Bajaj Housing Finance IPO Company Profile:

Bajaj Housing Finance Limited (BHFL) is a 100% subsidiary of Bajaj Finance Limited — one of the most diversified NBFCs in the Indian market, catering to more than 88.11 million customers across the country. Headquartered in Pune, BHFL offers finance to individuals as well as corporate entities for the purchase and renovation of homes, or commercial spaces. It also provides loans against property for business or personal needs as well as working capital for business expansion purposes. BHFL also offers finance to developers engaged in the construction of residential and commercial properties as well as lease rental discounting to developers and high-net-worth individuals. The Company is rated AAA/Stable for its long-term debt Programme and A1+ for its short-term debt Programme from CRISIL and India Ratings.

| IPO-Note | Bajaj Housing Finance Limited |

| Rs.66 – Rs.70 per Equity share | Recommendation: Apply |

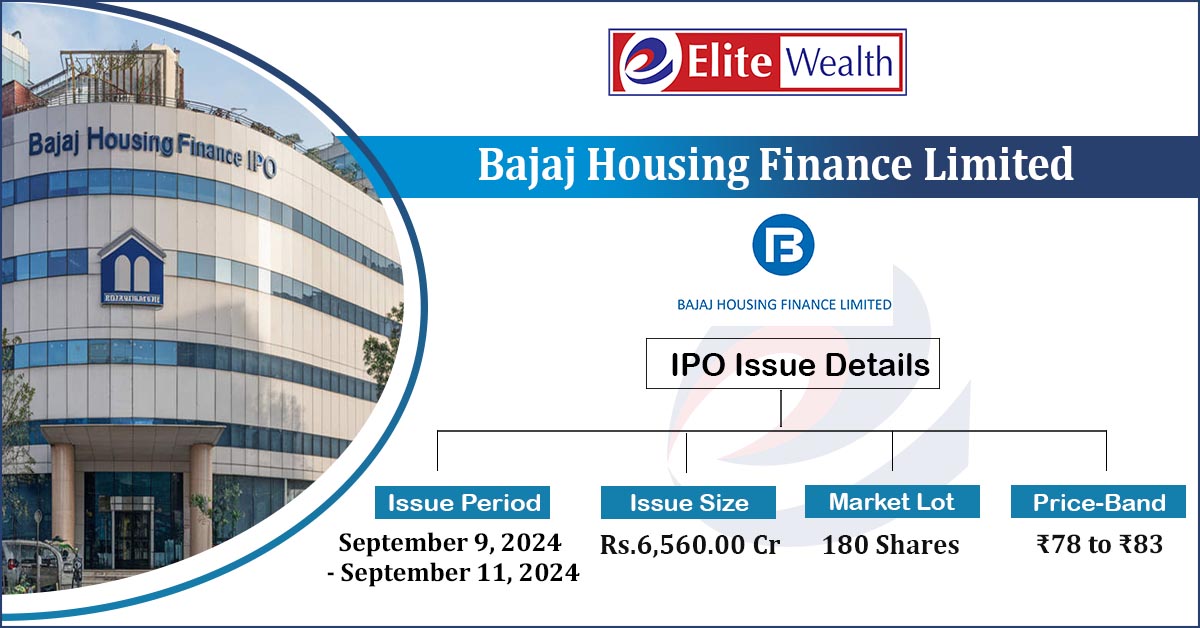

Bajaj Housing Finance IPO Details:

| Issue Details | |

| Objects of the issue |

· To fulfill the lending requirement. |

| Issue Size | Total issue Size – Rs.6,560.00 Cr

Fresh Issue – Rs 3,560 Cr Offer for sale- Rs 3000 cr Shareholder reserve- Rs 50 crores (applicable for Bajaj Finserv and Bajaj limited shareholders as of AUG, 30 2024.) |

| Face value | Rs.10 |

| Issue Price | Rs.66 – Rs.70 |

| Bid Lot | 214 Shares |

| Listing at | BSE, NSE |

| Issue Opens | September 9, 2024 – September 11, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer(including shareholder portion) |

| SHAREHOLDER PORTION | Not more than 10% of Net Issue Offer |

Bajaj Housing Finance IPO Strengths:

-

BHFL will benefit from the success of its parent company, “Bajaj Finance” in the market. The company offers a broad range of services to consumers like housing loan, loan against property etc., contributing to its extensive portfolio.

-

For the three months ending June 30, 2024, the total loan disbursements amounted to ₹12,003.51 crores, an increase from ₹10,382.52 crores in the same period of 2023. For the fiscal years, loan disbursements were ₹44,656.24 crores in 2024 and ₹34,333.63 crores in 2023.

-

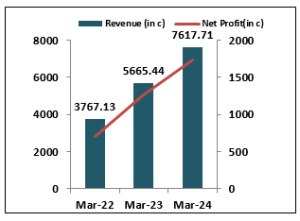

The company’s total income saw a robust increase of 34%, reaching ₹7,618 crore in FY24. As of March 31, 2024, the capital adequacy ratio stood at 21.28%. Additionally, PAT experienced a substantial growth of 38% in FY24 as compared with FY23 rising to ₹1,731 crore.

-

The company’s assets under management (AUM) have been steadily increasing. In FY22, AUM were ₹53,000 crore, which grew by approximately 30.6% to ₹69,228 crore in FY23which further grew by 31.5% to ₹91,370 crore in FY24.

-

BHFL has achieved the lowest Gross Non-Performing Assets (GNPA) ratio of 0.27% and Net Non-Performing Assets ratio of 0.10% among major Housing Finance Companies.

Bajaj Housing Finance IPO Risk Factors:

-

The Indian housing finance market is highly competitive, with key players like SBI, HDFC, and LIC. To gain an edge, BHFL will need to offer attractive interest rates and superior customer service.

-

The company is vulnerable to interest rate fluctuations. Changes in the RBI’s repo rate could impact the rates it charges its customers.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Bajaj Housing Finance IPO Allotment Status

Bajaj Housing Finance IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Bajaj Housing Finance IPO Financial Performance:

Bajaj Housing Finance IPO Shareholding Pattern:

| Particulars | Pre- Issue | |

| Promoters Group | 100% | |

| Others | – |

Bajaj Housing Finance IPO Outlook:

Bajaj Housing Finance Limited (BHFL) is a 100% subsidiary of Bajaj Finance Limited — one of the most diversified NBFCs in the Indian market, catering to more than 88.11 million customers. As per CMI, the Indian housing finance market is projected to expand at a CAGR of 24.1% from 2024 to 2033, positioning Bajaj Finance to benefit significantly from this growth. At upper price band of Rs 70, BHFL share price will be offered at a valuation of approx. 3.2x its trailing June 2024 Book value which seems slightly expensive compared to listed players like LIC housing, PNB housing and Canfin homes, but keeping in mind BHFL robust and diversified AUM growth and sturdy asset quality, we recommend investors to apply for the issue for listing gains as well as long term point of view.

Bajaj Housing Finance IPO FAQ:

Ans. Bajaj Housing Finance IPO is a main-board IPO of 937,142,858 equity shares of the face value of ₹10 aggregating up to ₹6,560.00 Crores. The issue is priced at ₹66 to ₹70 per share. The minimum order quantity is 214 Shares.

The IPO opens on September 9, 2024, and closes on September 11, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Bajaj Housing Finance IPO opens on September 9, 2024 and closes on September 11, 2024.

Ans. Bajaj Housing Finance IPO lot size is 214 Shares, and the minimum amount required is ₹14,980.

Ans. The Bajaj Housing Finance IPO listing date is not yet announced. The tentative date of Bajaj Housing Finance IPO listing is Monday, September 16, 2024.

Ans. The minimum lot size for this upcoming IPO is 214 shares.