Indian Market Outlook:

The Key benchmark indices rose over 2 percent during the week gone by and extended their up move for the fourth week in a row. Nifty ended the week with 2.49 percent higher at 18256 points while the Sensex ended with 2.47 percent higher at 61,223 points. BSE Small cap outperformed the key benchmark indices during the week. BSE Midcap index ended 2.40 percent higher, while the BSE Small cap index rose 3.06 percent. Foreign Institutional Investors were the net sellers during the week; sell equities worth Rs. 4003 crores while the DIIs were the net buyers of Rs. 3629 of crores. Bank Nifty was the underperformer during week rose over 1 percent. During the week all top IT companies announced their Q3 result. Except Wipro, all reported numbers in line or ahead of market estimates. Infosys raised it FY22 revenue guidance to 19.5%- 20% while HCL Tech maintained its double-digit revenue guidance and TCS announced a Rs 18,000 crore buyback. HDFC Bank also its reported in Q3 numbers on Saturday with improved asset quality and beats the estimates on Profit front on lower provisions. On Macro front, in December, US inflation hit 7 percent, which is fastest pace since 1982 while India’s retail inflation spikes to 5.59 percent. Going forward upcoming week is going to be a busy week with more companies will come their Q3 results, Reliance too will report its numbers on 21st January, 2022. Market will also react on Budget 2022 estimates as Union Budget will be presented in Parliament on 1st February, 2022. On IPO front. AGS Transact Technologies is the first company to be launching its IPO in the new year 2022.

Latest Spot Price (in US $)

| Precious Metal | Current Price | Change (%) | 3 Month | 6 Month | 1 Year | |||||

| Gold | 1817.35 | 1.11 | 3.08 | -0.03 | -7.62 | |||||

| Silver | 22.95 | 2.27 | -5.67 | -17.77 | -10.32 | |||||

| Platinum | 967.05 | 0.98 | -0.73 | -19.02 | 7.94 | |||||

| USD/INR | 74.15 | -0.16 | -0.12 | 0.75 | 0.32 | |||||

| Crude | 83.82 | 6.24 | 22.76 | 29.53 | 116.09 | |||||

Global Weekly Events

| Date | Region | Event Description | Forecast | Previous |

| Jan 17,2022 | CNY | Industrial Production (YoY) (Dec) | 3.6% | 3.8% |

| Jan 17,2022 | CNY | GDP (YoY) (Q4) | 3.6% | 4.9% |

| Jan 19,2022 | USD | Building Permits (Dec) | 1.701M | 1.717M |

| Jan 20,2022 | CNY | PBoC Loan Prime Rate | – | 3.8% |

| Jan 20,2022 | USD | Initial Jobless Claims | – | 230K |

| Jan 20,2022 | USD | Crude Oil Inventories | – | -4.533M |

Domestic Economy Indicators

| Heading | Indicators | Current | Previous |

| RBI Policy Rate | Policy Repo Rate | 4.00% | 4.00% |

| Reverse Repo Rate | 3.35% | 3.35% | |

| Bank Rate | 4.25% | 4.25% | |

| Reserve Ratio | CRR | 4.00% | 4.00% |

| SLR | 18.00% | 18.00% | |

| Inflation Rate | Wholesale Price Index | 13.56% | 14.23% |

| Consumer Price Index | 5.59% | 4.91% | |

| Trade Data | Export ($ Million) | 37810 | 30040 |

| Import ($ Million) | 59480 | 52940 | |

| IIP | 1.4% | 3.2% |

| Domestic Indices | Closing (14th

Jan) |

Change | %Change |

| BSE Sensex | 61,223.03 | 1,478.38 | 2.47 |

| Nifty | 18,255.75 | 443.05 | 2.49 |

| Mid Cap | 26,085.24 | 612.41 | 2.40 |

| Small Cap | 30,951.28 | 919.14 | 3.06 |

| Bank Nifty | 38,370.40 | 630.80 | 1.67 |

| Global Indices | Closing (14th Jan) | Change | %Change |

| Dow Jones | 35,911.28 | -320.25 | -0.88 |

| Nasdaq | 15,595.75 | 14.75 | 0.09 |

| FTSE | 7,542.95 | 57.67 | 0.77 |

| Nikkei | 28,124.28 | -354.28 | -1.24 |

| Hang Seng | 24,383.32 | 889.94 | 3.79 |

| Shanghai Com | 3,521.26 | -58.28 | -1.63 |

| Net Inflow (Cr) | FII | DII |

| 10-Jan-2022 | -124.23 | 481.55 |

| 11-Jan-2022 | 111.91 | 378.74 |

| 12-Jan-2022 | -1,001.57 | 1,332.01 |

| 13-Jan-2022 | -1,390.85 | 1,065.32 |

| 14-Jan-2022 | -1,598.20 | 371.41 |

| Total | -4002.94 | 3629.03 |

| Top Gainers | Closing Price | Prev Close | Chg (%) |

| Larsen & Toubro | 2044.75 | 1904.90 | 7.34 |

| Infosys | 1929.35 | 1814.30 | 6.34 |

| M & M | 881.20 | 829.00 | 6.30 |

| Adani Ports | 780.10 | 736.10 | 5.98 |

| Coal India | 164.75 | 156.95 | 4.97 |

| Top Losers | Closing Price | Prev Close | Chg (%) |

| Wipro | 639.80 | 711.50 | -10.08 |

| Asian Paints | 3364.40 | 3576.30 | -5.93 |

| Hind. Unilever | 2363.7 | 2416.15 | -2.17 |

| Axis Bank | 721.30 | 730.60 | -1.22 |

| Britannia | 3712.05 | 3737.35 | -0.68 |

Source: Investing, NDTV, BSE, CNBCTV18, Moneycontrol,

Economic News:

-

India’s wholesale inflation eased from its record high as a fall in prices of manufactured products, fuel and power offset costlier vegetables. Inflation, as measured by the Wholesale Price Index, stood at 13.56% in December against 14.23% in November, the highest reading since 1991. The gauge declined 0.35% over the previous month in December, according to data released by the Ministry of Commerce and Industry on Friday. Retail inflation stood at 5.59% in December, compared with 4.91% in November, according to data released by the Ministry of Statistics and Program Implementation on Wednesday.

-

The third wave of Covid-19 infections will likely have a far smaller economic impact than the previous two surges in infections, according to Nomura economists. Nomura expects the January-March quarter to see sequential growth of 1%, on a quarter-on-quarter seasonally adjusted basis, according to a Jan. 14 note. This compares to 3% sequential growth in the previous quarter. As such, the economic the economic hit from this wave of infections is seen to be much smaller than during the second wave when the economy contracted 8% on a quarter-on-quarter, seasonally adjusted basis.

Industry News:

-

The road transport ministry has said it will make it mandatory for carmakers to provide a minimum of six airbags in motor vehicles that can carry up to 8 passengers for enhanced safety of occupants from October this year. The Ministry of Road Transport and Highways (MoRTH) in a statement said that in order to enhance the safety of occupants of the motor vehicle against lateral impact, it has been decided to enhance safety features by amending the Central Motor Vehicles Rules (CMVR), 1989.

-

Banks are seeing a gradual pick-up in loans as there are distinct signs of pick-up in the economy and revival investments and loan demand Banks ended the calendar year with higher credit growth of 9.2 per cent as of December 31 on a year-on-year (y-o-y) basis compared to 6.6 per cent growth a year ago. Outstanding loans amounted to Rs 116.8 lakh crore. Significantly, loans rose Rs 3.69 lakh crore during the last fortnight of the calendar year ending December, according to the latest data released by the Reserve Bank of India.

Company News:

-

HDFC Bank on Saturday reported a net profit of Rs 10,342.2 crore in October-December quarter; registering an increase of 18 per cent year-on-year as strong growth in the private lender’s net revenues boosted its bottom line. Net interest income for the quarter under review grew by 13 per cent to Rs 18,443.5 crore, up from Rs 16,317.6 crore a year ago. The results were broadly in line with market expectations, which had pegged the on-year growth in net profit at 12-18 per cent and net interest income at 11-17 per cent

-

Aditya Birla Fashion and Retail Ltd (ABFRL) on Friday said it will acquire a 51 per cent majority shareholding in popular and contemporary brand ‘Masaba’ promoted by the leading designer Masaba Gupta for a cash consideration of Rs 90 crore. The Aditya Birla Group has entered into a ‘binding term sheet’ agreement to acquire a 51 per cent stake in ‘House of Masaba Lifestyle Pvt Ltd’, a move which will strengthen its play into fashion for young and digitally native consumers

-

The country’s largest two-wheeler maker Hero MotoCorp Friday announced a new investment of up to Rs. 420 Crore in Ather Energy. The company’s board has approved the investment in one or more tranches. Prior to the proposed investment, Hero MotoCorp’s shareholding in Ather Energy was 34.8% (on a fully diluted basis). Post the investment, the shareholding will increase and the exact shareholding will be determined upon completion of capital raise round by Ather.

Global News

-

After Tesla Founder & CEO Elon Musk said his company was facing challenges to launching operations in India, KT Rama Rao, the Industry & Commerce Minister of Telangana made a pitch to the former to set shop in Telangana. “Will be happy to partner Tesla in working through the challenges to set shop in India/Telangana,” the minister said on Twitter responding to Musk. “Our state is a champion in sustainability initiatives & a top notch business destination in India.

-

China’s economy expanded at its fastest pace for 10 years in 2021, according to an AFP poll of analysts, but its strong recovery from the Covid-19 pandemic is threatened by Omicron and a property sector slowdown. The eight percent growth would be well above the government’s target of more than six percent, and comes on the back of a strong start to the year as a “zero-Covid” policy allowed the country to lead the global economic recovery.

(Source:Bloomberg Quint, Economic Times, BusinessToday,Business Standard, Financial Express,Investing, Moneycontrol, livemint)

Forthcoming Corporate Actions – 17th January – 22nd January

| Security Name | Ex-Date | Purpose | Security Name | Ex-Date | Purpose |

| ELDEHSG | 17-Jan-22 | Stock Split from Rs.10/- to Rs.2/- | MAHACORP | 20-Jan-22 | E.G.M. |

| HGS | 17-Jan-22 | Interim Dividend – Rs. – 150.0000 | RAILTEL | 20-Jan-22 | Interim Dividend – Rs. – 1.7500 |

| NAUKRI | 17-Jan-22 | Interim Dividend – Rs. – 8.0000 | SIEMENS | 20-Jan-22 | Final Dividend – Rs. – 8.0000 |

| JOONKTOLL | 18-Jan-22 | Right Issue of Equity Shares | VGIL | 20-Jan-22 | Right Issue of Equity Shares |

| ANANDRATHI | 19-Jan-22 | Interim Dividend – Rs. – 5.0000 | VISAGAR | 20-Jan-22 | Stock Split from Rs.2/- to Rs.1/- |

| CHOICEIN | 19-Jan-22 | Right Issue of Equity Shares | VISAGAR | 20-Jan-22 | Bonus issue 1:2 |

| TCS | 19-Jan-22 | Interim Dividend – Rs. – 7.0000 | WIPRO | 21-Jan-22 | Interim Dividend – Rs. – 1.0000 |

| HCLTECH | 20-Jan-22 | Interim Dividend – Rs. – 10.0000 |

Source: BSE, Elite wealth Research

Upcoming Key Board Meetings – 17th January – 22nd January

| Symbol | Purpose | BM Date | Symbol | Purpose | BM Date |

| ANGELONE | Interim Dividend;Quarterly Results | 17-Jan-22 | TEJASNET | Quarterly Results | 19-Jan-22 |

| BCPL | General | 17-Jan-22 | ASIANPAINT | Quarterly Results | 20-Jan-22 |

| BEPL | Interim Dividend;Quarterly Results | 17-Jan-22 | ATFL | Quarterly Results | 20-Jan-22 |

| FCL | ESOP;Quarterly Results;General | 17-Jan-22 | BAJAJFINSV | Quarterly Results | 20-Jan-22 |

| GOODLUCK | Quarterly Results | 17-Jan-22 | BAJAJHLDNG | Quarterly Results | 20-Jan-22 |

| HATHWAY | Quarterly Results | 17-Jan-22 | BANARBEADS | Quarterly Results | 20-Jan-22 |

| HFCL | Quarterly Results | 17-Jan-22 | BIOCON | General;Quarterly Results | 20-Jan-22 |

| INDOCITY | Quarterly Results | 17-Jan-22 | CENTURYTEX | Quarterly Results | 20-Jan-22 |

| KPIGLOBAL | Interim Dividend;Quarterly Results | 17-Jan-22 | CONCOR | Interim Dividend;General; Results | 20-Jan-22 |

| MAHSCOOTER | Quarterly Results | 17-Jan-22 | CYIENT | Quarterly Results | 20-Jan-22 |

| MINDSPACE | General | 17-Jan-22 | DATAMATICS | Quarterly Results | 20-Jan-22 |

| MOSCHIP | Quarterly Results | 17-Jan-22 | DODLA | Quarterly Results | 20-Jan-22 |

| NAZARA | Preferential Issue of shares | 17-Jan-22 | HATSUN | Quarterly Results | 20-Jan-22 |

| SONATSOFTW | Quarterly Results | 17-Jan-22 | HAVELLS | Quarterly Results | 20-Jan-22 |

| TATASTLLP | Audited Results;Quarterly Results | 17-Jan-22 | HINDUNILVR | Quarterly Results | 20-Jan-22 |

| TATVA | Quarterly Results | 17-Jan-22 | KHAICHEM | Quarterly Results | 20-Jan-22 |

| ULTRACEMCO | Quarterly Results | 17-Jan-22 | MPHASIS | Quarterly Results | 20-Jan-22 |

| VIKASECO | Quarterly Results;General | 17-Jan-22 | ORIENTELEC | Interim Dividend;Quarterly Results | 20-Jan-22 |

| BAJFINANCE | Quarterly Results;General | 18-Jan-22 | PERSISTENT | Interim Dividend;General;Results | 20-Jan-22 |

| DCMSHRIRAM | Interim Dividend;Quarterly Results | 18-Jan-22 | PNBHOUSING | Quarterly Results | 20-Jan-22 |

| DEN | Quarterly Results | 18-Jan-22 | RIIL | Quarterly Results | 20-Jan-22 |

| GICRE | General | 18-Jan-22 | SASKEN | General;Quarterly Results | 20-Jan-22 |

| ICICIPRULI | Audited Results | 18-Jan-22 | SOUTHBANK | Quarterly Results | 20-Jan-22 |

| ISEC | Quarterly Results | 18-Jan-22 | VIMTALABS | Quarterly Results | 20-Jan-22 |

| JUSTDIAL | Quarterly Results;General | 18-Jan-22 | VSTIND | Quarterly Results | 20-Jan-22 |

| LTTS | Interim Dividend;Quarterly Results | 18-Jan-22 | 20MICRONS | Audited Results | 21-Jan-22 |

| NETWORK18 | Quarterly Results | 18-Jan-22 | AMAL | General | 21-Jan-22 |

| NEWGEN | Quarterly Results | 18-Jan-22 | BANDHANBNK | Quarterly Results | 21-Jan-22 |

| RKFORGE | Quarterly Results;Stock Split | 18-Jan-22 | CSBBANK | Quarterly Results | 21-Jan-22 |

| SHAKTIPUMP | Quarterly Results | 18-Jan-22 | CYBERTECH | Quarterly Results | 21-Jan-22 |

| SHALPAINTS | General | 18-Jan-22 | GLAND | Quarterly Results | 21-Jan-22 |

| TATAELXSI | Audited Results;Quarterly Results | 18-Jan-22 | HDFCLIFE | Quarterly Results | 21-Jan-22 |

| TRIDENT | Quarterly Results | 18-Jan-22 | HERITGFOOD | Quarterly Results | 21-Jan-22 |

| TV18BRDCST | Quarterly Results | 18-Jan-22 | HINDZINC | Quarterly Results | 21-Jan-22 |

| APTECHT | Quarterly Results | 19-Jan-22 | IDBI | Quarterly Results | 21-Jan-22 |

| ASRL | General | 19-Jan-22 | JSWSTEEL | Quarterly Results | 21-Jan-22 |

| BAJAJ-AUTO | Quarterly Results | 19-Jan-22 | JYOTHYLAB | Quarterly Results | 21-Jan-22 |

| CCL | Interim Dividend;Quarterly Results | 19-Jan-22 | KAJARIACER | Quarterly Results | 21-Jan-22 |

| CEATLTD | Quarterly Results | 19-Jan-22 | L&TFH | Quarterly Results | 21-Jan-22 |

| CFL | Quarterly Results | 19-Jan-22 | NETLINK | General;Quarterly Results | 21-Jan-22 |

| CHEMBOND | Quarterly Results | 19-Jan-22 | NGIL | Quarterly Results;General | 21-Jan-22 |

| GREENPOWER | Quarterly Results | 19-Jan-22 | OAL | Quarterly Results | 21-Jan-22 |

| ICICIGI | Audited Results | 19-Jan-22 | PNBGILTS | Quarterly Results | 21-Jan-22 |

| JSWENERGY | Quarterly Results | 19-Jan-22 | POLYCAB | Quarterly Results | 21-Jan-22 |

| JSWISPL | General;Quarterly Results | 19-Jan-22 | PVR | Quarterly Results | 21-Jan-22 |

| LTI | General;Quarterly Results | 19-Jan-22 | RAMCOIND | Quarterly Results | 21-Jan-22 |

| MASTEK | Quarterly Results | 19-Jan-22 | RELIANCE | Quarterly Results | 21-Jan-22 |

| NELCO | Quarterly Results | 19-Jan-22 | SBILIFE | Quarterly Results | 21-Jan-22 |

| OFSS | Quarterly Results | 19-Jan-22 | TANLA | Quarterly Results | 21-Jan-22 |

| RALLIS | Quarterly Results | 19-Jan-22 | VINYLINDIA | Quarterly Results | 21-Jan-22 |

| SAREGAMA | Quarterly Results | 19-Jan-22 | WENDT | Interim Dividend;Quarterly Results | 21-Jan-22 |

| STLTECH | Quarterly Results | 19-Jan-22 | ICICIBANK | Quarterly Results | 22-Jan-22 |

| SYNGENE | Quarterly Results | 19-Jan-22 | SESHAPAPER | Quarterly Results | 22-Jan-22 |

| TATACOMM | Quarterly Results | 19-Jan-22 | SHARDACROP | Interim Dividend;Quarterly Results | 22-Jan-22 |

| TATAINVEST | Quarterly Results | 19-Jan-22 | YESBANK | Quarterly Results | 22-Jan-22 |

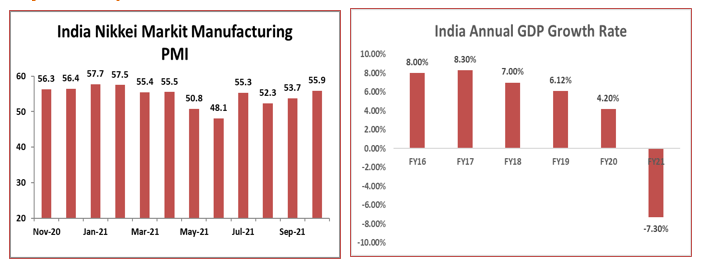

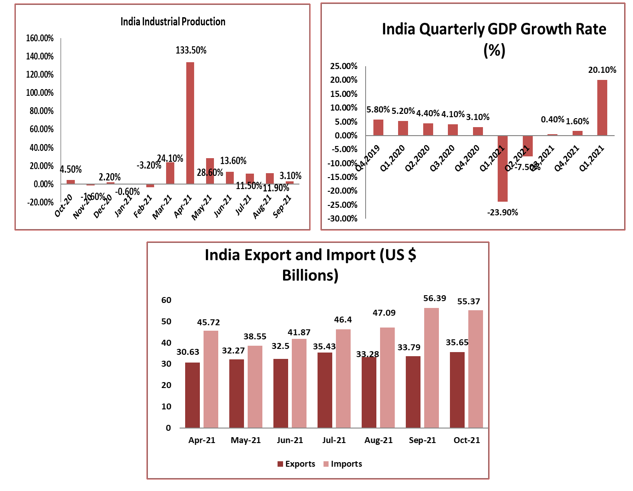

Major Economy Indicators

Disclosure in pursuance of Section 19 of SEBI (RA) Regulation 2014

Elite Wealth Limited does/does not do business with companies covered in its research reports. Investors should be aware that the Elite Wealth Limited may/may not have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only information in making their investment decision and must exercise their own judgment before making any investment decision.

For analyst certification and other important disclosures, see the Disclosure Appendix, or go to www.elitewealth.in. Analysts employed by Elite Wealth Limited are registered/qualified as research analysts with SEBI in India.( SEBI Registration No.: INH100002300)

Disclosure Appendix

Analyst Certification (For Reports)

Israil Khan, Elite Wealth Limited, suhail@elitewealth.in

The analyst(s) certify that all of the views expressed in this report accurately reflect my/our personal views about the subject company or companies and its or their securities. I/We also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Elite Wealth Limited.

As to each individual report referenced herein, the primary research analyst(s) named within the report individually certify, with respect to each security or issuer that the analyst covered in the report, that:

(1) all of the views expressed in the report accurately reflect his or her personal views about any and all of the subject securities or issuers; and

(2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in the report.

For individual analyst certifications, please refer to the disclosure section at the end of the attached individual notes.

Research Excerpts

This note may include excerpts from previously published research. For access to the full reports, including analyst certification and important disclosures, investment thesis, valuation methodology, and risks to rating and price targets, please visit www.elitewealth.in.

Company-Specific Disclosures

Important disclosures, including price charts, are available and all Elite Wealth Limited covered companies by visiting https://www.elitewealth.in, or emailing research@elitestock.com with your request. Elite Wealth Limited may screen companies based on Strategy, Technical, and Quantitative Research. For important disclosures for these companies, please e-mail research@elitestock.com.

Options related research:

If the information contained herein regards options related research, such information is available only to persons who have received the proper option risk disclosure documents. For a copy of the risk disclosure documents, please contact your Broker’s Representative or visit the OCC’s website at https://www.elitewealth.in

Other Disclosures

All research reports made available to clients are simultaneously available on our client websites. Not all research content is redistributed, e-mailed or made available to third-party aggregators. For all research reports available on a particular stock, please contact your respective broker’s sales person.

Ownership and material conflicts of interest Disclosure

Elite Wealth Limited policy prohibits its analysts, professionals reporting to analysts from owning securities of any company in the analyst’s area of coverage. Analyst compensation: Analysts are salary based permanent employees of Elite Wealth Limited. Analyst as officer or director: Elite Wealth Limited policy prohibits its analysts, persons reporting to analysts from serving as an officer, director, board member or employee of any company in the analyst’s area of coverage.

Country Specific Disclosures

India – For private circulation only, not for sale.

Legal Entities Disclosures

Mr. Ravinder Parkash Seth is the Managing Director of Elite Wealth Ltd (EWL, henceforth), having its registered office at Casa Picasso, Golf Course Extension, Near Rajesh Pilot Chowk, Radha Swami, Sector-61, Gurgaon-122001 Haryana, is a SEBI registered Research Analyst and is regulated by Securities and Exchange Board of India. Telephone:011-43035555, Facsimile: 011-22795783 and Website: www.elitewealth.in

EWL discloses all material information about itself including its business activity, disciplinary history, the terms and conditions on which it offers research report, details of associates and such other information as is necessary to take an investment decision, including the following:

1. Reports

a) EWL or his associate or his relative has no financial interest in the subject company and the nature of such financial interest;

(b) EWL or its associates or relatives, have no actual/beneficial ownership of one per cent. or more in the securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance;

(c) EWL or its associate or his relative, has no other material conflict of interest at the time of publication of the research report or at the time of public appearance;

2. Compensation

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) EWL or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months;

(c) EWL or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(d) EWL or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months;

(e) EWL or its associates have not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

3 In respect of Public Appearances

(a) EWL or its associates have not received any compensation from the subject company in the past twelve months;

(b) The subject company is not now or never a client during twelve months preceding the date of distribution of the research report and the types of services provided by EWL