Anthem Biosciences Limited IPO Company Profile:

Incorporated in 2006, Anthem Biosciences Ltd is a technology-driven CRDMO offering fully integrated services across the pharmaceutical value chain. It specializes in New Chemical Entities (NCEs) and New Biological Entities (NBEs), supporting global clients ranging from emerging biotech firms to large pharmaceutical companies. The company’s CRDMO platform spans five key therapeutic modalities—RNAi, Antibody Drug Conjugates (ADCs), peptides, lipids, and oligonucleotides—and four core manufacturing capabilities: custom synthesis, flow chemistry, fermentation, and biotransformation. With its innovation-led approach, deep scientific expertise, and end-to-end service offerings from discovery to commercial-scale production, the company serves as a strategic partner for customers developing complex, next-generation therapeutics across multiple therapeutic areas and development stages.

| IPO-Note | Anthem Biosciences Limited |

| Rs. 540– Rs. 570 per Equity share | Recommendation: Apply |

Anthem Biosciences Limited IPO Details:

| Issue Details | |

| Objects of the issue | · For listing Benefits |

| Issue Size | Total issue Size – Rs. 3,395.00 Cr

Offer For Sale – Rs. 3,395.00 Cr |

| Face value |

Rs . 2 |

| Issue Price | Rs. 540 – Rs. 570 per share |

| Bid Lot | 26 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | July 14, 2025- July 16, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

| Employee Discount | Rs. 50.00 |

Anthem Biosciences Limited IPO Strengths:

- For Fiscal 2025, the company has a diversified portfolio of 242 projects, comprising 68 discovery-stage projects involving the synthesis of 355 molecules, 145 early-phase development projects, 16 late-phase projects associated with 10 late-stage molecules, and 13 commercial manufacturing projects related to active pharmaceutical ingredients (APIs) and advanced intermediates for 10 commercialized molecules.

- As of March 31, 2025, the company serves over 550 customers across its CRDMO and specialty ingredients businesses, spanning more than 44 countries, including the United States, various European nations, and Japan. Many of these customers represent long-standing relationships, reflecting the company’s strong track record and global reach.

- The company has the largest fermentation capacity among Indian CRDMO players, with a capacity of 142 kL as of March 31, 2025. Upon completion of its ongoing expansion by the first half of Fiscal 2026, the company’s fermentation capacity is expected to increase to 182 kL—more than six times that of the second-largest assessed player in the industry, according to the F&S Report.

- The company generates over 80% of its revenue from its CRDMO services, which encompass development, commercial-scale manufacturing, and research and development activities. Additionally, a portion of its revenue is derived from the manufacturing and sale of specialty ingredients.

- The Indian CRO market grew at a CAGR of 15.1%, increasing from USD 1.0 billion in 2019 to USD 2.0 billion in 2024. During the same period, the Indian CDMO market expanded at a CAGR of 12.6% to reach USD 6.2 billion. By 2029, the CRO market is projected to reach USD 3.6 billion, while the CDMO market is expected to grow to USD 11.8 billion.

- The EBITDA margin of 36.81% in Fiscal 2025 was the highest compared to its assessed peers in India and the second highest compared to its assessed peers globally and the PAT margin of 23.38% in Fiscal 2025 was the highest compared to its assessed peers in India and the second highest compared to overseas peers, according to the F&S Report.

- As of March 31, 2025, the company operates three manufacturing facilities, including its upcoming Unit III, which is expected to become fully operational in the first half of Fiscal 2026. All facilities are located in Bommasandra and Harohalli in Bengaluru, Karnataka. Additionally, the company has acquired land in Harohalli for the proposed Unit IV facility and in Hosur, Tamil Nadu, for the proposed Unit V facility.

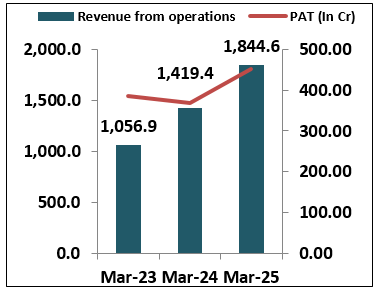

- The company reported revenue from operations of Rs 1,844.6 crore in Fiscal 2025, representing a 30% increase compared to Rs 1,419.4 crore in Fiscal 2024. Profit after tax for Fiscal 2025 stood at Rs 451.3 crore, reflecting a 23% growth from Rs 367.3 crore in the previous fiscal year.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Anthem Biosciences Limited IPO Allotment Status

Anthem Biosciences Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Anthem Biosciences Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Anthem Biosciences Limited IPO Risk Factors:

- The company operates in a highly competitive industry, facing strong competition from both domestic and global players. Key competitors include Syngene International Limited, Sai Life Sciences Limited, Cohance Lifesciences Limited, Divi’s Laboratories Limited, Aragen Life Sciences Limited, WuXi AppTec Co. Ltd., and Lonza Group AG. This competitive landscape may influence the company’s pricing strategies and market share, requiring ongoing innovation, operational excellence, and differentiated service offerings to sustain and enhance its position in domestic and the international market.

- The company faces challenges from raw material cost fluctuations and geopolitical risks, including U.S. tariffs on pharmaceuticals and global conflict-related disruptions. These factors pose operational risks, particularly as a significant share of the company’s revenue is generated from North America, making it sensitive to changes in that regional market.

Anthem Biosciences Limited IPO Financial Performance:

Anthem Biosciences Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 76.88%

|

74.69% |

| Others | 23.12%

|

25.31% |

Anthem Biosciences Limited IPO Outlook:

The company reported strong financial performance in FY25, with a 30% increase in revenue from operations and a 23% rise in profit after tax. It posted an EBITDA margin of 36.81% and a PAT margin of 23.38%, the second highest among its peers. Ongoing expansion of manufacturing capacity is expected to support future growth. The CRDMO industry is also projected to grow steadily, benefiting the company. However, challenges such as raw material cost fluctuations and tariffs on pharmaceuticals especially in key markets like North America may impact revenue. At the upper price band of Rs 570, the issue is priced at a P/E of 70.94x based on FY25 earnings. Keeping in mind the valuation and competitive position of the company, we recommend applying for the issue for both listing gains and medium to long-term investment.

Anthem Biosciences Limited IPO FAQ:

Ans. Anthem Biosciences IPO is a main-board IPO of 5,95,61,404 equity shares of the face value of ₹2 aggregating up to ₹3,395.00 Crores. The issue is priced at ₹540 to ₹570 per share. The minimum order quantity is 26.

The IPO opens on July 14, 2025, and closes on July 16, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Anthem Biosciences IPO opens on July 14, 2025 and closes on July 16, 2025.

Ans. Anthem Biosciences IPO lot size is 26, and the minimum amount required for application is ₹14,820.

Ans. The Anthem Biosciences IPO listing date is not yet announced. The tentative date of Anthem Biosciences IPO listing is Monday, July 21, 2025.

Ans. The finalization of Basis of Allotment for Anthem Biosciences IPO will be done on Thursday, July 17, 2025, and the allotted shares will be credited to your demat account by Friday, July 18, 2025.