Waaree Energies IPO Company Profile:

Waaree Energies Limited (WEL) began operations in 2007, specializing in the manufacturing of solar PV modules to deliver quality, cost-effective sustainable energy solutions. The company’s mission is to reduce carbon footprints and promote sustainable energy, ultimately enhancing quality of life. As of June 30, 2023, WEL operates four manufacturing facilities in India, situated in Surat, Tumb, Nandigram, and Chikhli, covering a total area of 136.30 acres. The company also has a presence in international markets .Over the years they have significantly expanded their aggregate installed capacity from 4 GW in Fiscal 2022 to 12 GW, as of June 30, 2024.

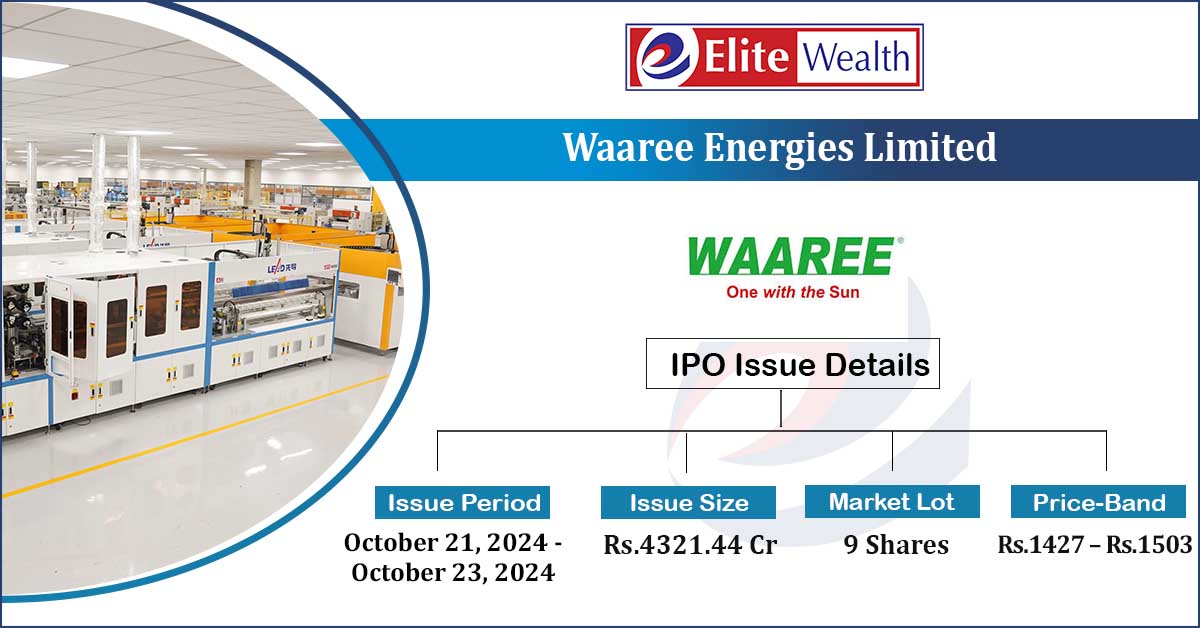

| IPO-Note | Waaree Energies Limited |

| Rs.1427– Rs.1503per Equity share | Recommendation: Apply |

Waaree Energies IPO Details:

| Issue Details | |

| Objects of the issue | · Financing cost for manufacturing facility.

· General corporate purposes. |

| Issue Size | Total issue Size – Rs.4321.44 Cr

Fresh Issue – Rs 3600 Cr Offer for sale- Rs 721.44 Cr |

| Face value | Rs.10 |

| Issue Price | Rs.1427 – Rs.1503per share |

| Bid Lot | 9 Shares |

| Listing at | BSE, NSE |

| Issue Opens | October 21, 2024 – October 23, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Waaree Energies IPO Strengths:

-

WEL is a leading player in the solar PV cell manufacturing sector and is the largest manufacturer of solar PV modules in India, with an aggregate installed capacity of 12 GW as of June 30, 2024.

-

The company operates across India and, as of March 31, 2024, has established 369 franchises. In FY24, it became the leading player in India’s solar module export market. Also, they have developed a strong global customer base, serving clients in countries such as the United States, Canada, Italy, Turkey, Hong Kong, and Vietnam.

-

Company has a significant order book for solar PV modules of 16.6 GW as of June 30, 2024. This includes domestic and export orders, as well as franchisee orders.

-

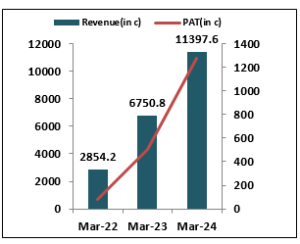

In FY24 the company has generated revenue from operations of ₹11,397.6 crores, marking a 68.8% increase compared to FY23. The compound annual growth rate (CAGR) for revenue from FY22 to FY24 was 99.83%. Additionally, the profit after tax (PAT) for FY24 reached ₹1,274.3 crores, reflecting a remarkable 154.8% growth compared to FY23.

-

The company reported a positive cash flow from operations (CFO) of ₹2305 crores in FY24 which is 47% more as compared with FY23.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Waaree Energies IPO Allotment Status

Waaree Energies IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Waaree Energies IPO Risk Factors:

- They face intense competition from other Indian module manufacturers as well as module manufacturers from China and South East Asia for domestic demand. . Some of their key competitors across are business verticals include Vikram Solar Limited, Adani Mundra Solar PV Limited (Adani), Premier Energies Limited.

- The company is highly dependent on exports. More than 57% of total revenue in FY24 came from exports market and majority of export Revenue coming from USA.

Waaree Energies IPO Financial Performance:

Waaree Energies IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 72.32% | 64.16% |

| Others | – | 35.81 |

Waaree Energies IPO Outlook:

Waaree Energy Limited is a leading manufacturer of solar photovoltaic (PV) modules, with total installed capacity of 12 GW. The company has demonstrated strong financial performance which is reflected in its revenue growth. With a solid order book, it is well-positioned for continued success in the coming years. On upper price band shares are offered at an appealing P/E ratio of 26.7x compared to its competitors which are trading much higher valuations. Thus, we recommend that investors to apply for the issue for listing gains as well as long term point of view.

Waaree Energies IPO FAQ:

Ans. Waaree Energies IPO is a main-board IPO of 28,752,095 equity shares of the face value of ₹10 aggregating up to ₹4,321.44 Crores. The issue is priced at ₹1427 to ₹1503 per share. The minimum order quantity is 9 Shares.

The IPO opens on October 21, 2024, and closes on October 23, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Waaree Energies IPO opens on October 21, 2024 and closes on October 23, 2024.

Ans. Waaree Energies IPO lot size is 9 Shares, and the minimum amount required is ₹13,527.

Ans. The Waaree Energies IPO listing date is not yet announced. The tentative date of Waaree Energies IPO listing is Monday, October 28, 2024.

Ans. The minimum lot size for this upcoming IPO is 9 shares.