Aditya Birla Sun Life Multi Asset Allocation Fund (NFO)

Aditya Birla Sun Life AMC Limited (“ABSLAMC”) was established in 1994, and is co-owned and backed by Aditya Birla Capital Limited and Sun Life (India) AMC Investments Inc. ABSLAMC is primarily the investment manager of Aditya Birla Sun Life Mutual Fund, a registered trust under the Indian Trusts Act, 1882. ABSLAMC also operates multiple alternate strategies including Alternative Investment Funds, Portfolio Management Services, and Real Estate Investments. Aditya Birla Sun Life AMC Limited is one of the leading asset managers in India, servicing around 8.1 million investor folios with a pan India presence across 280 plus locations and a total AUM of over Rs. 2,938 billion for the quarter ending September 30, 2022, under its suite of a mutual fund (excluding our domestic FoFs), portfolio management services, offshore and real estate offerings.

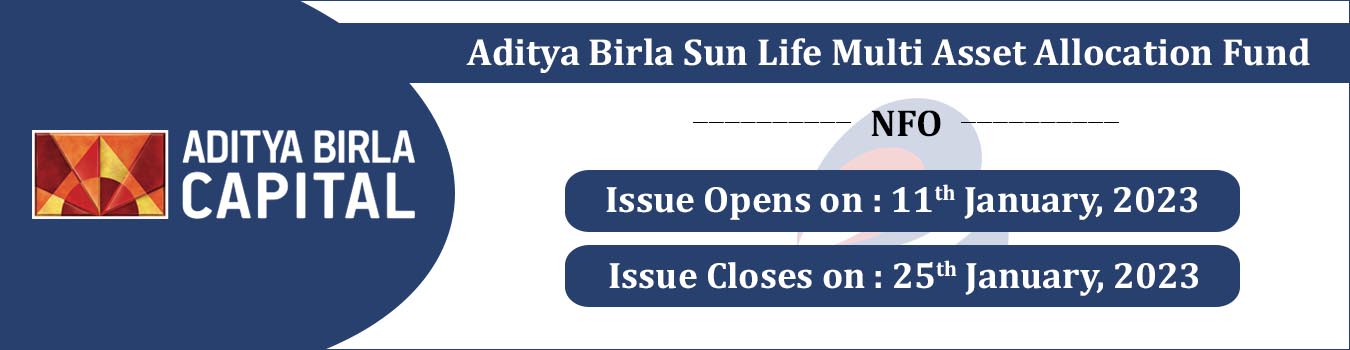

Aditya Birla Sun Life AMC Limited is coming up with Aditya Birla Sun Life Multi Asset Allocation Fund, an NFO scheme with an investment objective to generate long-term capital appreciation by investing across asset classes like Equity, Debt, Commodities, & units of REITs & InvITs, however, there can be no assurance that the investment objective of the scheme will be achieved. The scheme opens on the 11th of January, 2023, and closes on the 25th of January, 2023. The scheme reopens for continuous sale and purchase from the 14th of December, 2022.

Aditya Birla Sun Life Multi Asset Allocation Fund (NFO) details:

| Mutual Fund: | Aditya Birla Sun Life AMC Limited |

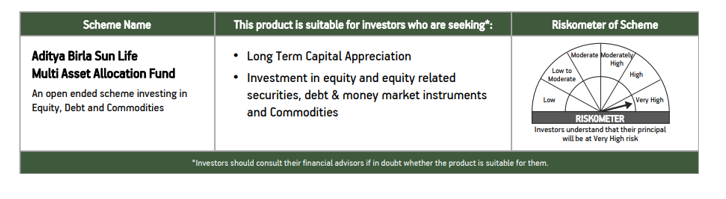

| Scheme Name: | Aditya Birla Sun Life Multi Asset Allocation Fund |

| Objective of Scheme: | The investment objective of the Scheme is to provide long-term capital appreciation by investing across asset classes like Equity, Debt, Commodities, & units of REITs & InvITs. The Scheme does not guarantee/indicate any returns. There can be no assurance that the objective of the Scheme will be achieved. |

| Scheme Type: | An open-ended scheme investing in Equity, Debt, and Commodities. |

| Scheme Code: | ABSL/O/H/MAA/22/08/0132 |

| New Fund Launch Date: | 11th January 2023 |

| New Fund Offer Closure Date: | 25th January 2023 |

| Plans & Options: | Regular Plan and Direct Plan; Both plans will have following options: (1) Income Distribution cum capital withdrawal (“IDCW”) Option (Payout of IDCW & Reinvestment of IDCW)^; (2) Growth Option. ^the amounts can be distributed out of investors capital (Equalization Reserve), which is part of sale price that represents realized gains |

| Fund Managers: | Mr. Dhaval Shah for equity investments

Mr. Bhupesh Bameta for fixed income Mr. Sachin Wankhede for commodity derivatives. Mr. Dhaval Joshi for overseas investments |

| Benchmark Index: | 65% S&P BSE 200 + 25% CRISIL Short Term Bond Fund Index + 5% of Domestic prices of Gold + 5% of Domestic prices of Silver |

| Minimum Application Amount/

Number of Units: |

During New Fund Offer Period:

Minimum of ` 500/- and in multiples of ` 1/- thereafter during the New Fund Offer period. During the Ongoing Offer period: · Fresh Purchase (Incl. Switch-in): Minimum of ` 500/- and in multiples of ` 1/- thereafter · Additional Purchase (Incl. Switch-in): Minimum of ` 500/- and in multiples of ` 1/- thereafter · Repurchase for all Plans/Options: In Multiples of ` 1/- or 0.001 units |

| Minimum Amount: | · Daily Plan: Minimum 20 Transfers of ` 500/- each and in multiples of ` 100/- thereafter.

· Weekly / Monthly / Quarterly Plan: For STP installments greater than ` 500 but less than ` 999, Investors are required to instruct for a minimum of 12 transfers of ` 500 and in multiples of ` 1 thereafter. For STP installments greater than ` 1000 and above, Investors are required to instruct for a minimum of 6 transfers of ` 1000 and in multiples of ` 1 thereafter. |

| Exit Load: | · For redemption/switch-out of units on or before 365 days from the date of allotment: 1.00% of applicable NAV.

· For redemption/switch-out of units after 365 days from the date of allotment: Nil. |

Aditya Birla Sun Life Multi Asset Allocation Fund (NFO) Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity & Equity related instruments | 65% | 80% | High |

| Debt and Money Market Instruments | 10% | 25% | Low to Moderate |

| Commodities | 10% | 25% | Moderate to High |

| Units issued by REITs & InvITs | 0% | 10% | Moderate to High |

Aditya Birla Sun Life Multi Asset Allocation Fund (NFO) Conclusion:

Timing the equity market is difficult amid a constantly evolving macroeconomic scenario. Balanced asset allocation can help in long-term wealth creation, Endeavours combine the stability of fixed income, cushioning of gold, and the high growth potential of equity in one portfolio to help mitigate volatility in returns and improve investing experience, Professional management and regular rebalancing basis relative valuation of various asset classes Actively managed equity portfolio may enhance long term return potential, Lower volatility in the portfolio can help endure periods of high uncertainty and Can be an ideal portfolio for any market environment. However, mutual fund investments are subject to market risks, therefore, this product is suitable for investors who are seeking long-term capital appreciation and are seeking investment in equity and equity-related securities, debt & money market instruments, and Commodities. Investors should consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them.