Bikaji Foods International Limited IPO Company Profile :

Bikaji Foods International Limited is one of India’s largest fast-moving consumer goods (“FMCG”) brands with an international footprint, selling Indian snacks and sweets, and is among the fastest-growing companies in the Indian organized snacks market. In Fiscal 2021, the company was the largest manufacturer of Bikaneri bhujia with an annual production of 26,690 tonnes, and the second largest manufacturer of handmade papad with an annual production capacity of 9,000 tonnes in Fiscal 2021. The company is also one of the largest manufacturers of packaged rasgulla with an annual capacity of 24,000 tonnes and one of the largest manufacturers of soan papdi and gulab jamun with an annual capacity of 23,040 tonnes and 12,000 tonnes respectively. The company is one of the pioneers in the Indian packaged snacks industry which has given a novel twist to classic Indian snacks with a contemporary taste along with maintaining the regional flavours to address the evolving consumer preferences in India and internationally.

| IPO-Note | Bikaji Foods International Limited |

| Rs.285 — Rs.300 per Equity share | Recommendation: Subscribe |

Bikaji Foods International Limited IPO Product range:

The product range includes six principal categories:

- Bhujia

- Namkeen

- Packaged sweets

- Papad

- Western snacks: Western snacks include extruded products, pellets, and chips.

- Other snacks: Other snacks include gift packs (assortment), frozen food, mathri range, and cookies.

- Others: Others include primarily sales at the company’s Mumbai restaurant.

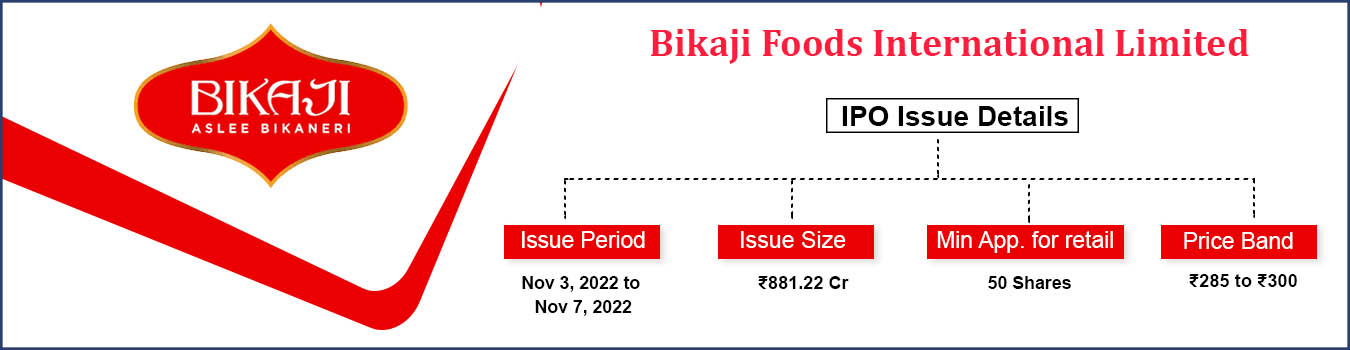

Bikaji Foods International Limited IPO Details:

| Issue Details | |

| Objects of the issue | · To gain the listing benefits

· To carry out the Offer for Sale |

| Issue Size | Issue Size – 881.22 Crore

Offer for Sale- 881.22 Crore |

| Face value | Rs. 1 Per Equity Share |

| Issue Price | Rs. 285 – 300 Rs. |

| Bid Lot | 50 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 03rd November 2022 – 07th November 2022 |

| QIB | 50% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

Bikaji Foods International Limited IPO Revenue from the products:

| Segment | 9M FY-22(in cr.) | % | FY-21(in cr.) | % | FY-20(in cr.) | % | FY-19(in cr.) | % |

| Bhujia | 279.42 | 36.43% | 464.11 | 35.51% | 347.99 | 32.46% | 296.23 | 32.99% |

| Namkeen | 276.79 | 36.09% | 480.56 | 36.77% | 401.69 | 37.47% | 333.71 | 37.16% |

| Packaged sweets | 102.81 | 13.40% | 160.58 | 12.29% | 129.78 | 12.10% | 112.50 | 12.53% |

| Papad | 42.98 | 5.60% | 91.41 | 6.99% | 82.23 | 7.67% | 69.88 | 7.78% |

| Western snacks | 39.91 | 5.20% | 65.76 | 5.03% | 56.12 | 5.23% | 40.28 | 4.49% |

| Other snacks | 15.46 | 2.02% | 29.56 | 2.26% | 33.06 | 3.08% | 25.04 | 2.79% |

| Others | 9.67 | 1.26% | 14.91 | 1.14% | 21.28 | 1.98% | 20.41 | 2.27% |

| Total | 767.04 | 100.00% | 1306.89 | 100.00% | 1072.15 | 100.00% | 898.05 | 100.00% |

Bikaji Foods International Limited IPO Financial Analysis:

| Particulars | 6M FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | FY-19(in cr.) | CAGR |

| Revenue from products | 767.06 | 1306.90 | 1072.17 | 898.08 | 13.3% |

| Revenue from sale of services | 3.29 | 1.24 | 0.00 | 0.00 | |

| Cost of goods sold | 564.42 | 936.89 | 744.91 | 644.33 | |

| Employee Cost | 44.18 | 69.87 | 64.61 | 54.98 | |

| Other expenses | 91.45 | 159.21 | 170.42 | 108.77 | |

| EBITDA | 70.30 | 140.93 | 92.23 | 90.00 | 16.1% |

| EBITDA margin% | 9.16% | 10.78% | 8.60% | 10.02% | |

| Depreciation | 17.98 | 33.12 | 34.19 | 22.75 | |

| Interest | 3.31 | 2.99 | 5.11 | 3.94 | |

| PBT | 49.01 | 104.82 | 52.93 | 63.31 | 18.3% |

| Total tax | 14.84 | 29.77 | 7.27 | 24.92 | |

| PAT | 34.17 | 75.05 | 45.66 | 38.39 | 25.0% |

| Dep./revenue% | 2.34% | 2.53% | 3.19% | 2.53% | |

| Int./revenue% | 0.43% | 0.23% | 0.48% | 0.44% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Bikaji Foods International Limited IPO Strengths:

-

Well-established Bikaji brand with pan-India recognition, focusing on a diverse range of quality products, authentic ethnic Indian taste, innovative packaging, and effective pricing strategies covering all key price points. Bikaji Foods International Limited is among the top three Indian ethnic snack manufacturers in India. Amongst competitors, it is the market leader in the family pack segment, with the family pack segment constituting 63% of the sale of food products in Fiscal 2021, as compared to the other SKUs of ₹ 5 and ₹ 10 packs.

-

Continued focus on efficiency, productivity, and cost rationalization has enabled the company to deliver consistent financial performance, despite the recent increase in the cost of certain raw ingredients, and packaging material.

-

Bikaji Foods International Limited has entered into arrangements with various modern retail channels including supermarkets, hypermarkets, and retail store chains either directly or through super stockists. Within India, the company has entered into arrangements with multiple retail chains. Sales through these modern retail channels contributed 5.72%, 6.68%, 5.94%, and 6.56% of our total sales of food products in Fiscal 2019, 2020, and 2021 and in the six months ended September 30, 2021, respectively.

-

Growing e-commence platform channels include a listing of the company’s products on various large popular e-commerce platforms, distribution start-ups as well as its own e-commerce platform, www.bikaji.com. Sales through e-commerce channels contributed 0.03%, 0.28%, 0.78% and 1.49%of the total sales of food products in Fiscal 2019, 2020, and 2021 and in the six months ended September 30, 2021, respectively.

- The company has diversified product portfolio focused on various consumer segments and markets and at present it has more than 300 products.

- It has extensive distribution network of 6 depots, 38 superstockists, 416 direct and 1,956 indirect distributors located across India.

- BFIL has seven operational manufacturing facilities with four facilities located in Bikaner (Rajasthan), one in Guwahati (Assam), one facility in Tumakuru (Karnataka) and one in one facility in Muzaffarpur (Bihar).

- Experienced and well – qualified promoters and senior management team with good financial track record.

Check Bikaji Foods International Limited IPO Allotment Status

Go Bikaji Foods International Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

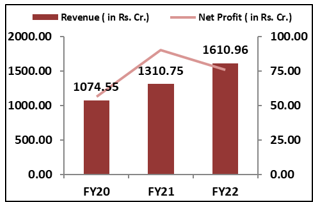

Bikaji Foods International Limited IPO Financial Performance:

Bikaji Foods International Limited IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoters Group | 77.97% | 66.20% |

| Public | 22.03% | 33.80% |

Source: DRHP, EWL Research

Pre-Offer shareholding of the Selling Shareholders:

| S. No. | Name of the Selling Shareholder | No. of Equity Shares

held |

Percentage of the pre-Offer paid

Up equity share capital (%) |

| 1. | Shiv Ratan Agarwal | 88,243,200 | 35.37 |

| 2. | Deepak Agarwal | 41,405,880 | 16.59 |

| 3. | India 2020 Maharaja, Limited | 18,166,450 | 7.28 |

| 4. | IIFL Special Opportunities Fund | 4,827,030 | 1.93 |

| 5. | IIFL Special Opportunities Fund – Series 4 | 4,273,380 | 1.71 |

| 6. | IIFL Special Opportunities Fund – Series 5 | 3,355,930 | 1.35 |

| 7. | IIFL Special Opportunities Fund – Series 2 | 3,097,240 | 1.24 |

| 8. | Avendus Future Leaders Fund I | 2,431,330 | 0.97 |

| 9. | IIFL Special Opportunities Fund – Series 3 | 1,515,100 | 0.61 |

| 10. | Intensive Softshare Private Limited | 798,240 | 0.32 |

| Total | 16,81,13,780 | 67.38 | |

Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Aggregate number of Equity Shares

being offered in the Offer for Sale |

| 1. | Shiv Ratan Agarwal | Up to 2,500,000 Equity Shares |

| 2. | Deepak Agarwal | Up to 2,500,000 Equity Shares |

| 3. | India 2020 Maharaja, Limited | Up to 12,110,967 Equity Shares |

| 4. | Intensive Softshare Private Limited | Up to 50,000 Equity Shares |

| 5. | IIFL Special Opportunities Fund | Up to 3,110,056 Equity Shares |

| 6. | IIFL Special Opportunities Fund- Series 2 | Up to 1,995,552 Equity Shares |

| 7. | IIFL Special Opportunities Fund- Series 3 | Up to 976,179 Equity Shares |

| 8. | IIFL Special Opportunities Fund- Series 4 | Up to 2,753,339 Equity Shares |

| 9. | IIFL Special Opportunities Fund- Series 5 | Up to 2,162,226 Equity Shares |

| 10. | Avendus Future Leaders Fund I | Up to 1,215,665 Equity Shares |

Bikaji Foods International Limited IPO Key Highlights:

-

Revenue of the company increased from Rs. 1075 crore in FY 2020 to Rs. 1611 crore in FY 2022 with a CAGR of 14.45%.

-

Net profit of the company grew from Rs. 56 crore in FY 2020 to Rs. 76 crore in FY 2022 with a CAGR of 10.5%.

-

Operating profit margin of the company stood at 21.8% for the FY 2022.

-

The Debt to Equity ratio of the company is at 0.17, Return on Equity and Return on Capital Employed is at 9.50% and 13.89% respectively for FY 2022.

Bikaji Foods International Limited IPO Risk factors:

-

Bikaji Foods International Limited relies on a limited number of super-stockists and direct distributors for a portion of the revenue from operations. A significant decrease in revenue from any of those super-stockists may adversely affect the business, results of operations, and financial condition.

-

Bikaji Foods International Limited sells some of its products through direct arrangements with retail chains in India and in markets outside India where its products are exported. If the company is not able to maintain such relationships or increase the share of shelf space or add products to these retail chains, it may have an adverse effect on the results of operations and the financial condition of the company.

-

Any loss of business or potential adverse publicity resulting from spurious or imitation products, could result in a loss of goodwill for the products leading to loss of sales, and adversely affecting the business, prospects, results of operations, and financial condition of the company.

-

Profit and EBITDA margins may be impacted by a variety of factors, including but not limited to, variations in raw materials, pricing, product mix, end consumer preferences, sales velocities, advertisement and sales promotion initiatives, and competition.

Bikaji Foods International Limited IPO Outlook:

BFIL is one of India’s largest FMCG brands and is one of the pioneers in the Indian packaged snacks industry which has given a novel twist to classic Indian snacks with a contemporary taste along with maintaining the regional flavours. Its major product range includes bhujia, namkeen, packed sweets, papad and western snacks which contributed 35%, 36%, 13%, 7% and 6% respectively in the revenue of FY 2022. The company is enhancing its brand image by roping celebrity as brand ambassador and also strengthening its presence in e-commerce, new generation and institutional channels. The organized Indian Savoury Snacks market has been strengthening over the last few years and is expected to grow at a CAGR of 15% till 2026; this growth will benefit the Companies like BFIL. The company is offering the PE of 98.46 times at the upper price in comparison to the industry average of 110. We recommend to subscribe to the offering.

Objects of the Offer:

The Selling Shareholders will be entitled to the entire proceeds of the Offer after deducting the Offer expenses and relevant taxes thereon. The Company will not receive any proceeds from the Offer.

Bikaji Foods IPO Prospectus:

- Bikaji Foods IPO DRHP

- Bikaji Foods IPO RHP

Registrar to the offer:

Link Intime India Private Limited

C-101, 1st Floor, 247 Park

L.B.S. Marg, Vikhroli West

Mumbai – 400 083, Maharashtra

Phone: +91 22 4918 6200 /+91 810 811 4949

Email: bikaji.ipo@linkintime.co.in

Website: www.linkintime.co.in

Bikaji Foods International Limited IPO FAQ

Ans.Bikaji Foods International Limited IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The Bikaji Foods IPO opens on Nov 3, 2022 and closes on Nov 7, 2022.

Ans. The minimum lot size that investors can subscribe to is <> shares.

Ans. The Bikaji Foods IPO listing date is not yet announced. The tentative date of Bikaji Foods IPO listing is Nov 16, 2022.

Ans. The minimum lot size for this upcoming IPO is <> shares.