Why Bank of India Consumption Fund?

5 Market capitalization agnostic

(source; https://boimf.in/)

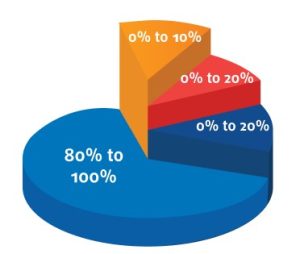

Asset Allocation Framework

- Equity & Equity related instruments of companies engaged in consumption and consumption related sectors or allied sectors 80% to 100%

- Other Equity & Equity Related Instruments 0% to 20%

- Debt and Money Market instruments 0% to 20%

- Units issued by REITs and InVlTS 0% to 10%

(source; https://boimf.in/)

Type

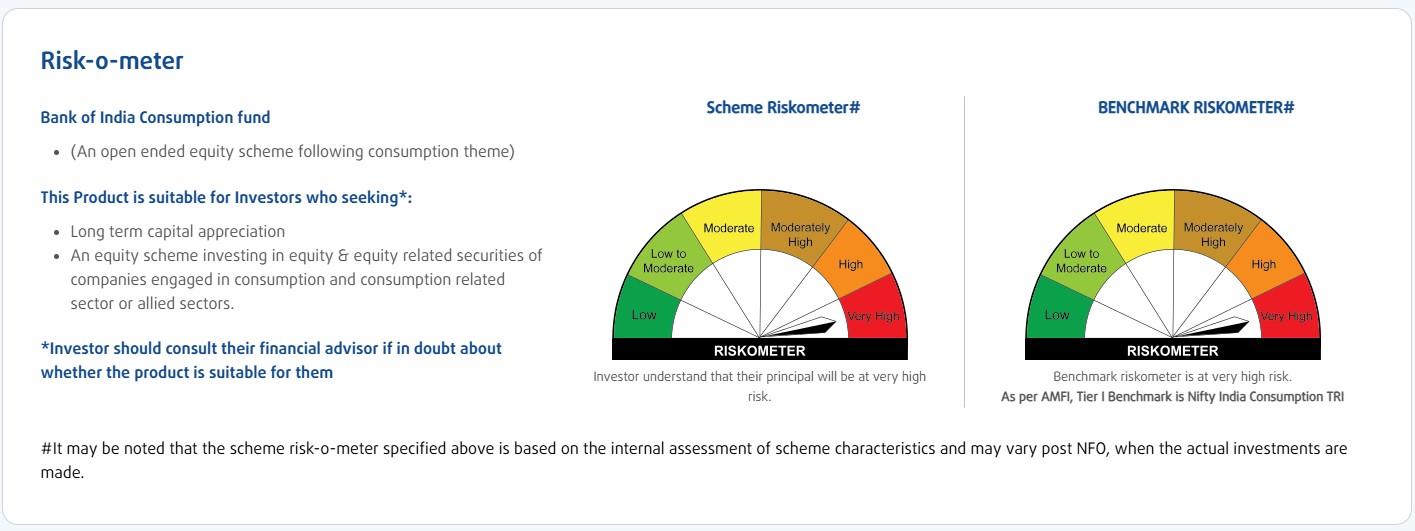

(An open ended equity scheme following consumption theme)

Benchmark

Nifty India Consumption TRI

Fund Manager

Mr. Nitin Gosar

Plan & Options

Plans- Direct Plan and Regular Plan

Options under each Plan(s):

(An open ended equity scheme following consumption theme)

Benchmark

Nifty India Consumption TRI

Fund Manager

Mr. Nitin Gosar

Plan & Options

Plans- Direct Plan and Regular Plan

Options under each Plan(s):

- Growth

- Income Distribution cum Capital Withdrawal (IDCW) (Reinvestment of IDCW & payout of IDCW option)

Load structureExit Load:

- NIL— There will be no exit load within 3 months from the date of allotment for redemption/switch out upto 10% of the units allotted.

- 1% – Any redemption/switch out in excess of the above mentioned limit would be subject to an exit load of 1%, if the units are redeemed/ switched out within 3 months from the date of allotment of units.

- NIL— There will be no exit load on any redemption/switch out after 3 months from the date of allotment of units.

Minimum Investment AmountRs. 5,000/- and in multiples of Re. 1/- thereafter.

Bank of India Consumption Fund NFO Details:

| Mutual Fund | Bank of India Mutual Fund |

| Scheme Name | Bank of India Consumption Fund |

| Objective of Scheme | The Investment objective of the Scheme is to provide longterm capital appreciation from an actively managed portfolio of equity and equity related securities of companies engaged in consumption and consumption related sector or allied sectors. However, there is no assurance that the investment objective of the Scheme will be achieved. |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 29-Nov-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 13-Dec-2024 |

| Indicate Load Seperately | |

| Minimum Subscription Amount | 5000 |

| For Further Details Please Visit Website | https://www.boimf.in |

(source:https://www.amfiindia.com/)