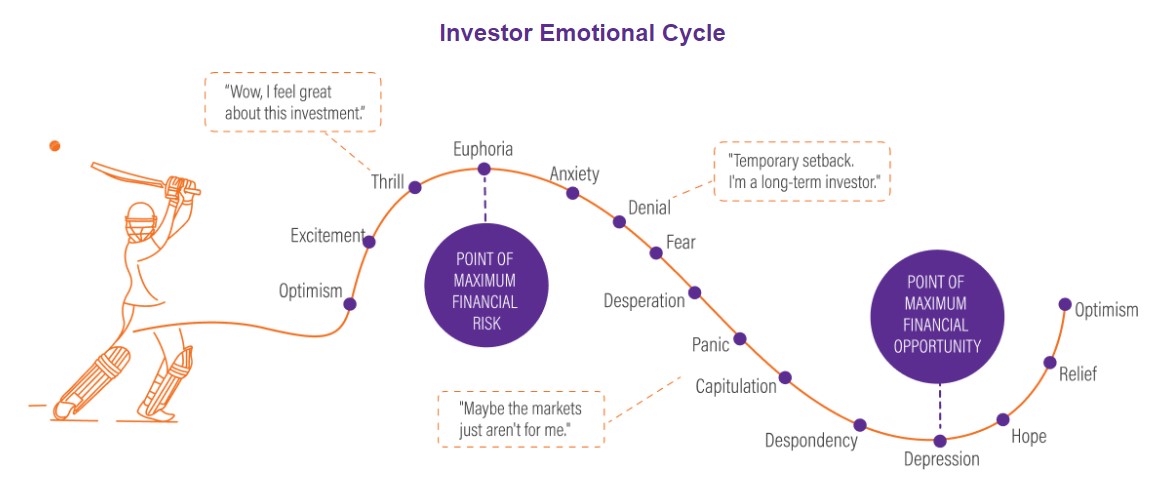

Market Volatility and Emotions:

Equity market volatility causes extreme emotions. Leading to sub-optimal asset allocation resulting in relatively lower investor returns.

(source: canararobeco.com)

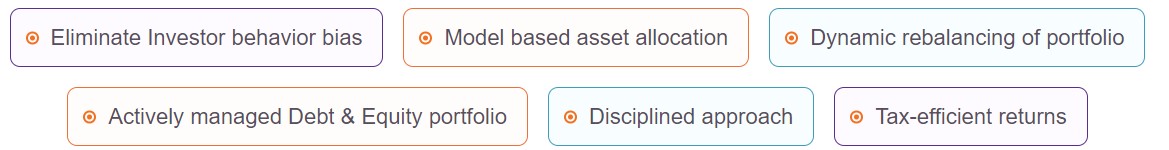

Key Features of Balanced Advantage Fund:

(source: canararobeco.com)

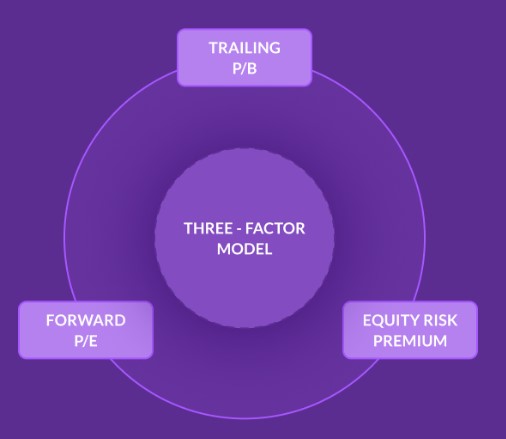

Introducing Canara Robeco Balanced Advantage Fund:

- Uses proprietary in-house Market Valuation Metrics to decide Net Equity allocation in a disciplined manner.

- The model is indicative on net equity exposure allocation using below factors.

- Trailing Price-to-Book : Valuation ratio which uses book value

- Forward P/E : Valuation ratio which uses forecasted earnings.

- Equity Risk Premium : Difference between Bond Yield and Earnings Yield.

- The model effectively suggests changes in equity allocation depending on changes in fundamental factors, same has been tested across time frames.

- Aims to

- Reduce downside during Falling Market and

- Provide reasonable participation during Rising Market.

Note : The above is only for general understanding purposes, and should not be construed as CRAMC investment policy, portfolio construction or the performance or the scheme.

Note : The above is based upon our current fund management/investment strategy. However, the same shall be subject to change depending on the market conditions, Investors shall note that there is no assurance or guarantee that the investment objective of the scheme will be achieved.

(source: canararobeco.com)

Canara Robeco Balanced Advantage Fund NFO Details:

| tual Fund | Canara Robeco Mutual Fund |

| Scheme Name | Canara Robeco Balanced Advantage Fund |

| Objective of Scheme | The fund aims to generate long-term capital appreciation with income generation by dynamically investing in equity and equity related instruments and debt and money market instruments. However, there can be no assurance that the investment objective of the scheme will be realized. |

| Scheme Type | Open Ended |

| Scheme Category | Hybrid Scheme – Dynamic Asset Allocation or Balanced Advantage |

| New Fund Launch Date | 12-Jul-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 26-Jul-2024 |

| Indicate Load Seperately | Entry Load: Nil Exit Load: 1% – if redeemed/switched out above 12% of allotted units within 365 days from the date of allotment. Nil – if redeemed/switched out upto 12% of allotted units within 365 days from the date of allotment, Nil – if redeemed/switched out after 365 days from the date of allotment |

| Minimum Subscription Amount | Rs. 1000 and multiples of Re. 1 thereafter |

| For Further Details Please Visit Website | https://www.canararobeco.com |

(source :amfiindia)

(source: canararobeco.com)

Canara Robeco Balanced Advantage Fund NFO Riskometer :