Blue Jet Healthcare Limited IPO Company Profile :

Blue Jet Healthcare Limited (BJHL) is a specialty pharmaceutical and healthcare ingredient and intermediate co., offering niche products targeted toward innovator pharmaceutical companies and multi-national generic pharmaceutical companies. Due to early and strategic investments in manufacturing infrastructure and research and development (“R&D”), the co. has developed a contract development and manufacturing organization (CDMO) business model with specialized chemistry capabilities in contrast to media intermediates and high-intensity sweeteners. In contrast to media intermediates and high-intensity sweeteners like saccharin and its salts, the co. possesses competencies and manufacturing capabilities. The co. manufactures a range of products in-house, including the key starting intermediate and advanced intermediates, which allows it to control its production process for consistent quality and cost-effectiveness. It serves more than 400 customers in 39 countries including Colgate-Palmolive, Unilever, Prinova and MMAG.

| IPO-Note | Blue Jet Healthcare Limited |

| Rs.329 – Rs.346 per Equity share | Recommendation: Subscribe |

Blue Jet Healthcare Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To gain the listing benefits |

| Issue Size | Total issue Size – Rs.840.27 Cr.

Fresh Issue – Rs.840.27 Cr. |

| Face value | Rs.2 |

| Issue Price | Rs.329 – Rs.346 |

| Bid Lot | 43 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 25th Oct, 2023 – 27th Oct, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Blue Jet Healthcare Limited IPO Product Categories:

- Contrast Media Intermediates:

Contrast media are agents used in medical imaging to enhance the visibility of body tissues under X-rays, computed tomography (“CT”), magnetic resonance imaging (“MRI”), or ultrasound. The global contrast media formulation market had a market size of US $6.7billion in terms of moving annualturnover2425for March 2022. The market is expected to grow at a CAGR of 8-10% between the Financial Years 2022 and 2025, with growth expected to be primarily led by volume. It is dominated by four contrast media manufacturers, namely GEHealthcare, Guerbet, Bracco, and Bayer. The company supplies a critical starting intermediate and several advanced intermediates primarily to three of the largest contrast media manufacturers in the world, including GE Healthcare, Guerbet, and Bracco, directly.

- High-intensity Sweeteners:

High-intensity sweetener business involves the development, manufacture, and marketing of saccharin and its salts, which is backward integrated with the aim to ensure environmental sustainability with zero by-products and cost-effective production processes. The global high-intensity sweetener market was estimated to be between US$2.3 billion to US$2.4 billion in size, as of the calendar year 2021, comprising products such as sucralose, aspartame, saccharin and stevia, and neotame. As a result of the consistent quality of the company’s high-intensity sweeteners, it has become part of the select supplier base of several multi-national companies in the oral care and non-alcoholic beverage markets, such as Colgate Palmolive (India) Limited, Unilever, Prinova US LLC, and MMAG Co. Ltd, and many other international and domestic customers across all end product categories.

- Pharma Intermediates and APIs:

CDMO activity in the pharma intermediate and API business primarily focuses on collaborating with innovator pharmaceutical companies and multi-national generic pharmaceutical companies by providing them with pharma intermediates that serve as building blocks for APIs in chronic therapeutic areas, such as the cardiovascular system (“CVS”), oncology and central nervous system (“CNS”), including new chemical entities (“NCEs”).

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Plaza Wires IPO Allotment Status

Plaza Wires IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Revenue from the products:

| Segment | FY-22(in cr.) | % | FY-21(in cr.) | % | FY-20(in cr.) | % |

| Contrast media intermediates | 477.83 | 70.64 | 353.58 | 71.57 | 416.59 | 78.72 |

| High-intensity sweeteners | 157.48 | 23.28 | 98.72 | 19.98 | 87.80 | 16.59 |

| Pharma intermediates and API | 41.15 | 6.08 | 41.76 | 8.45 | 24.79 | 4.68 |

| Total | 676.46 | 100.00 | 494.06 | 100.00 | 529.18 | 100.00 |

Blue Jet Healthcare Limited IPO Financial Analysis:

| Particulars | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR |

| Revenue from sale of products | 676.78 | 494.21 | 529.51 | 8.5% |

| other operating revenue | 6.68 | 4.72 | 8.68 | |

| Cost of goods sold | 287.45 | 169.45 | 210.41 | |

| Employee Cost | 33.03 | 28.95 | 23.87 | |

| Other expenses | 113.71 | 94.46 | 90.18 | |

| EBITDA | 242.59 | 201.35 | 205.05 | 5.8% |

| EBITDA margin% | 35.84% | 40.74% | 38.72% | |

| Depreciation | 22.14 | 19.66 | 18.04 | |

| Interest | 3.3 | 5.3 | 7.36 | |

| PBT | 217.15 | 176.39 | 179.65 | 6.5% |

| Total tax | 61.63 | 48.87 | 49.16 | |

| PAT | 155.52 | 127.52 | 130.49 | 6.0% |

| Dep./revenue% | 3.27% | 3.98% | 3.41% | |

| Int./revenue% | 0.49% | 1.07% | 1.39% |

Blue Jet Healthcare Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 100% | 86.00% |

| Others | 0% | 14.00% |

Source: RHP, EWL Research

Blue Jet Healthcare Limited IPO Strengths:

-

With more than two decades of experience in manufacturing contrast media intermediates, Blue Jet Healthcare Limited is a large manufacturer of contrast media intermediates in India. The contrast media market is a fast growing category, driven by a growing global population, especially in the age group aged 65 years and above, the growing prevalence of lifestyle diseases, rising healthcare expenditures, advancements in diagnostic technologies, increasing convenience of diagnostics services, and increasing demand for preventive healthcare.

-

As a CDMO, Blue Jet Healthcare Limited collaborates and not compete with the customers. With its research and development capabilities, process optimization, technical know-how, knowledge of the regulatory environment, track record of timely fulfilment of customer orders and ability to ramp up manufacturing capacities in close coordination with its key customers, the company has been able to establish long-standing customer relationships in each of the product categories where it operates. More than 60% of the total sales in each of the Financial Years 2020, 2021 and2022 were backed by contracted sales volumes, through both annual and multi-year contracts.

-

In the high-intensity sweetener category, the company’s ability to deliver quality products has enabled it to establish long-term relationships with several key customers, such as Colgate-Palmolive (India) Limited, Unilever, Prinova US LLC, and MMAG Co. Ltd, which have provided the company with a stable stream of revenue from operations.

-

Blue Jet Healthcare Limited’s business is driven by medium-to-long-term supply contracts with agreed-upon volume forecasts by its customers. Accordingly, the company is required to maintain adequate production capacity to meet the volume demands of its customers. The company’s capital expenditure cycles have been planned on the basis of such supply contracts and volume forecasts, which provides it with better predictability regarding its product offtake before it invests in any increases in production capacity, allowing it to optimize its capacity utilization and asset turnover ratio.

-

The company is a major manufacturer of contrast media intermediates in India. It has presence in niche categories with high barriers to entry.

-

BJHL has Long-standing relationships and multi-year contracts with multinational customers.

-

It has strong product development and process optimization capabilities with focus on sustainability.

Blue Jet Healthcare Limited IPO Risk factors:

-

Blue Jet Healthcare Limited’s business is dependent on the sale of its products to a few key customers, including those in Europe and the United States, which are regulated markets. The loss of one or more such customers, the deterioration of their financial condition or prospects, or a reduction in their demand for its products could adversely affect the company’s business, results of operations, financial condition, and cash flows.

-

A significant portion of the total revenue from operations is denominated in currencies other than Indian Rupees, due to which the company faces foreign exchange risks that could adversely affect its results of operations and cash flows.

-

Failure to adhere to contractually agreed timelines to deliver the products on a timely basis, or at all, may have the following consequences, which could adversely affect the company’s business, results of operations, and financial condition: (i) payments to the company for its products may be delayed; (ii)liquidated damages may become payable by ; (iii) performance guarantees may be invoked against the company; (iv)claims may be brought against the company for losses suffered as a result of its non-performance; (v) the clients may terminate the contracts; and (vi) the company’s reputation may be damaged.

-

BJHL relies heavily on a small number of clients which poses a risk, if one or more of these customers reduce their orders or choose to work with competitors.

-

80% of the company’s revenue comes from exports to the US and Europe. The company’s revenue may be impacted by a slowdown in market expansion or the introduction of new competitors in these areas.

-

The company relies on a few key raw material suppliers, with the largest ones in China, Norway, and India. Any disruptions or cost increases in the supply chain could harm its business and financial health.

Blue Jet Healthcare Limited IPO Key Highlights:

-

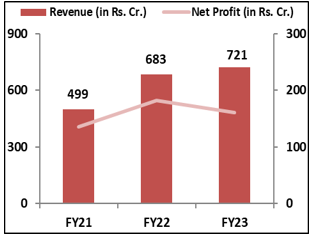

Revenue of the co. has increased from Rs.499 Cr. in FY21 to Rs.721 Cr. in FY23 with a CAGR of 13.1%; while Net Profit grew with nominal CAGR of 5.6% from Rs.136 Cr. in FY21 to Rs.160 Cr. in FY23. The profitability was impacted due to the higher cost of raw materials.

-

Co’s EBITDA Margin & PAT Margin stands at 30.4% & 22% respectively in FY23.

-

As of March, 2023, ROCE and ROE ratios are healthy at 31.91% and 26.60% respectively.

-

is a debt free company as of June 30, 2023.

Blue Jet Healthcare Limited IPO Outlook :

BJHL is a CDMO that produces and supplies specialty pharmaceutical and healthcare ingredients and intermediates, such as contrast media intermediates and high-intensity sweeteners. Co. has three manufacturing facilities in Maharashtra, India, with a total annual capacity of 1020.90 KL. In FY23, it generated 70.57% of revenue from contrast media intermediates, 24.48% revenue from high intensity sweeteners and 4.73% from the pharma intermediaries and API. Europe accounts for the majority (74.49%) of the co.’s revenue, followed by India (13.94%), the USA (4.88%), and other countries (6.69%). BJHL is strategically concentrating on patented medications, investigational new drugs, and New Chemical entities to meet growing clients’ demand. The company is actively working on enhancing operational efficiency and expanding manufacturing capacity in this specialized, high-barrier sector, which presents significant growth potential. The company is offering the P/E of 37.5x on the upper price band which seems reasonably valued. Considering all the factors, we recommend investors to apply to the offering.

Blue Jet Healthcare Limited IPO FAQ

Ans. Blue Jet Healthcare IPO is a main-board IPO of 24,285,160 equity shares of the face value of ₹2 aggregating up to ₹840.27 Crores. The issue is priced at ₹329 to ₹346 per share. The minimum order quantity is 43 Shares.

The IPO opens on October 25, 2023, and closes on October 27, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Blue Jet Healthcare IPO opens on October 25, 2023 and closes on October 27, 2023.

Ans. Blue Jet Healthcare IPO lot size is 43 Shares, and the minimum amount required is ₹14,878.

Ans. The Blue Jet Healthcare IPO listing date is not yet announced. The tentative date of Blue Jet Healthcare IPO listing is Monday, November 6, 2023.

Ans. The minimum lot size for this upcoming IPO is 43 shares.