Baroda BNP Paribas Multi Asset Fund NFO Company Profile:

Bank of Baroda, one of India’s leading public sector banks offering banking products and services to customers across 18 countries, has partnered with BNP Paribas Asset Management a leading, global asset management enterprise that offers a comprehensive range of active, passive, and quantitative investment solutions, the asset management arm of BNP Paribas, a leading European Union’s leading bank and a key player in international banking, with over 160 years of uninterrupted presence in India, to form Baroda BNP Paribas Mutual Fund.

Baroda BNP Paribas Mutual Fund is coming up with Baroda BNP Paribas Multi Asset Fund an NFO scheme with an objective to seek long-term capital growth by investing in equity and equity-related securities, REITs / InVITs, debt & money market instruments, and Gold ETF. However, there can be no assurance that the Scheme’s investment objectives will be realized, and it does not guarantee/indicate any returns. The scheme opens on the 28th of November, 2022, and closes on the 12th of December, 2022.

Baroda BNP Paribas Multi Asset Fund NFO Details:

| Mutual Fund: | Baroda BNP Paribas Mutual Fund |

| Scheme Name: | Baroda BNP Paribas Multi Asset Fund |

| Category: | Multi-Asset Allocation Fund |

| Objective of Scheme: | The investment objective of the scheme is to seek long-term capital growth by investing in equity and equity-related securities, debt & money market instruments, REITs / InVITs, and Gold ETF However, there can be no assurance that the Scheme’s investment objectives will be realized, and it does not guarantee/indicate any returns. |

| New Fund Launch Date: | 28th November 2022 |

| New Fund Offer Closure Date: | 12th December 2022 |

| Fund Managers: | For Equity portion: Mr. Jitendra Sriram

For Debt Portion: Mr. Vikram Pamnani |

| Type of scheme: | An open-ended scheme investing in Equity, Debt, and Gold ETF |

| Plans: | The Scheme offers two Plans thereunder, viz. Direct and Regular Each plan offers a Growth Option, and Income Distribution cum capital withdrawal (IDCW)** Option with payout and reinvestment options. |

| Benchmark Index: | 65% of Nifty 500 TRI + 20% of NIFTY Composite Debt Index + 15% of INR Price of Gold |

| STP Frequency: | Normal STP – Daily, Weekly, Fortnightly, Monthly, Quarterly |

| Minimum Application Amount Lumpsum Details: | · Minimum Application Amount: Rs. 5,000 and in multiples of Rs. 1 thereafter.

· Minimum Additional Application Amount: Rs. 1,000 and in multiples of Rs. 1 thereafter. |

| Minimum Application Amount SIP Details: | · Daily, Weekly, and Monthly SIP: Rs. 500/- and in multiples of Rs. 1/- thereafter;

· Quarterly SIP: Rs. 1500/- and in multiples of Rs. 1/- thereafter Frequency Available: Daily, Weekly, Monthly & Quarterly |

| Entry Load: | Not applicable |

| Exit Load*: | · If units of the Scheme are redeemed or switched out up to 10% of the units (the limit) within 12 months from the date of allotment – Nil.

· If units of the scheme are redeemed or switched out in excess of the limit within 12 months from the date of allotment – 1% of the applicable NAV · If units of the scheme are redeemed or switched out after 12 months from the date of allotment – Nil. |

* – The load shall also be applicable for switches between the schemes of the Fund and all Systematic Investment Plans, Systematic Transfer Plans, and Systematic Withdrawal Plans. No load will be charged on units issued upon re-investment of the amount of distribution under the same IDCW option and bonus units.

** – Amounts can be distributed out of investors’ capital (equalization reserve), which is part of the sale price that represents realized gains

Baroda BNP Paribas Multi Asset Fund NFO Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity & Equity related instruments | 65% | 80% | Very High |

| Debt and Money Market Securities | 10% | 25% | Low to Medium |

| Gold ETFs | 10% | 25% | High |

| Units issued by REITs & INvITs | 0% | 10% | Very High |

Baroda BNP Paribas Multi Asset Fund NFO Conclusion:

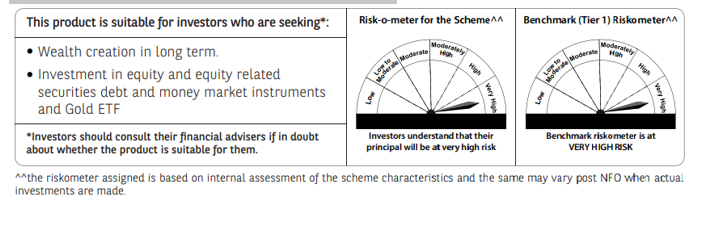

The fund invests in a mix of equity, gold ETF, and fixed income. Equity offers capital growth; fixed income help generate income and gold aims to provide a hedge during the global crisis. Investing in a combination of all asset classes helps to get optimal returns, and spread risk through different market cycles. Investors looking for a portfolio with an allocation to gold, asset class diversification, and new Investors wanting to create wealth in the long term can invest in this fund. However, all mutual funds and securities investments are subject to market risk, investments in equity and equity-related instruments are volatile and prone to price fluctuations on a daily basis, and the prices of gold may be affected by several factors such as global gold supply and demand, investors’ expectations with respect to the rate of inflation, currency exchange rates, interest rates, etc. Therefore, investors should consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them or not.