Indian Market Outlook:

The Key benchmark indices fell over 2 percent during the week led by escalation of Russia and Ukraine War, continuous FII Selling and rising crude Oil prices. Nifty ended the week with 2.48 percent lower at 16245.35 points while the Sensex ended with 2.73 percent lower at 54,333.81 points. Maruti Suzuki, Asian Paints, Eicher, Hero MotoCorp, M&M were the top Nifty losers. Broader market fell less than the key benchmark indices. BSE Midcap index ended 2.35 percent lower, while the BSE Small cap index fell 0.62 percent. Bank Nifty fell more than 5%, biggest weekly fell in 18 months. Foreign Institutional Investors were the net sellers during the week; sell equities worth Rs. 14932 crores while the DIIs were the net buyers of Rs. 12003 crores. Skyrocketing inflation is what people fear and the best hedge for that is energy and industrial metals which led the rally in metal and energy stocks during the week. India’s GDP grew by a lesser-than-expected 5.4 per cent in the third quarter, while the growth estimate for the year as a whole was revised downward to 8.9 per cent from 9.1 per cent earlier. Going forward, the final phase of voting for Assembly polls in Uttar Pradesh is scheduled for March 7 after which the elections for the five poll-bound states will be finally concluded on 10th March, 2022. Rising crude oil prices is expected to push India’s domestic prices of petrol and diesel by Rs 15-22 per litre. OMCs expected to revise the current prices on or after March 7. Besides this, developments in the Russo-Ukrainian war will also be key for the markets. We advise investors to invest in quality stocks with any further dip.

Latest Spot Price (in US $)

| Precious Metal | Current Price | Change (%) | 3 Month | 6 Month | 1 Year | |||||

| Gold | 1974.30 | 4.59 | 10.82 | 7.88 | 14.17 | |||||

| Silver | 25.89 | 7.79 | 14.56 | 14.15 | -2.12 | |||||

| Platinum | 1126.00 | 6.30 | 20.47 | 12.87 | -3.29 | |||||

| USD/INR | 76.41 | 1.80 | 1.35 | 4.56 | 4.76 | |||||

| Crude | 115.03 | 25.59 | 65.53 | 67.32 | 87.71 | |||||

Global Weekly Events

| Date | Region | Event Description | Forecast | Previous |

| Mar 9,2022 | USD | Crude Oil Inventories | – | -2.597M |

| Mar 10,2022 | USD | Core CPI (MoM) (Feb) | 0.5% | 0.6% |

| Mar 11,2022 | GBP | Manufacturing Production (Jan) | 0.1% | 1.1% |

| Mar 11,2022 | USD | Federal Budget Balance (Feb) | – | 119.0B |

| Mar 11,2022 | GBP | GDP (MoM) | – | -0.2% |

| Mar 11,2022 | INR | Industrial Production (YoY) (Jan) | 1.3% | 0.4% |

Domestic Economy Indicators

| Heading | Indicators | Current | Previous |

| RBI Policy Rate | Policy Repo Rate | 4.00% | 4.00% |

| Reverse Repo Rate | 3.35% | 3.35% | |

| Bank Rate | 4.25% | 4.25% | |

| Reserve Ratio | CRR | 4.00% | 4.00% |

| SLR | 18.00% | 18.00% | |

| Inflation Rate | Wholesale Price Index | 12.96% | 13.56% |

| Consumer Price Index | 6.01% | 5.66% | |

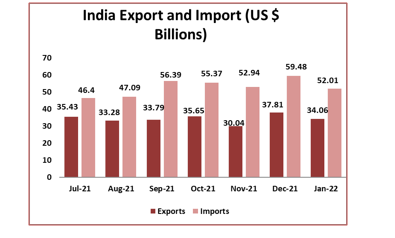

| Trade Data | Export ($ Million) | 33810 | 34500 |

| Import($ Million) | 55010 | 51930 | |

| IIP | 0.4% | 1.3% |

| Domestic Indices | Closing(4th

Mar) |

Change | %Change |

| BSE Sensex | 54,333.81 | -1,524.71 | -2.73 |

| Nifty | 16,245.35 | -413.05 | -2.48 |

| Mid Cap | 22,618.58 | -543.92 | -2.35 |

| Small Cap | 26,286.66 | -163.72 | -0.62 |

| Bank Nifty | 34,407.80 | -2,022.95 | -5.55 |

| Global Indices | Closing (4th Mar) | Change | %Change |

| Dow Jones | 33,614.80 | -443.75 | -1.30 |

| Nasdaq | 13,313.44 | -381.18 | -2.78 |

| FTSE | 6,987.14 | -502.32 | -6.71 |

| Nikkei | 25,985.47 | -491.03 | -1.85 |

| Hang Seng | 21,905.29 | -861.89 | -3.79 |

| Shanghai Com | 3,447.65 | -3.76 | -0.11 |

| Net Inflow (Cr) | FII | DII |

| 28-Feb-2022 | -3,948.47 | 4,142.82 |

| 02-Mar-2022 | -4,338.94 | 3,061.70 |

| 03-Mar-2022 | -6,644.65 | 4,799.24 |

| 04-Mar-2022 | -7,631.02 | 4,738.99 |

| Total | -14,932.06 | 12,003.76 |

| Top Gainers | Closing Price | Prev Close | Chg (%) |

| Coal India | 181.00 | 150.00 | 20.67 |

| GAIL India | 155.45 | 129.75 | 19.81 |

| Tata Steel | 1277.10 | 1074.00 | 18.91 |

| UPL | 713.45 | 632.30 | 12.88 |

| Hindalco | 583.80 | 517.65 | 12.78 |

| Top Losers | Closing Price | Prev Close | Chg (%) |

| Maruti Suzuki | 7247.30 | 8210.15 | -11.73 |

| Asian Paints | 2738.15 | 3069.05 | -10.78 |

| Eicher Motors | 2339.25 | 2617.15 | -10.62 |

| M & M | 732.30 | 795.80 | -7.98 |

| Hero MotoCorp | 2311.30 | 2490.40 | -7.19 |

Source: Investing, NDTV, BSE, CNBCTV18, Moneycontrol,

Economic News:

-

India’s forex reserves declined by USD 1.425 billion to USD 631.527 billion for the week ended in February 25 due to a dip in currency assets, according to the Reserve Bank data released on Friday. The overall reserves had increased by USD 2.762 billion to USD 632.952 billion in the previous reporting week. Expressed in dollar terms, the foreign currency assets include the effect of appreciation or depreciation of non-US units like the euro, pound and yen held in the foreign exchange reserves.

-

Export demand for Indian wheat, corn and spices has shot up after Russia launched a military operation against Ukraine, forcing the international trade of agricultural commodities to shift sourcing to India since supplies from the two nations have come to a grinding halt. “The prices of wheat at the Kandla port have increased from ₹2,200 per quintal to ₹2,350-2,400 per quintal in the last four days.

Industry News:

-

India’s agriculture sector is expected to face the heat from hostilities between Russia and Ukraine which are expected to push up prices and availability of — Potash — a key component used in the manufacturing of fertilisers. At present, Belarus and Russia are key suppliers of Potash in the global market. On the other hand, India is a major importer of Potash, which is used in the manufacture of fertilisers. At an overall level, Russia, Ukraine and Belarus contribute 10-12 per cent of India’s total fertiliser imports. Besides, other Potash miners mostly based in Canada are not willing to raise production, thereby, keeping the prices at an elevated level.

-

RBI’s revised norms led to a 1.50 per cent jump in the non-bank lenders’ reported gross non-performing assets to 6.80 per cent in the December quarter, a credit ratings agency said on Friday. If not for the revised norms, the improvement in economic activity would have led to a 0.30 per cent improvement in GNPAs during the December quarter to 5.3 per cent, Crisil said. The GNPAs for the NBFCs (non-banking finance companies) are, however, expected to reduce going ahead as the players have bolstered their collection processes and economic activity is also improving, Crisil said in a note.

-

India’s state-run fuel retailers are increasing their ethanol storage capacity by 51% as the nation targets to double the biofuel’s blending with gasoline to 20% by 2025, a director at the country’s top refiner Indian Oil Corp said on Friday. India is the world’s third biggest oil importer and relies on foreign suppliers to meet more than 80% of its demand.

Company News:

-

Reliance Industries on Friday announced the opening of India’s largest convention centre at Jio World Centre in Mumbai. The convention centre has three exhibition halls spanning over an area of more than 1.61 lakh square feet and two convention halls of 1.07 lakh square feet. The convention centre has “hybrid and digital experiences enabled by 5G network”, Reliance Industries Ltd (RIL) said in a statement. RIL also dedicated Dhirubhai Ambani Square and ‘Fountain of Joy’ to the city of Mumbai at the Jio World Convention Centre.

-

NTPC Limited on Friday said it will start commercial operations of 74.88 megawatt capacity (MW) of its 296 MW Fatehgarh solar project in Rajasthan from midnight. With this, the commercial capacity of NTPC and NTPC Group will reach 54,452.18 MW and 67,907.18 MW respectively, the power giant said in a statement.

-

MG Motor, owned by China’s SAIC Motor Corp, is planning to raise $350-500 million (Rs 2,650-3,800 crore) in private equity in India to fund its future needs, including expansion in electric vehicles (EVs). The maker of the Hector and Astor SUVs is seeking to tap the local market because of a delay in getting government approval for new investment from the Chinese parent.

-

Mahindra & Mahindra Ltd on Friday said it has partnered with CSC Grameen eStore, a government of India initiative, to deepen connections with over 7 lakh villages in India. The partnership will harness CSC Grameen’s digital platform to facilitate Mahindra vehicle enquiries and real-time online lead transfer to M&M from deep rural pockets, the company said in a statement.

Global News

-

S. hiring boomed in February while wage growth slowed, showing a robust labor market that likely keeps the Federal Reserve on track to raise interest rates this month and offering some respite from strong inflationary pressures. Nonfarm payrolls increased 678,000 last month — the most since July — after upward revisions in the prior two months, a Labor Department report showed Friday.

-

Russia is on course for an economic collapse that will rival or even eclipse the size of the 1998 slump which followed its debt default, although the financial fallout may be less than then. Days after President Vladimir Putin ordered troops into Ukraine, economists are starting to publish forecasts for what is currently the world’s eleventh largest economy, even though they warn the outlook is opaque and subject to revision.

(Source:Bloomberg Quint, Economic Times, BusinessToday,Business Standard, Financial Express,Investing, Moneycontrol, livemint)

Forthcoming Corporate Actions – 7th March – 12th March

| Security Name | Ex-Date | Purpose | Security Name | Ex-Date | Purpose |

| JAYSHREETEA | 07-Mar-22 | E.G.M. | BCLENTERPR | 10-Mar-22 | Bonus issue 1:1 |

| NOUVEAU | 07-Mar-22 | Stock Split From Rs.10/- to Rs.1/- | EIDPARRY | 10-Mar-22 | Interim Dividend – Rs. – 5.5000 |

| DEEP | 08-Mar-22 | Bonus issue 3:4 | MUL | 10-Mar-22 | Stock Split From Rs.10/- to Rs.1/- |

| VIPIND | 08-Mar-22 | Interim Dividend – Rs. – 2.5000 | ULTRACAB | 10-Mar-22 | Stock Split From Rs.10/- to Rs.2/- |

| WOCKPHARMA | 08-Mar-22 | Right Issue of Equity Shares | ULTRACAB | 10-Mar-22 | Bonus issue 1:2 |

| VEDL | 09-Mar-22 | Interim Dividend – Rs. – 13.0000 | VISHAL | 10-Mar-22 | Bonus issue 2:1 |

| 7TEC | 10-Mar-22 | Interim Dividend – Rs. – 1.0000 | SRTRANSFIN | 11-Mar-22 | Interim Dividend |

| BCLENTERPR | 10-Mar-22 | Stock Split From Rs.10/- to Rs.1/- |

Source: BSE, Elite wealth Research

Upcoming Key Board Meetings– 7th March – 12th March

| Symbol | Purpose | BM Date | Symbol | Purpose | BM Date |

| AAVAS | General | 07-Mar-22 | AKSHAR | General | 09-Mar-22 |

| DECIPHER | General | 07-Mar-22 | BALPHARMA | Amalgamation;General | 09-Mar-22 |

| GANESHBE | General | 07-Mar-22 | BRANDBUCKT | Increase in Authorised Capital | 09-Mar-22 |

| KCLINFRA | Right Issue of Equity Shares | 07-Mar-22 | DILIGENT | Stock Split | 09-Mar-22 |

| METROBRAND | Interim Dividend;General | 07-Mar-22 | DWL | General | 09-Mar-22 |

| NLCINDIA | Interim Dividend | 07-Mar-22 | PENIND | Buy Back of Shares;General | 09-Mar-22 |

| PRECISION | General | 07-Mar-22 | TOYAMIND | General | 09-Mar-22 |

| RAINBOWF | General;Rights Issue | 07-Mar-22 | BCLIL | Interim Dividend | 10-Mar-22 |

| SHREEGANES | Bonus issue | 07-Mar-22 | INDINFO | General | 10-Mar-22 |

| SPMLINFRA | Preferential Issue of shares | 07-Mar-22 | INDLEASE | General | 10-Mar-22 |

| SUNTV | Interim Dividend | 07-Mar-22 | KABRADG | General | 10-Mar-22 |

| TRADWIN | A.G.M.;Audited Results;Results | 07-Mar-22 | MOTOGENFIN | General | 10-Mar-22 |

| CORALAB | General | 08-Mar-22 | PARACABLES | General | 10-Mar-22 |

| MPL | General | 08-Mar-22 | KESARPE | General | 11-Mar-22 |

| SHALPAINTS | General | 08-Mar-22 | SHREYASI | General | 11-Mar-22 |

| SHRIRAMCIT | Interim Dividend;General | 08-Mar-22 | MDRNSTL | Quarterly Results | 12-Mar-22 |

Source: BSE, Elite wealth Research

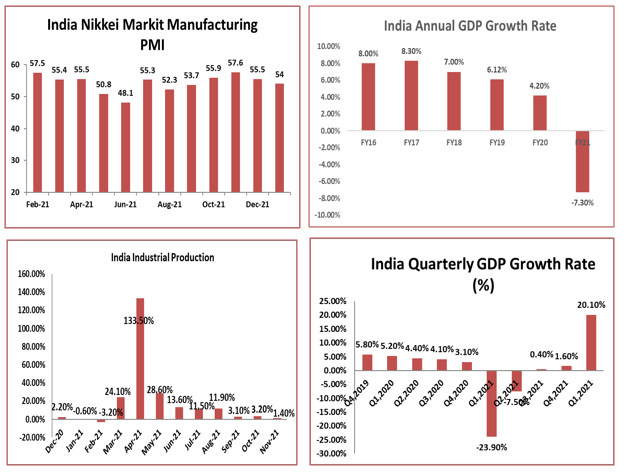

Major Economy Indicators

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL