Dreamfolks Services Limited IPO Company Profile :

DreamFolks is India’s largest airport service aggregator platform. It began operations in 2013 facilitating airport lounge access services and has now become an end-to-end technology solutions provider. The company provides access to various other services such as food and beverage offerings, spa services, ‘meet and assist’, airport transfer services, transit hotels / nap rooms access and baggage transfer. It has unique, capital-efficient, asset-light business model. It provides services to all the card networks operating in India including Visa, Mastercard, Diners/Discover and RuPay; and many of India’s prominent Card Issuers including ICICI Bank Limited, Axis Bank Limited, Kotak Mahindra Bank Limited, HDFC Bank Limited (in respect of debit card lounge program) and SBI Cards and Payment Services Limited.

| IPO-Note | Dreamfolks Services Limited |

| Rs 308 – Rs 326 per Equity share | Recommendation: Neutral |

Dreamfolks Services Limited IPO Details-

| Issue Details | |

| Objects of the issue | Listing Gains, entire Offer proceeds will be received by the selling shareholders |

| Issue Size | Total issue Size -Rs. 562 Crore

Offer for Sale – Rs. 562 Crore Fresh Issue – Nill |

| Face value | Rs. 2.00 Per Equity Share |

| Issue Price | Rs. 308 – Rs. 326 |

| Bid Lot | 46 shares |

| Listing at | BSE, NSE |

| Issue Opens: | 24th August, 2022 – 26th August, 2022 |

| QIB | Not less than 75% of Net Issue Offer |

| Retail | Not more than 10% of Net Issue Offer |

| NII | Not more than 15% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Dreamfolks Services Limited IPO Allotment Status

Go Dreamfolks Services Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Dreamfolks Services Limited IPO Strengths:

-

Company is the largest and dominant airport lounge access provider in India. It holds almost 95%-97% of the domestic India market lounge share.

-

The co. currently accounts for more than 80%, of the total lounge traffic in major cities like Bangalore, Mumbai, Cochin, and Ahmedabad to name a few.

-

Established relationships with marquee clients. It has tie-ups with all the 5 Card Networks operating in India including Visa, Master Card, Diners/Discover, and RuPay.

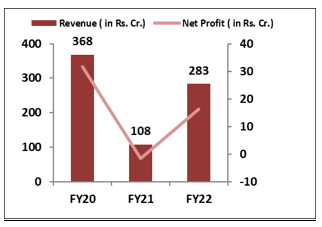

Dreamfolks Services Limited IPO Financial Performance:

Dreamfolks Services Limited IPO Shareholding Pattern:

| Shareholding Pattern | Pre- Issue | Post Issue |

| Promoters & Promoter Group | 100% | 67% |

| Others | Nill | 33% |

Source: RHP, EWL Research

Dreamfolks Services Limited IPO Key Highlights:

-

Revenue from operations impacted by the covid pandemic. It was Rs 368 crore during FY20, Rs 108 crore during FY21 and raised again to Rs 284 crore during FY22.

-

Profit after Tax was at Rs 31.68 crore in FY20. Company faced Loss of Rs 1.45 crore in FY21 & in FY22 it made Profit of Rs 16.25 crore.

-

EBITDA decreased from Rs 45.85 crore in FY20 to Rs 24.04 crore in FY22. The EBITDA margins for FY20, FY21, and FY22 was 12.47%, 19.43%, and 8.47% respectively.

-

Debt to Equity Ratio stood at 1.05 in the Financial Year 2022.

-

ROCE stood at 0.7% and 24% respectively in FY21 and FY22.

Dreamfolks Services Limited IPO Risk Factors:

-

Highly dependence on card networks. Card networks and card issuers contribute around 98% of its total revenue from operations.

-

Financials of the company heavily impacted due to Covid pandemic.

-

Operations are heavily dependent on the travel industry. Any downturn in the industry will adversely impact the financials of the company.

Dreamfolks Services Limited IPO Outlook:

DreamFolks has got the first mover advantage in the lounge access aggregator industry. It has a dominant share of over 80% in the domestic lounge access market in India. The Indian lounge market is expected to grow at 4X times of the current market size. After turning in a loss of Rs 1.45 crore in FY21, the company posted a profit of Rs 16.25 crore in FY22. However, they are still below pre-pandemic levels. Due to the current pandemic, certain lounges offered by DreamFolks are temporarily non-operational or closed on short notice. At the higher end of the Price band, the IPO is priced at 109 times & at the lower end of price band it is priced at 103 times considering FY22 Earnings. There are no listed peers of the company in this sector. DreamFolks IPO seems aggressively priced. High risk taking investors can take part.