Abans Holdings IPO Company Profile :

Abans group is a globally diversified organization engaged in Financial Services, Gold Refining, Commodities Trading, Jewellery, Agricultural Trading and Warehousing, Software Development, and Real Estate. The group was founded by young entrepreneur – Mr. Abhishek Bansal who leads a global team of qualified people operating growing businesses from multiple locations including India, Dubai, the United Kingdom, Shanghai, Hong Kong, and Mauritius

Abans Holdings Limited represents the financial services arm of the Abans Group. The company operates a diversified global financial services business, headquartered in India, providing NBFC services, global institutional trading in commodities, equities, and foreign exchange, private client stock broking, asset management services, depositary services, investment advisory services, and wealth management services to institutional, corporates, and high net worth clients.

| IPO-Note | Abans Holdings Limited |

| Rs. 256 – Rs. 270 per Equity share | Recommendation: Avoid |

Since the inception of Abans Holdings Limited, the company has grown from being a commodities trading company into a diversified multi-national and multi-asset financial services company having varied financial services businesses which are mainly organized as under:

- Finance Business:

the company operates an RBI Registered Non-Deposit taking NBFC. The Finance business is primarily focused on lending to private traders and other small and medium businesses involved in the commodities trading market.

- Agency Business:

the company is a SEBI-registered Stock and Commodity Exchange Broker with memberships across all the major stock exchanges in India, including BSE, NSE, MCX, MSEI, NCDEX, and ICEX. Further being FCA registered financial services firm in London, the company has direct/indirect memberships in various international exchanges like LME (London), DGCX (Dubai), INE, and DCE (China). The company is also a SEBI Registered Portfolio Management company and Category-I FPI. We offer various institutional and non-institutional trading services, wealth management, and private client brokerage services, mainly in commodities, equity, and foreign exchange.

- Capital and other Business:

The Capital Business includes internal treasury operations which manage excess capital funds. The company does so by investing its capital in low / medium risk strategies, maintaining positions in physical as well as exchange-traded commodities and other instruments. The company structures its treasury investments to maintain sufficient liquidity in the portfolio to support the capital needs of the other businesses. Further, the company provides Warehousing Services to commodity market participants.

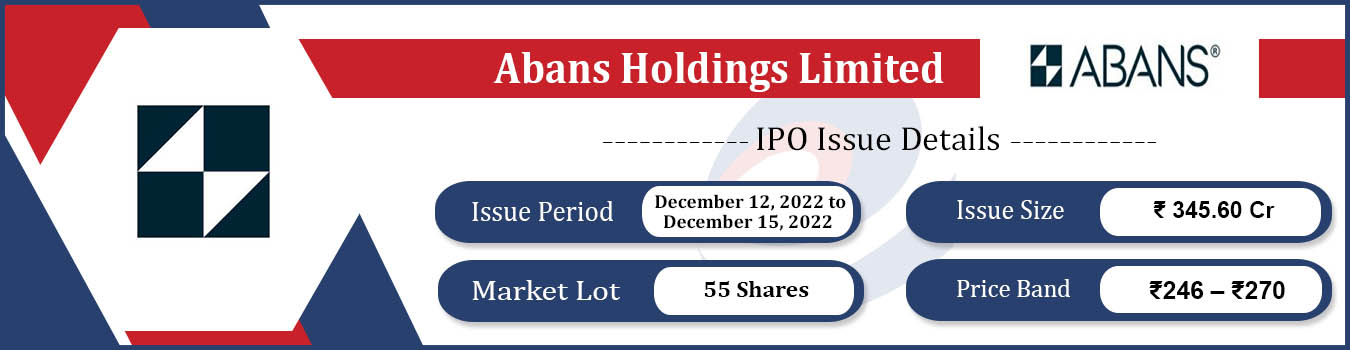

Abans Holdings IPO Details:

| Issue Details | |

| Objects of the issue | ·To invest in its NBFC subsidiary |

| Issue Size | Total issue Size – Rs.345.60 Cr.

Fresh Issue – Rs. 102.60 Cr. Offer for Sale – Rs. 243 Cr. |

| Face value | Rs. 2.00 Per Equity Share |

| Issue Price | Rs. 246 – Rs. 270 |

| Bid Lot | 55 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 12th Dec, 2022 – 15th Dec, 2022 |

| QIB | 10% of Net Issue Offer |

| Retail | 30% of Net Issue Offer |

| NIB | 60% of Net Issue Offer |

Abans Holdings IPO Financial Analysis:

| Particulars | 5M FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR (FY-20 to FY-22) |

| Revenue from sale | 284.90 | 638.63 | 1325.54 | 2765.21 | -38.6% |

| Other Income | 3.41 | 7.61 | 5.85 | 6.67 | |

| Operating Cost | 242.37 | 518.99 | 1170.90 | 2629.56 | |

| Employee Cost | 6.24 | 12.95 | 14.85 | 23.35 | |

| Other expenses | 7.52 | 22.27 | 64.09 | 22.07 | |

| EBITDA | 32.17 | 92.03 | 81.56 | 96.90 | -1.7% |

| EBITDA margin% | 11.29% | 14.41% | 6.15% | 3.50% | |

| Depreciation | 0.25 | 0.72 | 1.12 | 1.36 | |

| Interest | 2.08 | 25.51 | 31.30 | 53.21 | |

| Exceptional Items | 0.00 | 0.46 | 0.00 | 0.00 | |

| PBT | 29.83 | 66.26 | 49.14 | 42.33 | 16.1% |

| Total tax | 0.09 | 4.28 | 3.31 | 3.11 | |

| PAT | 29.74 | 61.97 | 45.83 | 39.22 | 16.5% |

| PAT margin% | 10.44% | 9.70% | 3.46% | 1.42% |

Pre-Offer shareholding of the Selling Shareholders:

| S. No. | Name of the Selling Shareholder | No. of Equity Shares

held |

Percentage of the pre-Offer paid

Up equity share capital (%) |

| 1. | Mr. Abhishek Bansal | 4,46,98,500 | 96.45% |

| Total | 4,46,98,500 | 96.45% | |

| Other Shareholders (Promoters & Promoter Group) | |||

| 2. | Mrs. Rita Bhalotia jointly held with Mr. Vishnu Bhalotia | 7,66,065 | 1.65% |

| Total | 4,54,64,565 | 98.10% | |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Abans Holdings IPO Allotment Status

Go Abans Holdings IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Abans Holdings IPO Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Number of Equity Shares

being offered in the Offer for Sale (Up to) |

| 1. | Mr. Abhishek Bansal | 90,00,000 Equity Shares |

Abans Holdings IPO Strengths:

-

Abans Holdings Limited’s integrated service platform allows it to leverage relationships across lines of businesses and its industry/product knowledge by providing multi-channel delivery systems to the client base, thereby increasing the ability to cross-sell its services.

-

Abans Holdings Limited’s management team‘s experience and understanding of the diverse financial market in the domestic and global scenarios will enable it to continue to take advantage of both current and future market opportunities. It is also expected that the management personnel‘s experience will help the company in addressing and mitigating various risks inherent in its business, including research-driven trading, client management, competition, and fluctuations in the financial market on a macro level.

-

Abans Holdings Limited’s International exposure helps its customers diversify a portfolio, which in turn provides a balance between geographies. The commodities traded globally also provide its trading teams with ample arbitrage and short-term investment opportunities for its internal treasury operations.

-

Abans Holdings Limited’s dedicated focus on client coverage and its ability to provide ongoing and innovative solutions in terms of diversity of investment avenues and global execution, enables the company to establish longterm relationships with institutional and high-net-worth individual clients. These deep relationships provide the company with an advantage in attracting better brokerage fees and trade commissions.

-

Abans Holdings Limited’s IT infrastructure and effective use of technology have enabled it to develop an effective risk control framework for its global business transactions and also improve employee productivity and operating efficiencies. The company is able to offer clients unique financial access to a large number of financial products, strategies, and investments by having a robust IT infrastructure that provides updates on global equity, commodity, and other financial product movements.

Abans Holdings IPO Risk Factors:

-

Abans Holdings Limited is primarily a holding company that operates all its business through its 17 subsidiaries and the performance of the Subsidiaries may adversely affect the results of operations of the company.

-

Abans Holdings Limited has reported negative net cash flows in the past and it cannot assure that its net cash flows will be positive in the future. If the Company is not able to generate sufficient cash flows, the Company may not be able to generate sufficient amounts of cash flow to finance its projects, make new capital expenditure, pay dividends, make new investments, or fund other liquidity needs which could have a material adverse effect on the business and results of operations of the company.

-

Unexpected market movements and disruptions could affect the capital business of the company making its revenues and profits highly volatile, which may make it difficult for it to achieve steady earnings growth on a quarterly basis and hence may adversely impact the business operations, stock prices, and financial position of the company.

-

A majority of Abans Holdings Limited’s advances by its NBFC are unsecured and are not supported by any collateral that could help ensure repayment of the loan. If the company is unable to recover such advances in a timely manner or at all, the financial condition, results of operations, and cash flows may be adversely affected.

Objects of the Offer:

The Objects of the Net Fresh Issue is to raise funds for:

- Further Investment in the NBFC Subsidiary (Abans Finance Pvt. Ltd.) for financing the augmentation of its capital base to meet its future capital requirements

- General Corporate Purpose

Abans Holdings IPO Prospectus:

- Abans Holdings Limited IPO DRHP –

- Abans Holdings Limited IPO RHP –

Registrar to the offer:

Bigshare Services Private Limited

Contact Person: Babu Raphael

Telephone: +91 – 22 – 6263 8200

E-mail: ipo@bigshareonline.com

Mobikwik IPO FAQ

Ans.Abans Holdings IPO is a main-board IPO of 12,800,000 equity shares of the face value of ₹2 aggregating up to ₹345.60 Crores. The issue is priced at ₹256 to ₹270 per share. The minimum order quantity is 55 Shares.

The IPO opens on Dec 12, 2022, and closes on Dec 15, 2022.

Ans. The Abans Holdings IPO opens on Dec 12, 2022 and closes on Dec 15, 2022.

Ans. The minimum lot size that investors can subscribe to is 55 shares.

Ans. The Abans Holdings IPO listing date is not yet announced. The tentative date of Abans Holdings IPO listing is Dec 23, 2022.

Ans. The minimum lot size for this upcoming IPO is 55 shares.