Vodafone Idea Limited FPO Company Details:

Vodafone Idea Limited (VIL) is India’s third-largest provider of telecommunication services. Using 2G, 3G, and 4G technologies, the company provides a variety of services including voice, data, enterprise, and value-added services including digital and short messaging services. With over 223 million users as of December 31, 2023, VIL had a 19.3% market share for subscribers. Furthermore, during the same period, it enabled roughly 401 billion call minutes and roughly 6,004 billion megabytes of data through its network. On a larger scale, the Vodafone group works with mobile networks in 45 other countries and provides its fixed and mobile services to over 300 million users in 17 countries. The company also has one of the biggest Internet of Things (“IoT”) systems in the world. VIL boasts a strong infrastructure, with more than 438,900 broadband (3G and 4G) sites that are completely VoLTE-enabled and about 183,400 distinct tower locations. It serves a population of more than 1.2 billion people, and its network of optical fiber cable (OFC) is more than 298,000 kilometers long, including its own infrastructure and any purchased irreversible rights of use (IRUs) (not including overlaps). Additionally, as of December 31, 2023, the company’s mobile network served communities in over 487,000 Indian towns and villages, and more than 342,200 towns and villages had access to broadband services.

| FPO-Note | Vodafone Idea Limited |

| Rs.10 – Rs.11 per Equity share | Recommendation: Avoid |

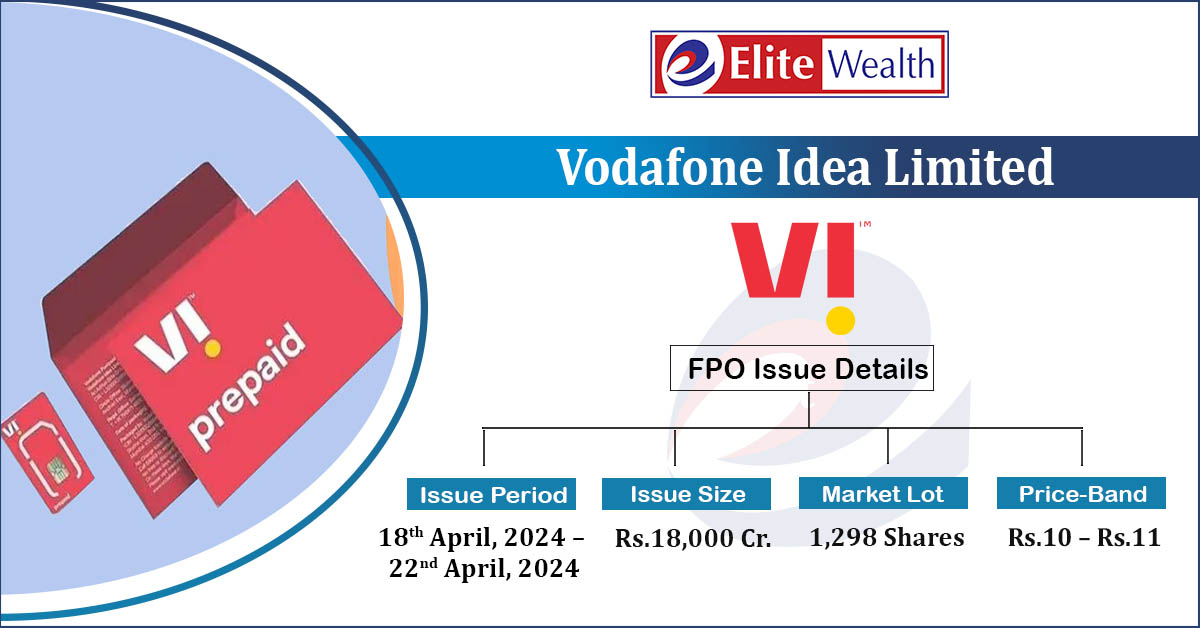

Vodafone Idea Limited FPO Details :

| Issue Details | |

| Objects of the issue | · To purchase equipment for the network infrastructure expansion

· To pay certain deferred payments for spectrum to the DoT and the GST |

| Issue Size | Total issue Size – Rs.18,000 Cr.

Fresh Issue – Rs.18,000 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.10 – Rs.11 |

| Bid Lot | 1,298 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 18th April, 2024 – 22nd April, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Vodafone Idea Limited FPO Strengths:

-

VIL has a substantial customer base and a wide expansive network of telecommunications.

-

It has long standing relationship with broad customer base.

-

Company’s advanced 4G network is 5G-ready, with future-proof architecture and over 90% of radios boasting ultra-fast 10G bandwidth.

-

It currently holds an extensive Distribution and Service Network of 10,000 distributors servicing approximately 7,87,000 retailers across India.

Vodafone Idea Limited FPO Risk Factors:

- The Company has not complied with certain covenants specified in its financing agreements and accumulated a large amount of debt.

- The company faces intense competition which may have an effect on its profitability and market share.

- Company has been occurring losses from past few years and may not achieve or sustain profitability in the future.

- VIL, along with certain of its Subsidiaries, Promoters, Directors, and Group Companies, are currently involved in certain legal proceedings. Any adverse outcome in these proceedings may impact its operations, business and reputation.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Vodafone Idea FPO Allotment Status

Vodafone Idea FPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

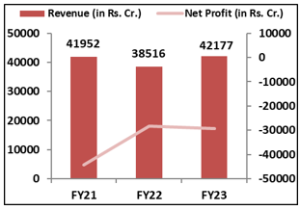

Vodafone Idea Limited FPO Financial Performance:

Vodafone Idea Limited FPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 48.91% | 36.87% |

| Others | 51.09% | 63.13% |

Source: RHP, EWL Research

Vodafone Idea Limited FPO Outlook:

VIL is a joint venture between the Vodafone Group and the Aditya Birla Group. It is one of the top telecom service providers in India offering voice and data services throughout India on 2G, 3G, and 4G networks. The company owns a sizable spectrum portfolio, which includes 16 circles of mmWave 5G spectrum and 17 circles of mid band 5G spectrum. Company is building the infrastructure necessary to implement smarter and newer technologies, preparing retail and enterprise clients for the future with cutting-edge products that are easily accessed through a network of digital channels and a significant physical presence. Despite a large customer base of over 223 million, VIL is facing financial losses, significant debt, and intense competition in the telecommunication segment. Considering company’s financials, debt and current market scenario we recommend investors to avoid the offering.

Bharti Hexacom IPO FAQ

Ans. VI FPO is a main-board FPO of 16,363,636,363 equity shares of the face value of ₹10 aggregating up to ₹18,000.00 Crores. The issue is priced at ₹10 to ₹11 per share. The minimum order quantity is 1298 Shares.

The FPO opens on April 18, 2024, and closes on April 22, 2024.

Link Intime India Private Ltd is the registrar for the FPO. The shares are proposed to be listed on BSE, NSE.

Ans. The VI FPO opens on April 18, 2024 and closes on April 22, 2024.

Ans. VI FPO lot size is 1298 Shares, and the minimum amount required is ₹14,278.

Ans. The VI FPO listing date is not yet announced. The tentative date of VI FPO listing is Thursday, April 25, 2024.

Ans. The minimum lot size for this upcoming IPO is 1298 shares.