Sai Life Sciences Limited IPO Company Profile:

Sai Life Sciences Ltd is a leading global Contract Research, Development, and Manufacturing Organization (CRDMO) that supports pharmaceutical innovators by providing end-to-end solutions across drug discovery, development, and manufacturing. Headquartered in Hyderabad, India, the company operates state-of-the-art facilities in Hyderabad, Pune, and Bidar, along with international operations in the USA and the UK. The company specializes in drug discovery, process development, and manufacturing for small-molecule New Chemical Entities (NCEs). Its robust infrastructure and commitment to excellence make it a trusted partner for global pharmaceutical and biotechnology companies.

| IPO-Note | Sai Life Sciences Limited |

| Rs.522– Rs.549 per Equity share | Recommendation: Avoid |

Sai Life Sciences Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Repayment of borrowings · General Corporate Expenses |

| Issue Size | Total issue Size – Rs.3,042.62 Cr

Fresh Issue – Rs. 950 Cr Offer for sale- Rs 2,092.62 Cr |

| Face value |

Rs.1 |

| Issue Price | Rs.522 – Rs.549 per share |

| Bid Lot | 27 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | December 11, 2024- December13, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Sai Life Sciences Limited IPO Strengths:

-

The global pharmaceutical market, valued at USD 1451 billion in 2023 and projected to reach USD 1956 billion by 2028, at a CAGR of 6.2%. Factors such as rising chronic diseases, aging populations, and increased health awareness present strong growth opportunities for the company.

-

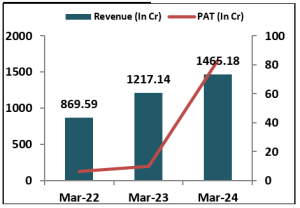

The company has reported revenue of Rs 1465.18 crore which is up 20.37% from FY23. Profit after tax also saw a significant increase of 729.65%, reaching ₹82.81 crore in FY24, compared to ₹9.99 crore in FY23. Additionally, the company achieved a 29.50% CAGR from FY2022 to FY2024.

-

The company’s presence in innovation hubs like Boston (US), Manchester (UK), and manufacturing facilities in India provides access to advanced research, global talent, and cost advantages, boosting its capabilities in drug discovery, development, and large-scale production.

-

As of September 30, 2024, Sai Life Sciences had served over 280 pharmaceutical companies, including 18 of the top 25 global pharma companies. As of September 30, 2024, the company’s development and manufacturing portfolio included 38 APIs and intermediates, supporting the production of 28 commercial drugs.

Sai Life Sciences Limited IPO Risk Factors:

- Intense competition from established players like Divi’s Lab, Wuxi Apptec, and Pharmaron, both internationally and domestically, poses a significant risk to the company’s market share, pricing power, and ability to attract and retain customers in the highly competitive CDMO sector.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Sai Life Sciences Limited IPO Allotment Status

Sai Life Sciences Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Sai Life Sciences Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 41.82%

|

35.24%

|

| Others | 58.18%

|

64.76%

|

Sai Life Sciences Limited IPO Outlook:

Sai Life Sciences Limited, a leading Contract Research, Development, and Manufacturing Organization (CRDMO. The company is global player for healthcare related products development serving over 25 world’s leading pharma companies. The company’s asking price of Rs 522 to 549 is offered at a P/E of 126.42 based on it’s FY24 earning and Expected FY25 eEPS 2.69 and eP/E is 203.82. Thus we advice Investors to skip the issue as it was overprice.

Sai Life Sciences Limited IPO FAQ:

Ans. Sai Life Sciences IPO is a main-board IPO of 55,421,123 equity shares of the face value of ₹1 aggregating up to ₹3,042.62 Crores. The issue is priced at ₹522 to ₹549 per share. The minimum order quantity is 27 Shares.

The IPO opens on December 11, 2024, and closes on December 13, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Sai Life Sciences IPO opens on December 11, 2024 and closes on December 13, 2024.

Ans. Sai Life Sciences IPO lot size is 27 Shares, and the minimum amount required is ₹14,823.

Ans. The Sai Life Sciences IPO listing date is not yet announced. The tentative date of Sai Life Sciences IPO listing is Wednesday, December 18, 2024.

Ans. The minimum lot size for this upcoming IPO is 27 shares.