HSBC Financial Services Fund

India’s financial services sector symbolises nation’s thriving economic landscape and future potential. With growth expected to surge by 2035, this progress is underpinned by higher incomes, a focused government agenda on financial inclusion and transformative digital adoption.

India is becoming a major driving force in the world economy. In nominal GDP terms, India is the 5th largest country globally and is projected to become 3rd largest by 2030. India’s financial services sector, from banking and insurance to asset management and fintech, is poised for significant growth driven by country’s rapidly expanding economy, offering immense opportunities for wealth creation.

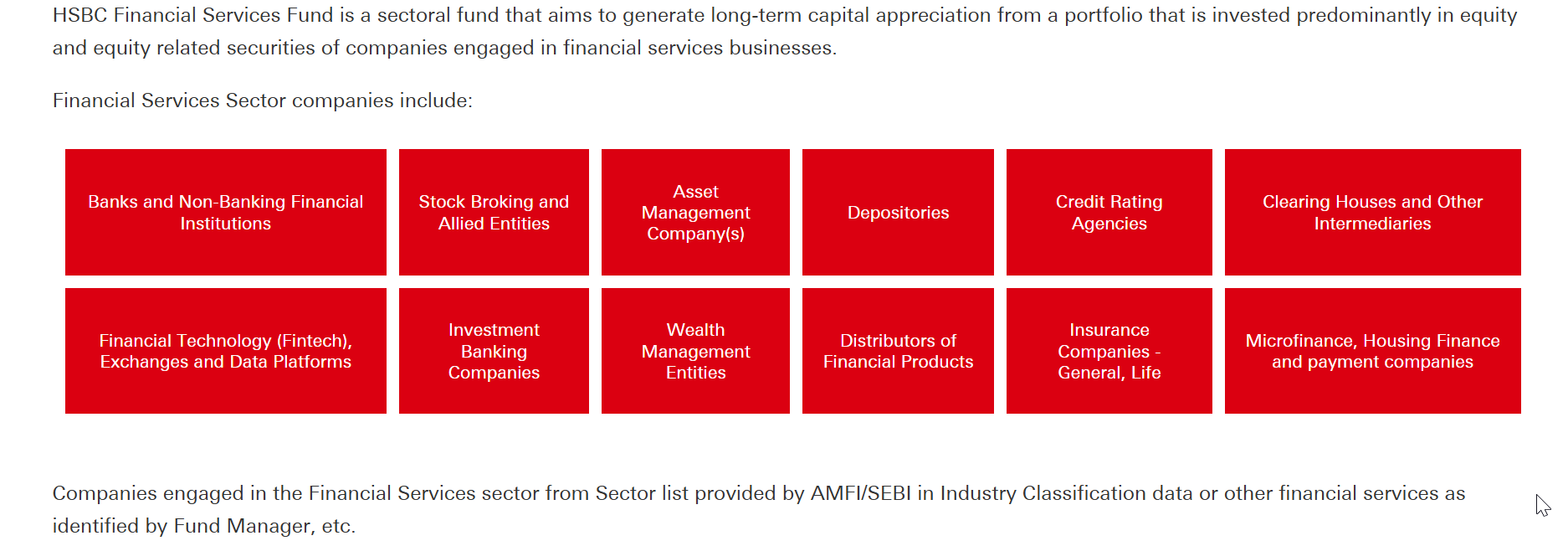

The banking sector is considered the backbone of the Indian economy, playing a crucial role in economic growth and development whereas other segment of financial services sector is on a growth trajectory, driven by increasing financial inclusion, digitalization, and supportive regulatory policies. These factors contribute to the potential for robust growth in the sector, making it an attractive proposition for investors seeking to capitalize on the sector’s performance.

Source: RBI, Financial Stability Board, World Bank, Federal Reserve, Bundesbank, BCG analysis

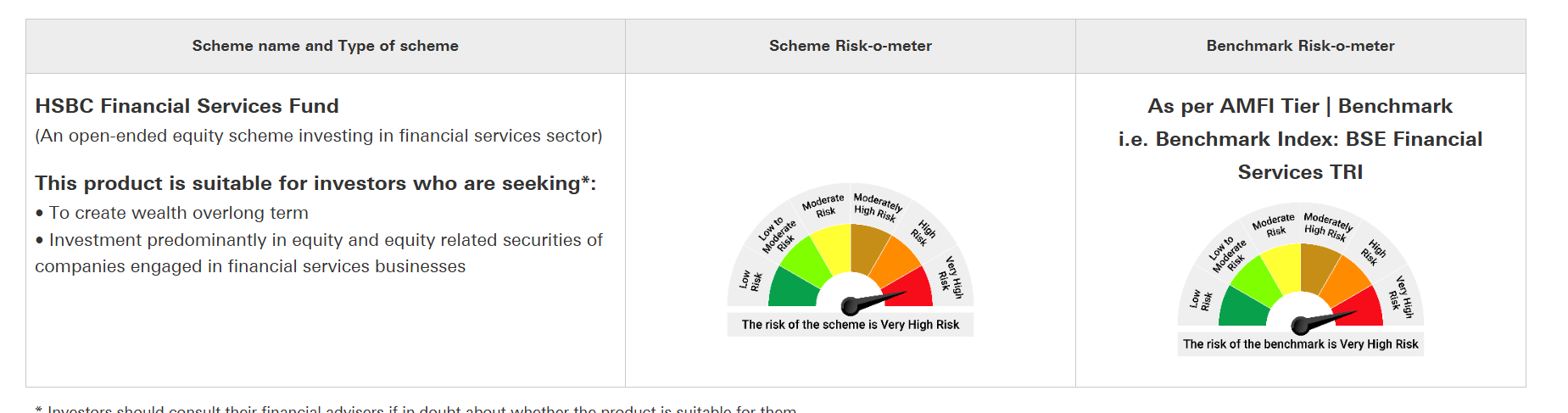

Presenting HSBC Financial Services Fund

Portfolio Construction Approach

(source:https://www.assetmanagement.hsbc.co.in/)

HSBC Financial Services fund NFO Details:

| Mutual Fund | HSBC Mutual Fund |

| Scheme Name | HSBC Financial Services fund |

| Objective of Scheme | The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in financial services businesses. There is no assurance that the investment objective of the scheme will be achieved |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 06-Feb-2025 |

| New Fund Earliest Closure Date | 20-Feb-2025 |

| New Fund Offer Closure Date | 20-Feb-2025 |

| Indicate Load Seperately | Exit Load: i. If the units redeemed or switched out are up to 10% of the units purchased or switched in (“the limit”) within 1 year from the date of allotment – Nil ii. If units redeemed or switched out are over and above the limit within 1 year from the date of allotment – 1% iii. If units are redeemed or switched out on or after 1 year from the date of allotment – Nil. • No Exit load will be chargeable in case of switches made between different options of the Scheme. • No Exit load will be cha |

| Minimum Subscription Amount | 5000 |

| For Further Details Please Visit Website | https://www.assetmanagement.hsbc.co.in |

(source:https://www.amfiindia.com/)

Scheme Documents

(source : https://www.assetmanagement.hsbc.co.in/)