About ICICI Prudential Energy Opportunities Fund:

India’s energy demand is expected to grow over the decade due to various factors like Growth in Per Capita Income, India’s focus on Manufacturing, Climate Change, etc.

This expected growth, combined with government reforms in the energy theme, and India’s growth story being dependent on energy, are all reasons for the launch of the ICICI Prudential Energy Opportunities Fund.

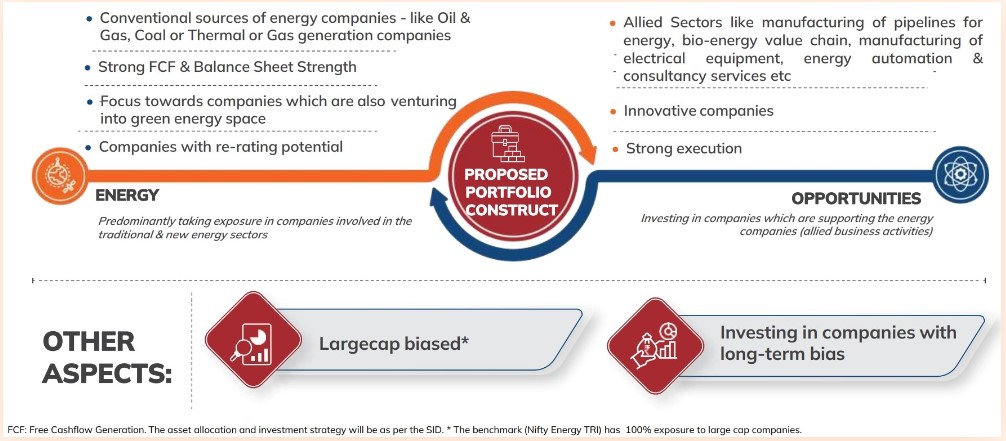

The scheme will invest across the value chains of Oil, Power, and Power transmission, and also in allied sectors.

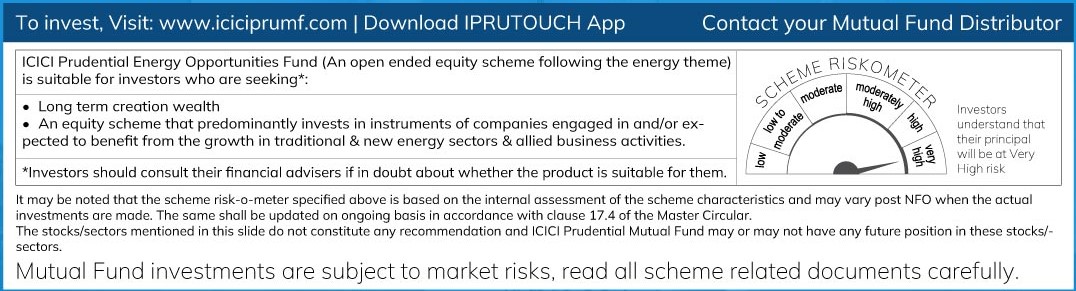

The investment objective of the Scheme is to provide investors with opportunities for long term capital appreciation by investing in equity and equity related instruments of companies engaging in activities such as exploration, production, distribution, transportation and processing of traditional & new energy including but not limited to industries/sectors such as oil & gas, utilities and power. However, there can be no assurance or guarantee that the investment objective of the scheme would be achieved.

(source: icicipruamc.com)

ICICI PRUDENTIAL ENERGY OPPORTUNITIES FUND NFO Details:

| Mutual Fund | ICICI Prudential Mutual Fund |

| Scheme Name | ICICI PRUDENTIAL ENERGY OPPORTUNITIES FUND |

| Objective of Scheme | The investment objective of the Scheme is to provide investors with opportunities for long term capital appreciation by investing in equity and equity related instruments of companies engaging in activities such as exploration, production, distribution, transportation and processing of traditional & new energy including but not limited to industries/sectors such as oil & gas, utilities and power. However there can be no assurance or guarantee that the investment objective of the |

| Scheme Type | Open Ended |

| Scheme Category | Equity Scheme – Sectoral/ Thematic |

| New Fund Launch Date | 02-Jul-2024 |

| New Fund Earliest Closure Date | |

| New Fund Offer Closure Date | 16-Jul-2024 |

| Indicate Load Seperately | Exit Load: ? 1% of applicable Net Asset Value – If the amount sought to be redeemed or switch out is invested for a period of up to three months from the date of allotment ? Nil – If the amount, sought to be redeemed or switch out is invested for a period of more than three months from the date of allotment The Trustees shall have a right to prescribe or modify the exit load structure with prospective effect subject to a maximum prescribed under the Regulations |

| Minimum Subscription Amount | 5000 |

| For Further Details Please Visit Website | https://www.icicipruamc.com |

(source:amfiindia)

(source: icicipruamc.com)

ICICI PRUDENTIAL ENERGY OPPORTUNITIES FUND NFO Scheme Highlights: