Mamata Machinery Limited Company Profile:

Mamata Machinery specializes in manufacturing and also exporting machines for producing plastic bags, pouches, packaging machinery, and extrusion equipment. It provides comprehensive manufacturing solutions for the packaging industry. The machines it produces are used in various sectors for packaging applications, including the packaging of food and FMCG products. The company mainly sells its packaging machinery to direct consumer brands in the FMCG, Food, and Beverage industries. It also supplies bag and pouch-making machines to converters and service providers who cater primarily to the FMCG and consumer sectors. In addition, Mamata’s machinery is used for non-packaging applications such as e-commerce and garment packaging.

| IPO-Note | Mamata Machinery Limited |

| Rs.230– Rs.243 per Equity share | Recommendation: Apply |

Mamata Machinery Limited IPO Details :

| Issue Details | |

| Objects of the issue |

· Entirely an Offer for sale. |

| Issue Size | Total issue Size – Rs.179.39 Cr

Offer for sale- Rs 179.39 Cr Employee discount- Rs 12 per share |

| Face value |

Rs.10 |

| Issue Price | Rs.230 – Rs.243 per share |

| Bid Lot | 61 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | December 19, 2024 – December 23, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not more than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Mamata Machinery Limited IPO Strengths:

-

The company provides a one-stop solution for the packaging industry, offering services such as supplying packaging machines, as well as machines for pouches and bags. As of September 30, 2024, the company has installed over 4,500 machines across 75 countries worldwide.

-

The Indian packaging industry demonstrated a CAGR of 26.7% from 2019 to 2023. With continued growth in the FMCG sector, the packaging industry is expected to experience further expansion, driven by the rising demand for packaged food. This growth is anticipated to benefit the company significantly.

-

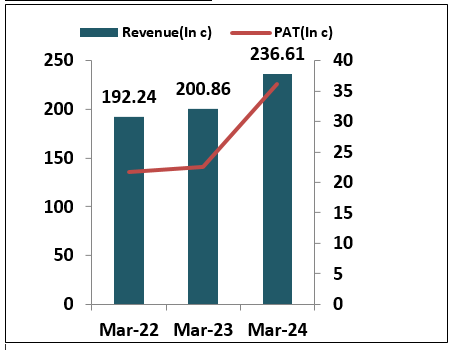

The company reported a revenue of Rs 236.61 crores in FY24, marking an 18% increase compared to FY23. During the same period, the company posted a profit after tax (PAT) of Rs 36.12 crores, reflecting a 63% growth over FY23.

For FY24, the company reported a Return on Equity (ROE) of 27.76%, indicating strong profitability from shareholders’ equity.

Mamata Machinery Limited IPO Risk Factors:

-

The industry in which the company operates is highly competitive, with key competitors including Windsor Machines, Rajoo Engineering, and others. Internationally, the company faces competition from major players such as Windmöller & Hölscher and Reifenhäuser GmbH & Co.

-

Since the company generates a significant portion of its revenue in the second half of the year, its inventory days are relatively high, reaching 880 days as of June 30, 2024.

Mamata Machinery Limited IPO Financial Performance :

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Mamata Machinery Limited IPO Allotment Status

Mamata Machinery Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Mamata Machinery Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 92.45% | 62.5% |

| Others | 7.55% | 37.5% |

Mamata Machinery Limited IPO Outlook:

Mamata Machinery Limited has established a strong presence in the manufacturing of machines for plastic bags. Going forward, Mamata Machinery is poised to benefit significantly from the growth of the FMCG sector and the increasing demand for packaged foods. . The company has demonstrated solid financial performance, reflected in its revenue growth and profitability. For FY24, the company reported an EPS of Rs 16.55, which results in a post-IPO P/E ratio of 14.68, based on FY24 earnings. This valuation appears reasonable and indicates that the stock is fairly priced. Therefore, we recommend that investors consider applying for the IPO for both long-term capital appreciation and potential listing gains.

Mamata Machinery Limited IPO FAQ:

Ans. Mamata Machinery IPO is a main-board IPO of 7382340 equity shares of the face value of ₹10 aggregating up to ₹179.39 Crores. The issue is priced at ₹230 to ₹243 per share. The minimum order quantity is 61.

The IPO opens on December 19, 2024, and closes on December 23, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Mamata Machinery IPO opens on December 19, 2024 and closes on December 23, 2024.

Ans. Mamata Machinery IPO

Ans. The Mamata Machinery IPO listing date is not yet announced. The tentative date of Mamata Machinery IPO listing is Friday, December 27, 2024.

Ans. The minimum lot size for this upcoming IPO is 61 shares.