Samco Multi Asset Allocation Fund – Direct Growth

About Scheme: This is a unique fund with a dynamic R.O.T.A.T.E. strategy. The fund has an ability to rotate predominantly into EQUITY Mode when equities are in a bull market, into GOLD mode when equities take a back seat but Gold is outperforming and into DEBT/ARBITRAGE mode when both equities and gold are falling.

Fund Overview

Investment Objective

The investment objective of the scheme is to generate long term capital appreciation by investing in a diversified portfolio of equity and equity related instruments, debt and money market instruments, Exchange Traded Commodity Derivatives / Units of Gold ETFs, Silver ETF & units of REITs/InvITs.

There is no assurance that the investment objective of the scheme will be achieved.

Key Highlights

| Gold : Ability to transform into a predominantly Gold Fund when Gold is trending upwards inversely vs Equity. |

| Real Time Allocation Model : Allows quick re-allocation between 3 modes and doesn’t wait for quarterly/monthly rebalancing cycles. |

| Dynamic in nature : A hybrid fund that can transform into pre-dominantly Equity Mode or Gold Mode or Debt Mode. |

| Drawdown Protection : Limited drawdown during bear markets. |

| Momentum Trend following system : Only stay in the equities when the markets are trending upside. |

(source: https://www.samcomf.com/)

Samco Multi Asset Allocation Fund NFO Details

| Mutual Fund | Samco Mutual Fund |

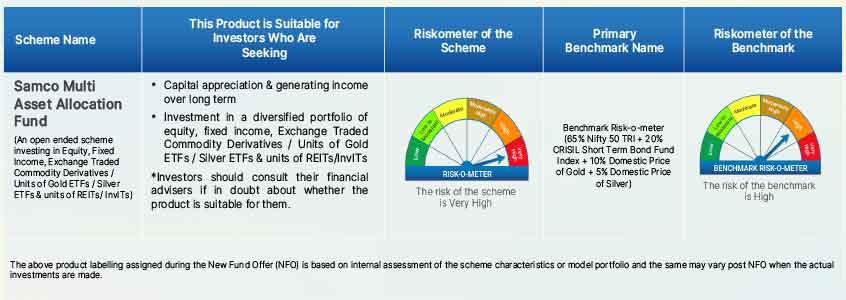

| Scheme Name | Samco Multi Asset Allocation Fund |

| Objective of Scheme | The investment objective of the scheme is to generate long term capital appreciation by investing in a diversified portfolio of equity and equity related instruments, debt and money market instruments, Exchange Traded Commodity Derivatives / Units of Gold ETFs, Silver ETF & units of REITs/InvITs. There is no assurance that the investment objective of the scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Hybrid Scheme – Multi Asset Allocation |

| New Fund Launch Date | 04-Dec-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 18-Dec-2024 |

| Indicate Load Seperately | 10% of units can be redeemed without an exit load within 12 months of allotment. Any redemption in excess of such limit in the first 12 months will incur 1% exit load. No exit load, if redeemed or switched out after 12 months from the date of allotment of unit. |

| Minimum Subscription Amount | Rs. 5,000 and in multiples of Rs. 1/- thereafter |

(source:https://www.amfiindia.com/)

Samco Multi Asset Allocation Fund NFO

Application Form

Scheme Documents

(source:https://www.samcomf.com/)