Axis Mutual Fund is a mutual fund company of Axis Bank that launched its first scheme in October 2009 since then Axis Mutual fund has grown strongly. The company attributes its success thus far to its 3 founding principles – Long term wealth creation, outside in (Customer) view and Long term relationship. A well-rounded product suite that consists of 56 Schemes, Over 1.32+ Crore Active Investor Accounts, and a presence in over 100 cities.

Axis Mutual Fund is coming up with Axis Business Cycles Fund, an NFO scheme with an investment objective To provide long-term capital appreciation by investing predominantly in equity and equity-related securities with a focus on riding business cycles through dynamic allocation between various sectors and stocks at different stages of business cycles in the economy However, there can be no assurance that the investment objective of the Scheme will be achieved. The scheme opens on the 2nd of February, 2023, and closes on the 16th of February, 2023.

Axis Business Cycles Fund (NFO) details:

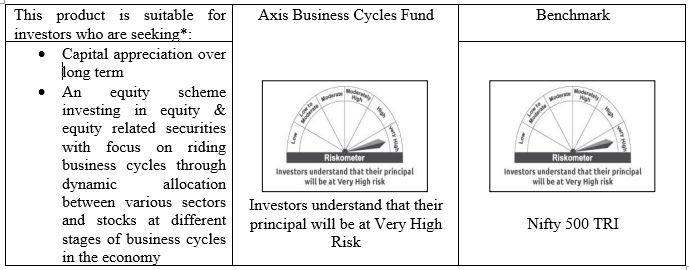

To provide long-term capital appreciation by investing predominantly in equity and equity-related securities with a focus on riding business cycles through dynamic allocation between various sectors and stocks at different stages of business cycles in the economy However, there can be no assurance that the investment objective of the Scheme will be achieved.

| Mutual Fund: | Axis Mutual Fund |

| Scheme Name: | Axis Business Cycles Fund |

| Scheme Code: | AXIS/O/E/THE/22/12/0070 |

| Objective of Scheme: | |

| Benchmark: | Nifty 500 TRI |

| Scheme Type: | Open Ended |

| Scheme Category: | Equity Scheme – Sectoral/Thematic |

| New Fund Launch Date: | 2nd February 2023 |

| New Fund Offer Closure Date: | 16th February 2023 |

| Fund Managers: | Mr. Ashish Naik and Mr. Hitesh Das (for Foreign Securities) |

| Plans: | · Axis Business Cycles Fund – Regular Plan

· Axis Business Cycles Fund – Direct Plan |

| Entry Load: | Not Applicable |

| Exit Load: | If redeemed / switched-out within 12 months from the date of allotment –

· For 10% of investment: Nil · For remaining investment: 1% If redeemed/switched out after 12 months from the date of allotment: Nil |

| Minimum Application Amount: | Rs. 5,000 and in multiples of Re. 1/- thereafter |

| Minimum Additional Purchase Amount | Rs. 1000 and in multiples of Re. 1/- thereafter |

Asset Allocation:

| Instrument | Indicative Allocation ( % of assets) | Risk Profile | |

| Minimum | Maximum | High/Moderate/Low | |

| Equity & Equity related instruments selected on the basis of business cycle#$ | 80% | 100% | Very High |

| Other Equity & Equity Related Instruments #$ | 0% | 20% | Very High |

| Debt and Money Market Instruments*$ | 0% | 20% | Low to Moderate |

| Units issued by REITs & InvITs | 0% | 10% | Moderate to High |

Axis Business Cycles Fund (NFO) Conclusion:

India is at the cusp of a new growth phase, powered by higher capital spending by the government, production-linked incentives, Make in India, and other such initiatives. The fund aims to capture these opportunities as the Indian economy ascends into the next phase of domestic-led growth. The scheme allows participation in opportunities that arise from evolving economic conditions. However, Investment in mutual fund units involves investment risks such as trading volumes, settlement risks, liquidity risks, and default risks including the possible loss of principal. Therefore, this product is suitable for investors who are seeking Capital appreciation over the long term. Investors should consult with financial advisers at Elite Wealth if in doubt about whether the product is suitable for them.