Jana Small Finance Bank IPO Company Details:

Jana Small Finance Bank Limited (JSFL) is a non-banking finance company which is specialized in providing MSME Loans, term loans to NBFCs, affordable housing loans, two wheeler loans, gold loans and loans against fixed deposits. The bank offers a wide range of unsecured lending products, including group loans, loans for individuals and microbusinesses, and loans for agriculture and related industries.

The bank divides its loan portfolio into three main categories:

- Individual loans for house repair or improvement;

- Individual loans for educational expenses;

- Individual personal loans for debt relief, family obligations, incidental costs, and company needs.

The bank serves both retail and corporate customers by providing digital goods, services, and platforms, such as internet and mobile banking. The gross secured advances of the bank increased significantly between March 31, 2021, and March 31, 2023, from Rs.5,076 Cr. to Rs.9,905 Cr., representing a noteworthy CAGR of 39.69%. By March 31, 2023, JSFL have 754 banking locations spread across 22 states and two union territories. Of those locations, 272 are carefully placed in rural areas that lack access to banks. This widespread presence across the country is a calculated strategic move to reduce the risks associated with concentration. Since its inception in 2008, bank has provided services to around 12 million clients; as of March 31, 2023, and had 4.57 million active clients. The bank has successfully added 0.91 million, 0.51 million, and 0.08 million new customers in the last three fiscal years.

| IPO-Note | Jana Small Finance Bank Limited |

| Rs.393 – Rs.414 per Equity share | Recommendation: Apply for Long Term |

Jana Small Finance Bank IPO Details:

| Issue Details | |

| Objects of the issue | · To augment the Bank’s Tier-1 capital base to meet the future capital requirements

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.570 Cr.

Fresh Issue – Rs.462 Cr. Offer for Sale – Rs.108 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.393 – Rs.414 |

| Bid Lot | 36 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 07th Feb, 2024 – 09th Feb, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Jana Small Finance Bank IPO Strengths:

-

JSFL has Pan-India presence with strong brand recognition.

-

The bank has a diversified retail deposit which helped it to decrease its cost of funds from 8.61% in March, 2021 to 7.55% in September, 2023.

-

It operates in the expanding small finance industry, where there is a growing need for financial services in neglected markets.

-

It has a track record of profitability and good asset quality.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Jana Small Finance Bank IPO Allotment Status

Jana Small Finance Bank IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Jana Small Finance Bank IPO Risk Factors:

-

Numerous regulatory bodies, including the RBI, PFRDA, IRDA, and National Pension System Trust, have the right to inspect the business. Failure to abide by these authorities’ observations may have a negative impact on the bank’s operations and business performance.

-

If the bank is unable to maintain its non-performing assets or unable to maintain adequate provisioning coverage, its financial conditions could be adversely impacted.

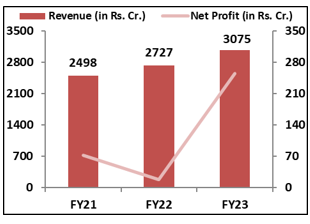

Jana Small Finance Bank IPO Financial Performance:

Jana Small Finance Bank IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue | |

| Promoters Group | 25.23% | 23.12% | |

| Others | 74.77% | 76.88% |

Source: RHP, EWL Research

Jana Small Finance Bank IPO Outlook:

JSFL is among the top five small finance banks in terms of share of Retail Deposits among all Small Finance bank as at March, 2023. The bank has shown consistent growth in providing financial services to individuals as well as corporates. The PE of JSFL stands at 16.5x on the upper price band which seems attractive when compared to its peer’s average of 93x. The bank’s financials, strategic positioning, and growth trajectory look good; it is well-positioned to capitalize the growing trend in the SFB sector with its focus on underserved rural and semi-urban markets. Considering the valuations, financials and future growth prospect we recommend investors to apply in the offering for long term perspective.

Jana Small Finance Bank IPO FAQ

Ans. Jana SFB IPO is a main-board IPO of 13,768,049 equity shares of the face value of ₹10 aggregating up to ₹570.00 Crores. The issue is priced at ₹393 to ₹414 per share. The minimum order quantity is 36 Shares.

The IPO opens on February 7, 2024, and closes on February 9, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Jana SFB IPO opens on February 7, 2024 and closes on February 9, 2024.

Ans. Jana SFB IPO lot size is 36 Shares, and the minimum amount required is ₹14,904.

Ans. The Jana SFB IPO listing date is not yet announced. The tentative date of Jana SFB IPO listing is Wednesday, February 14, 2024.

Ans. The minimum lot size for this upcoming IPO is 36 shares.