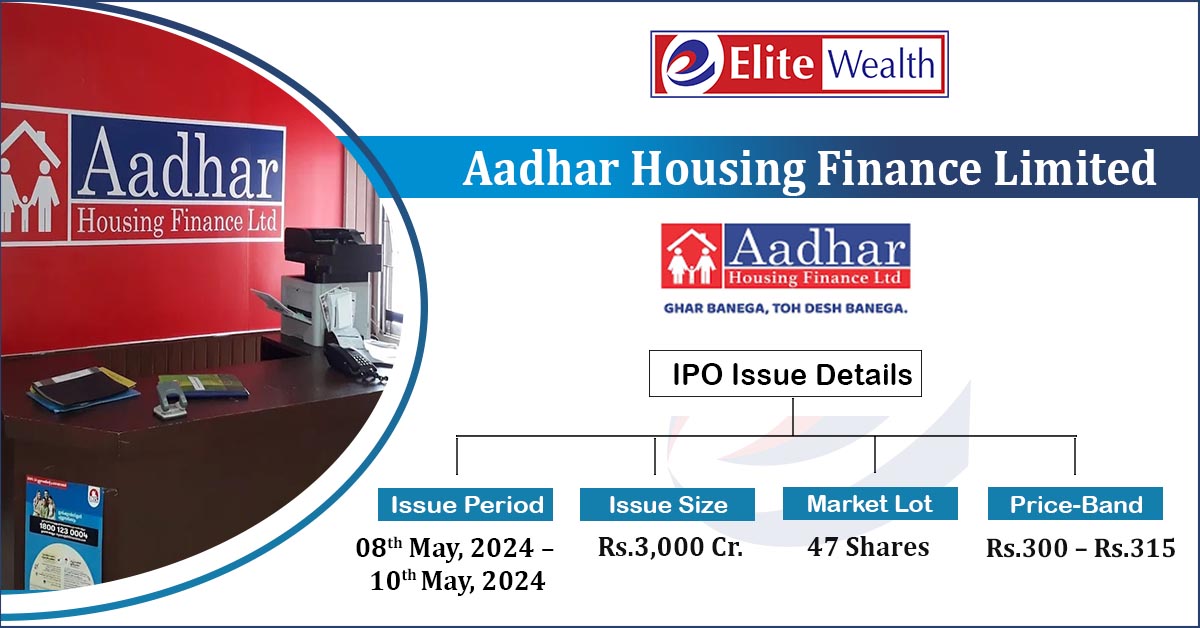

Aadhar Housing Finance Limited IPO Details:

Aadhar Housing Finance Limited (AHFL) is a housing finance company that provides loans up to Rs. 15 lakhs and focuses on the low-income housing market. The Company offers middle-class clients small-ticket loans. The total assets under management by the company as of December 2023 are valued at Rs. 19,865 crore. As of December 2023, the average loan amount offered by Aadhar Housing Finance was between Rs.9 and Rs.10 lakh, with an average loan-to-value ratio of 58.3%. With 109 sales offices, the company maintains a network of 487 branches. 41% of loans made by the AHFL go to self-employed borrowers, and 59% go to salaried clients. The company has obtained financing from a number of sources, including working capital facilities and term loans as well as cash credit. In order to meet the capital requirements, it raises money through the issuance of NCDs, refinancing from the National Housing Board (NHB), and subordinated debt borrowings from banks, mutual funds, and other domestic development institutions. AHFL has a strong management team, the board comprises independent directors as well as skilled and knowledgeable individuals who have a deep grasp of the banking and home finance sectors.

| IPO-Note | Aadhar Housing Finance Limited |

| Rs.300 – Rs.315 per Equity share | Recommendation: Apply for Long-Term |

Aadhar Housing Finance Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· To meet future capital requirements · To gain listing benefits |

| Issue Size | Total issue Size – Rs.3,000 Cr.

Fress Issue – Rs.1,000 Cr. Offer for Sale – Rs.2,000 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.300 – Rs.315 |

| Bid Lot | 47 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 08th May, 2024 – 10th May, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Aadhar Housing Finance Limited IPO Strengths:

-

The company’s primary focus is on the low-income housing market, which gives it the opportunity to take advantage of its position and reach the majority of Indian residents in towns and villages.

-

It has a Pan-India branch & sales office network. It has significantly increased its branch network from 310 in FY21 to over 487 as of FY23.

-

AHFL has strong asset quality: Gross Non-Performing Assets stood at 1.2% & the Net Non-Performing Assets stood at 0.8% as of FY23. The Company has robust and comprehensive processes for underwriting, collections & monitoring asset quality.

Aadhar Housing Finance Limited IPO Risk Factors:

-

If the company fails to effectively identify, monitor and manage risks, including risks of fraud, money laundering and other operational risks, it could have a material adverse effect on the business

-

The company’s asset quality and NPA levels may be adversely impacted by the RBI’s November 12 Circular on NPA recognition, which has increased NPA levels for NBFCs/HFCs.

-

The former promoters of the Company have ongoing regulatory investigations by the enforcement agencies including the ED.

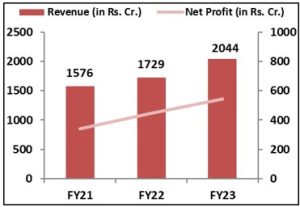

Aadhar Housing Finance Limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Aadhar Housing Finance Limited IPO Allotment Status

Aadhar Housing Finance Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Aadhar Housing Finance Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 98.72% | 76.48% |

| Others | 1.28% | 23.52% |

Source: RHP, EWL Research

Aadhar Housing Finance Limited IPO Outlook:

AHFL is a housing financing company that specializes in offering small loans to individuals with low and moderate incomes. Focusing on underserved areas, a large branch network, and low NPAs are some of its key strengths. The company has shown steady growth in interest income and profits, aided by lower borrowing costs. With more people involved in the official banking industry, there has been a significant increase in the demand for financial products in smaller cities in recent years. However, compared to other developing nations like China, India has a low credit penetration rate in terms of the credit-to-GDP ratio, indicating untapped potential. The PE of AHFL stands at 24.66x on the upper price band which seems reasonable compared to its peers’ average of 31.90x. Considering the company’s fundamentals and future growth prospects, we recommend investors to apply to the offering for the long term perspective.