overvalued. Therefore, we recommend investors to apply for the issue, considering the potential for listing gains and long-term value creation.

Carraro India Limited IPO FAQ:

Ans. Carraro India IPO is a main-board IPO of 17755680 equity shares of the face value of ₹10 aggregating up to ₹1,250.00 Crores. The issue is priced at ₹668 to ₹704 per share. The minimum order quantity is 21.

The IPO opens on December 20, 2024, and closes on December 24, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Carraro India IPO opens on December 20, 2024 and closes on December 24, 2024.

Ans. Carraro India IPO lot size is 21, and the minimum amount required is ₹14,784.

Ans. The Carraro India IPO listing date is on Monday, December 30, 2024.

Ans. The minimum lot size for this upcoming IPO is 21 shares.