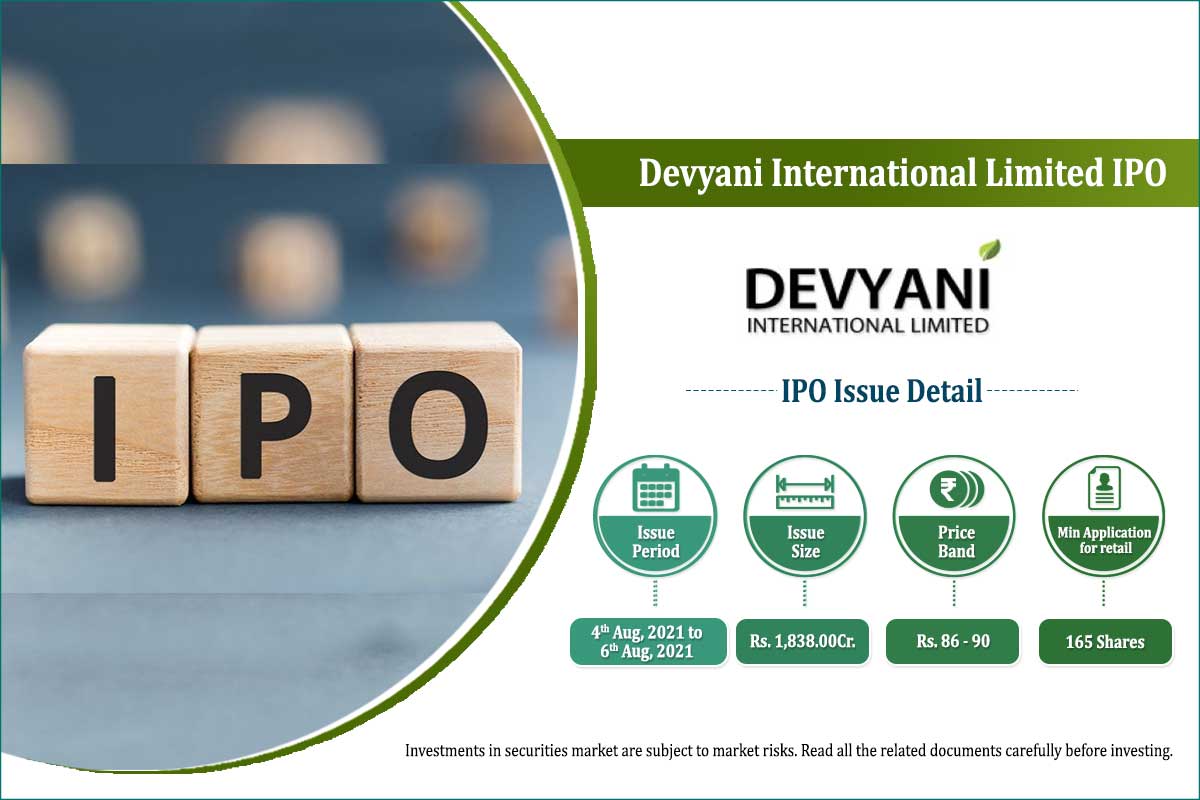

IPO-Note Devyani International Limited Rs-86-Rs90per Equity share Recommendation: Listing Gain Company Profile: - Devyani International Limited is the largest franchisee of Yum Brands in India and is amongthe largest chain operators of quick service restaurants (“QSR”) in India on a non-exclusive basis.Yum! Brands Inc. operates brands such as…

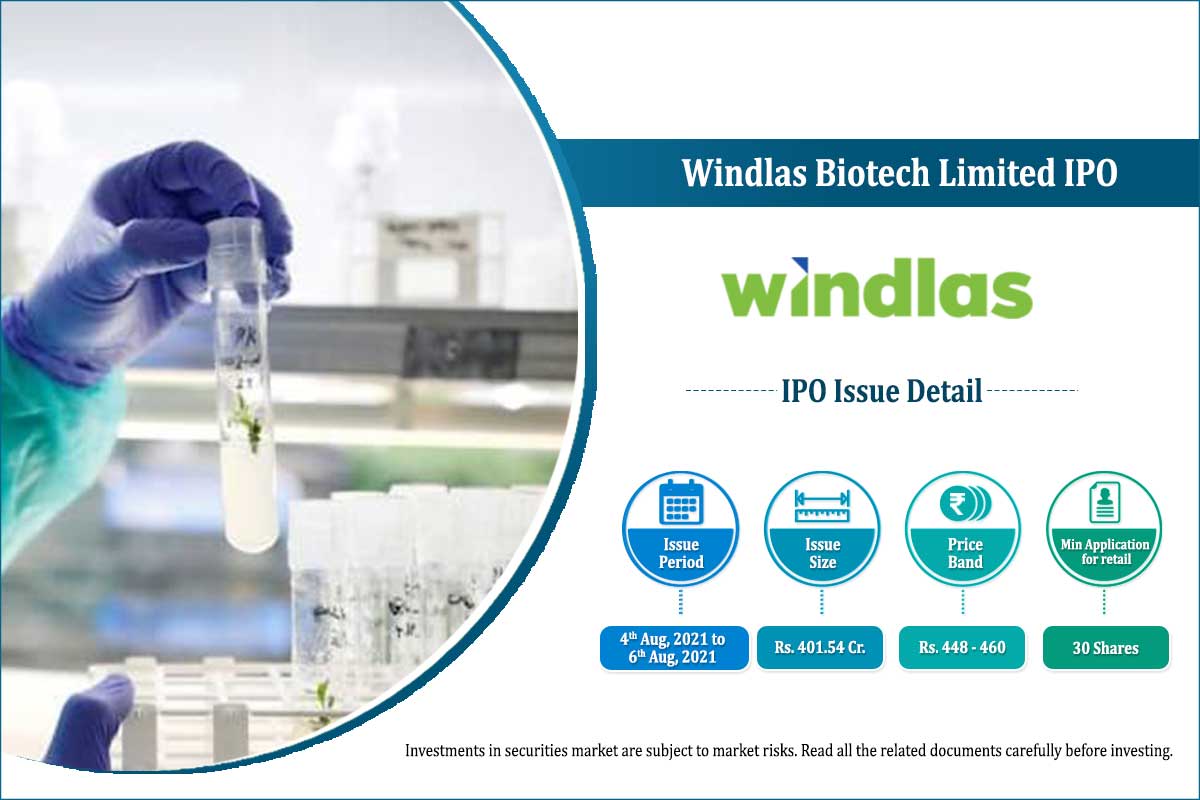

IPO-Note Windlas Biotech Limited Rs-448-Rs460per Equity share Recommendation: Listing Gain Company Profile: - Windlas Biotech is amongst the top five players in the domestic pharmaceutical formulations contract development andmanufacturing organization (“CDMO”) industry in India in terms of revenue. The company has three distinct strategic business verticals: (i)…

IPO-Note KRSNAA DIAGNOSTICS LIMITED Rs.933-Rs.954per Equity share Recommendation: Listing Gains Company Profile: - Krsnaa Diagnostics is one of the largest Diagnostic service provider that provides technology enabled diagnostic services like Pathology laboratory, Tele-radiology services and Imaging services to Private and Public hospitals, community healthCentre at affordable prices.Company follows…