| IPO Note | C.E. Info Systems Ltd |

| Rs 1000-Rs 1033 per Equity share | Recommendation: Subscribe |

C.E. Info systems limited IPO (MapmyIndia IPO) Company Profile: –

C.E. Info Systems Limited (also known as MapmyIndia) provide various products, platforms, application programming interfaces (“APIs”), Software Development Kits (“SDK”) and solutions across a range of digital map data, software and IoT for the Indian market under the “MapmyIndia” brand, and for the international market under the “Mappls” brand. They offer digital maps as a service (“MaaS”), Platform as a service (“PaaS”) and Software as a service (“SaaS”). They are India’s leading provider of geospatial software, advanced digital maps, and location-based IoT technologies. Their digital maps cover 62.9 lakh kms of roads in India, representing 98.50% of India’s road network. Their digital map data provides information of 7,933 towns, 6,37,472 villages, 1.78 Crore places across many categories such as restaurants, malls, hotels, police stations, EV charging stations etc., and 1.45 Crore house or building addresses.

C.E. Info systems limited IPO (MapmyIndia IPO) Details –

| Issue Details | |

| Objects of the issue | ·To get the benefit of listed company and enhance company’s brand value. |

| Issue Size | Total issue Size -Rs. 1040 Cr.

Offer for Sale – Rs. 1040 Cr. |

| Face value | Rs.2.00 Per Equity Share |

| Issue Price | Rs. 1000 – Rs. 1033 |

| Bid Lot | 14 shares |

| Listing at | BSE, NSE |

| Issue Opens: | 9th Dec, 2021 – 13th Dec, 2021 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check C.E. Info systems limited IPO (MapmyIndia IPO) Allotment Status

Go C.E. Info systems limited IPO (MapmyIndia IPO) allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

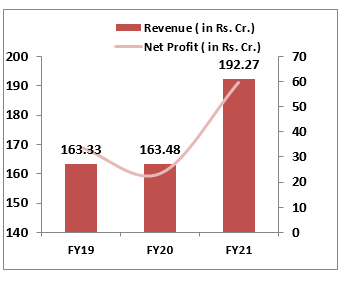

C.E. Info systems limited IPO (MapmyIndia IPO) Financial Performance:

C.E. Info systems limited IPO (MapmyIndia IPO) Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 61.71% | 53.73% |

| Public | 38.29% | 46.27% |

Source: RHP, EWL Research

C.E. Info systems limited IPO (MapmyIndia IPO) Strengths:

-

Market Leader in India to offer SaaS, PaaS and MaaS to its B2B and B2B2C enterprise customers;

-

Marquee customers across sectors with strong relationships and capability to up-sell and cross-sell such as HDFC Bank, Airtel, Hyundai, MG Motor, PhonePe, Flipkart, Goods and Service Tax Network (“GSTN”), Mahindra, TVS, Maruti Suzuki, Apple ( India) etc.

-

Company consistently showing strong financial numbers and have profitable business model.

-

Backed by Marquee Investors such as PhonePe, Qualcomm, and Zenrin. However, Qualcomm and Zenrin are selling 60% and 58% of their total stake respectively.

C.E. Info systems limited IPO (MapmyIndia IPO) Key Highlights:

-

Revenue has increased with a CAGR of 8.50% from FY19 to FY21.

-

Profit of the company has increased with a CAGR of 33.05% from FY19 to FY21. EBITDA margin has improved drastically from 18.9% to 33.7% in last three year due to better cost management.

-

In FY21 company has cash flow from operation of ₹ 83.28 crore and free cash flow of ₹ 80.92.

-

Cash Flow from Operation to EBITDA stands at 0.40 as on 30th Sept, 2021 vs. 1.57 as on 31st March, 2021.

-

In FY 21, Company has Return on Net Worth of 16.60% vs. 7.79% in FY 20.

C.E. Info systems limited IPO (MapmyIndia IPO) Risk Factors:

-

A failure or disruption in digital map database or system failures may result adverse impact on business and its operations.

-

Since this is an Offer for Sale so the fund raised cannot be utilized for the growth of the company.

C.E. Info systems limited IPO (MapmyIndia IPO) Outlook:

Mapmyindia is market leader in B2B and B2B2C segment in India with a comprehensive suite of SaaS, PaaS and MaaS offerings. With the adoption of company’s solution and product by new age companies and start-up companies across consumer tech, last-mile delivery, shared mobility and e-commerce is helping them to scale rapidly. The total Indian addressable market of digital maps and location-based intelligence services is expected to grow to USD 7.74 billion (Rs 47,490 Crore) in 2025 at around 15.5% CAGR from 2019 to 2025. At higher band price, Company is available at a P/E of 91x on FY21 which is quite high. Considering the asset light business model, robust financials and strong clientele, we recommend subscribe to the IPO with long term view.

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitewealth.in. with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitewealth.in.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL

Need An Assistance:

C.E. Info systems limited IPO (MapmyIndia IPO) FAQ

Ans. C.E. Info systems limited IPO (MapmyIndia IPO) will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The company will open for subscription on 09 December 2021.

Ans. The minimum lot size that investors can subscribe to is 14 shares.

Ans. The C.E. Info systems limited IPO (MapmyIndia IPO) listing date is 21 December 2021.

Ans. The minimum lot size for this upcoming IPO is 14 shares.

Ans. Link Intime India Pvt Ltd will be the registrar for this upcoming IPO.