Archean Chemical Industries Limited IPO Company Profile :

Archean Chemical Industries Limited is a leading speciality marine chemical manufacturer in India and focused on producing and exporting bromine, industrial salt, and sulphate of potash to customers around the world. According to Frost & Sullivan, the company is the largest exporter of bromine and industrial salt by volume in India in Fiscal 2021 and has amongst the lowest cost of production globally in both bromine and industrial salt. The company produces its products from the brine reserves in the Rann of Kutch, located on the coast of Gujarat, and it manufactures its products at its facility near Hajipir in Gujarat

Archean Chemical Industries Limited marketed its products to 18 global customers in 13 countries and 24 domestic customers. The customers include leading domestic and international multinational companies. The major customers include Sojitz Corporation, which is a strategic partner and stakeholder in the Company, Shandong Tianyi Chemical Corporation, Unibrom Corporation, Wanhau Chemicals, and Qatar Vinyl Company Limited.

| IPO-Note | Archean Chemical Industries Limited |

| Rs.386 — Rs.407 per Equity share | Recommendation: Subscribe |

Archean Chemical Industries Limited IPO Products :

- Bromine:

Bromine is the only non-metallic element that is a liquid at standard conditions. Bromine is widely distributed in nature but in relatively small amounts, mainly as soluble salts. The company’s bromine and bromine-based business are used in a broad range of end-use industries and have applications in the pharmaceuticals, fumigants, agrochemicals, water treatment, mercury control, flame retardants, oil & gas, and additives segments of the chemicals industry. The company is the largest exporter of Bromine from India by volume in Fiscal 2021. In the three months ended June 30, 2022 and in Fiscal 2022, Fiscal 2021 and Fiscal 2020, it exported 34.88%, 44.88%, 46.10% and 39.79%, respectively, of its bromine production abroad, mainly to China

- Industrial Salt:

Industrial salt is the principal material in chlorine and caustic soda production (together, known as chloralkali) and is widely used in the chemical and food and beverage industries. Chlorine finds end-uses in vinyl, phosgene, chloromethanes, chlorinated C3, water treatment, synthesis HCI, bleach, and other organic and inorganic chemical material. Caustic soda finds end-uses in alumina, paper and pulp, soap and detergents, textiles, water treatment, bleach, and other organic and inorganic chemical material. The company was the largest exporter of industrial salt in India with exports of 2.7 million MT in Fiscal 2021. In the three months ended June 30, 2022 and in Fiscal 2022, Fiscal 2021 and Fiscal 2020, the company exported 100% of its industrial salt production, primarily to customers in Japan and China.

- Sulphate of Potash:

Sulphate of potash, also known as potassium sulphate, is a high-end, specialty fertilizer for chlorine-sensitive crops. It is one of the most popular forms of low chloride potash, largely due to its high 50-52% K2O content, which contains about 50% of plant food. This stimulates the growth of strong stems and provides disease resistance to crops and plants by promoting the thickness of the outer cell walls. Further, sulphate of potash can reduce moisture loss from growing plants, thereby providing drought resistance, and has been proven to improve yield, nutritional value, colour, flavour, and storing quality of fruits and vegetables. Hence, the primary end-use industries for the company’s sulphate of potash include the agrochemicals industry, which uses its product for the manufacture of fertilizer.

Archean Chemical Industries Limited IPO Product segment analysis:

| Segment | Q1 FY-23

(in cr.) |

% | FY-22

(in cr.) |

% | FY-21

(in cr.) |

% | FY-20

(in cr.) |

% | CAGR |

| Bromine | 203.89 | 50.95 | 605.28 | 53.58 | 344.41 | 46.50 | 215.50 | 35.48 | 41.1% |

| Industrial Salt | 196.04 | 48.99 | 512.90 | 45.41 | 363.71 | 49.11 | 352.00 | 57.96 | 13.4% |

| Sulphate of Potash | 0.24 | 0.06 | 11.40 | 1.01 | 32.53 | 4.39 | 39.83 | 6.56 | -34.1% |

| Total | 400.17 | 100.00 | 1129.58 | 100.00 | 740.65 | 100.00 | 607.33 | 100.00 | 23.0% |

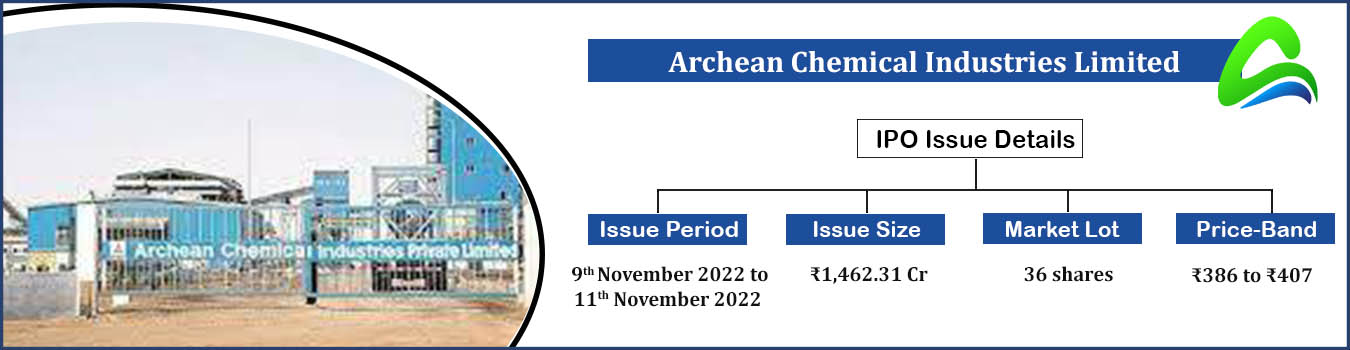

Archean Chemical Industries Limited IPO Details :

| IPO Open Date | 9th November 2022 |

| IPO Close Date | 11th November 2022 |

| Listing Date | 21st November 2022 |

| Face Value | ₹2 per share |

| Price | ₹386 to ₹407 per share |

| Lot Size | 36 Shares |

| Issue Size | 35,928,870 shares (aggregating up to ₹1,462.31 Cr) |

| Fresh Issue | 19,778,870 shares

(aggregating up to ₹805.00 Cr) |

| Offer for Sale | 16,150,000 shares

(aggregating up to ₹657.31 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| QIB Shares Offered | Not more than 75% of the Offer |

| NII (HNI) Shares Offered | Not less than 15% of the Offer |

| Retail Shares Offered | Not less than 10% of the Offer |

| Company Promoters | Chemikas Speciality LLP, Ravi Pendurthi and Ranjit Pendurthi |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Archean Chemical Industries Limited IPO Allotment Status

Go Archean Chemical Industries Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Archean Chemical Industries Limited IPO Financial analysis:

| Particulars | Q1 FY-23

(in cr.) |

FY-22

(in cr.) |

FY-21

(in cr.) |

FY-20

(in cr.) |

CAGR |

| Revenue from operations | 400.27 | 1130.44 | 740.76 | 608.17 | 23.0% |

| Other Income | 8.55 | 12.39 | 14.03 | 8.84 | |

| Cost of Goods Sold | 4.92 | 39.32 | 8.89 | 1.34 | |

| Employee Cost | 9.77 | 37.84 | 35.32 | 34.47 | |

| Other expenses | 224.52 | 586.12 | 434.32 | 425.38 | |

| EBITDA | 169.61 | 479.54 | 276.25 | 156.82 | 45.1% |

| EBITDA margin% | 42.37 | 42.42 | 37.29 | 25.79 | |

| Depreciation | 17.61 | 66.88 | 55.40 | 51.76 | |

| Interest | 39.15 | 161.67 | 130.39 | 121.76 | |

| PBT | 112.85 | 251.00 | 90.47 | -16.70 | |

| Total tax | 28.44 | 62.41 | 23.86 | 19.53 | |

| PAT | 84.41 | 188.58 | 66.61 | -36.23 | |

| PAT margin% | 21.09 | 16.68 | 8.99 | -5.96 | |

| Dep./revenue% | 4.40 | 5.92 | 7.48 | 8.51 | |

| Int./revenue% | 9.78 | 14.30 | 17.60 | 20.02 |

Pre-Offer shareholding of the Selling Shareholders:

| S. No. | Name of the Selling Shareholder | No. of Equity Shares

held |

Percentage of the pre-Offer paid

Up equity share capital (%) |

| 1. | Chemikas Speciality LLP | 39,458,790 | 38.21% |

| 2. | India Resurgence Fund, Scheme I | 15,132,347 | 14.65% |

| 3. | India Resurgence Fund, Scheme II | 8,958,509 | 8.67% |

| 4. | Piramal Natural Resources Private Limited | 8,958,509 | 8.67% |

| Total | 72,508,155 | 70.2% |

Archean Chemical Industries Limited IPO Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Number of Equity Shares

being offered in the Offer for Sale (Up to) |

| 1. | Chemikas Speciality LLP | 2,000,000 Equity Shares |

| 2. | India Resurgence Fund, Scheme I | 3,835,562 Equity Shares |

| 3. | India Resurgence Fund, Scheme II | 6,478,876 Equity Shares |

| 4. | Piramal Natural Resources Private Limited | 3,835,562 Equity Shares |

Archean Chemical Industries Limited IPO Strengths:

-

Archean Chemical Industries Limited has a leading market position as a speciality marine chemical manufacturer in India, with expansion and growth in bromine and industrial salt. The company is the largest exporter of bromine and industrial salt by volume in India in Fiscal 2021 and has amongst the lowest cost of production globally in both bromine and industrial salt.

-

The speciality marine chemicals industry in which the company operates has high entry barriers, which include the high cost and intricacy of product development, manufacture, and investment in salt beds, the limited availability of raw materials necessary for production, the limited number of locations with a suitable climate and access to reserves, and the lead time and expenditure required for research and development and building customer confidence and relationships, which can only be achieved through a long gestation period.

-

Archean Chemical Industries Limited is one of the largest salt works in one single location in the world. The industrial salt washing facility has three washeries, each having a capacity of 200 tons/hour. The facility is equipped with its own quality department, effluent treatment plant, sewage treatment plant and stockyard.

-

Archean Chemical Industries Limited has an integrated manufacturing site with access to the Rann of Kutch reserves and close connectivity to ports allows the company to manage the production process efficiently and to deliver high-quality and timely products to its customers.

-

Archean Chemical Industries Limited is the largest Indian exporter of bromine and industrial salt with a global customer base. As of June 30, 2022, the company had 18 global customers and 24 domestic customers.

-

Archean Chemical Industries Limited benefits from the industry experience of its financial investors and stakeholders. In 2011, the company established its relationship with Sojitz Corporation, a Japanese trading conglomerate and a major customer, which allowed it to develop new solar evaporation ponds in India based on the growing demand in Asia and offtake by Sojitz. In 2018, India Resurgence Fund, a joint venture between Piramal Enterprises Limited and Bain Capital Credit (“IndiaRF”) invested US $156 million in the Company in year 2018, which allowed it to refinance the debt, offer capital investment to optimize output across product lines, and provided working capital.

Archean Chemical Industries Limited IPO Risk factors:

-

Archean Chemical Industries Limited derives a significant part of its revenue from major customers. If one or more of such customers choose not to source their requirements from the company or to terminate their contracts with it, the business, financial condition and results of operations may be adversely affected.

-

Archean Chemical Industries Limited does not have long-term agreements with suppliers for its raw materials and an increase in the cost of, or a shortfall in the availability or quality of such raw materials could have an adverse effect on the business, financial condition and results of operations.

-

The company has incurred significant capital expenditure during the last three months and during the last three fiscal years. The company may require substantial financing for its business operations and planned capital expenditure and the failure to obtain additional financing on terms commercially acceptable to it may adversely affect its ability to grow and its future profitability.

-

Archean Chemical Industries Limited’s reliance on three principal products for substantially of the sales could have an adverse effect on the business of the company.

Archean Chemical Industries Limited IPO

The Net Proceeds are proposed to be utilised in the following manner:

- Redemption or earlier redemption, in part or full, of NCDs issued by the Company

- General Corporate Purposes

Archean Chemical Industries Limited IPO Prospectus:

- Archean Chemical Industries Limited IPO DRHP –

- Archean Chemical Industries Limited IPO RHP –

Registrar to the offer:

Link Intime India Private Limited

E-mail: archean.ipo@linkintime.co.in

Tel: +91 810 811 4949

Contact Person: Shanti Gopalkrishnan

Archean Chemical Industries Limited IPO FAQ

Ans.Archean Chemical Industries Limited IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The Archean Chemical IPO opens on Nov 9, 2022 and closes on Nov 11, 2022.

Ans. The minimum lot size that investors can subscribe to is 36 shares.

Ans. The Archean Chemical IPO listing date is not yet announced. The tentative date of Archean Chemical IPO listing is Nov 21, 2022.

Ans. The minimum lot size for this upcoming IPO is 36 shares.