Fund Details

Investment Objective

To generate long term capital appreciation from a diversified portfolio of predominantly equity and equity related securities while offering deduction on such investment made in the scheme under Section 80C of the Income Tax Act, 1961.

However, there is no assurance that the investment objective of the Scheme will be achieved.

(source : https://www.bajajamc.com/)

Bajaj Finserv ELSS Tax Saver Fund Details:

| Mutual Fund | Bajaj Finserv Mutual Fund |

| Scheme Name | Bajaj Finserv ELSS Tax Saver Fund |

| Objective of Scheme | To generate long term capital appreciation from a diversified portfolio of predominantly equity and equity related securities while offering deduction on such investment made in the scheme under Section 80C of the Income Tax Act, 1961. However, there is no assurance that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – ELSS |

| New Fund Launch Date | 24-Dec-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 22-Jan-2025 |

| Indicate Load Seperately | Entry Load: Nil Exit Load: Nil The Trustee / AMC reserves the right to change the load structure any time in the future if they so deem fit on a prospective basis. The investor is requested to check the prevailing load structure of the scheme before investing. |

| Minimum Subscription Amount | 500 |

| For Further Details Please Visit Website | https://www.bajajamc.com |

(source:https://www.amfiindia.com/)

ELSS Fund Overview:

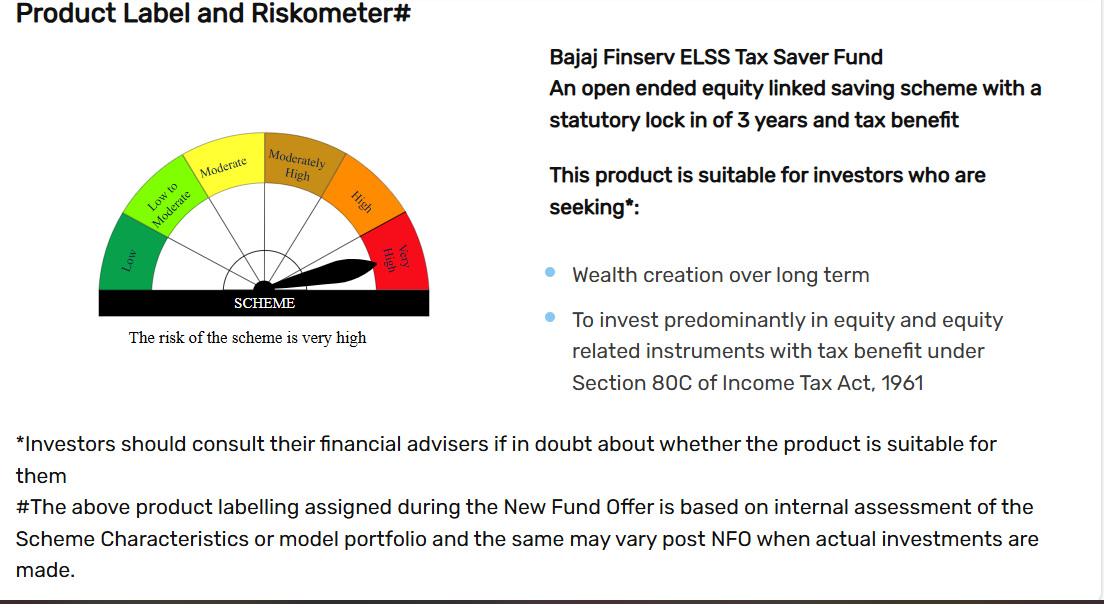

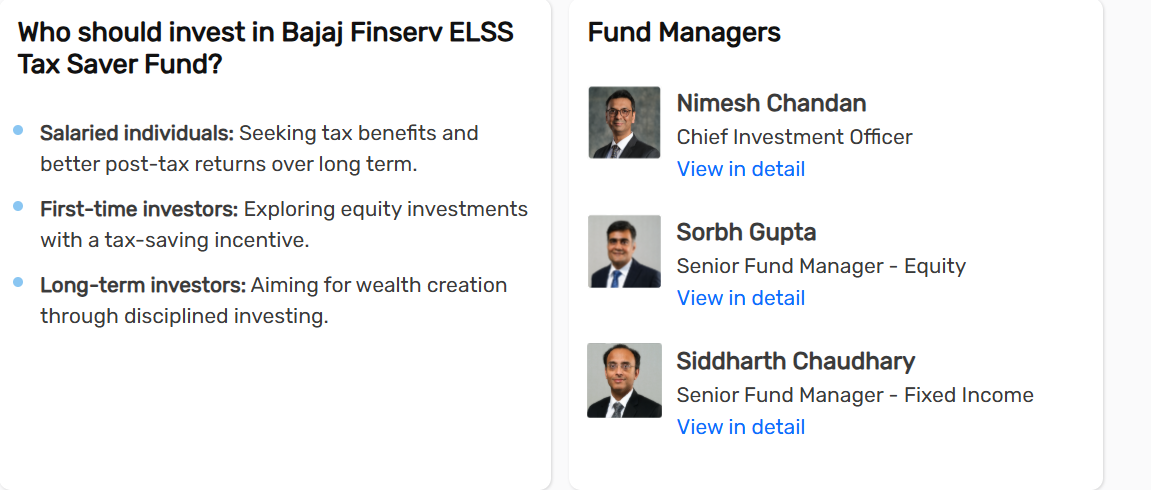

Equity-Linked Saving Scheme (ELSS) is a unique investment option that aims for potential wealth creation while also offering tax benefits under the provisions of Section 80C of the Income Tax Act, 1961. ELSS primarily invests the major corpus of money (minimum 80% of the portfolio) in equities and equity-related securities.

There is no minimum allocation required in each market capitalization, so the fund manager is free to plan the flexi cap fund investment portfolio as per their growth strategy, market knowledge and insights.

Furthermore, these funds have the shortest lock-in period among all tax-saving investment options. The mandatory lock-in period for ELSS is just three years.

In recent years, many salaried investors have opted for ELSS funds for tax benefits. After the lock-in period is over, the units can be redeemed or switched, or you can also continue your investments for long term wealth creation.

Investments in ELSS funds are eligible for a tax deduction of up to Rs. 1.5 lakh under Section 80C of the Income Tax Act. So basically, the amount you invest in ELSS can be subtracted from your total taxable income, thereby reducing your tax liability.

(source:https://www.bajajamc.com/)

Scheme Documents

(source : https://www.bajajamc.com/)