TVS Supply Chain Solutions IPO

TVS Supply Chain Solutions Limited is among India’s largest and fastest-growing integrated supply chain solutions providers in terms of revenues in Fiscal 2021. The Company is an India-based multinational company that pioneered the development of the supply chain solutions market in India. TVS Supply Chain Solutions Limited was promoted by the erstwhile TVS Group, one of the reputed business groups in India, and is now part of the TVS Mobility Group, which has four business verticals: (i) supply chain solutions; (ii) manufacturing; (iii) auto dealership; and (iv) aftermarket sales and service. TVS Supply Chain Solutions Limited is the only differentiated Indian supply chain logistics solution provider to have global capabilities and network across the value chain with cross-deployment abilities.

| IPO-Note | TVS Supply Chain Solutions Limited |

| Rs.187 – Rs.197 per Equity share | Recommendation: Avoid |

Our solutions spanning the entire value chain from sourcing to consumption can be divided into two segments:

- Integrated supply chain solutions (“ISCS”):

It includes sourcing and procurement, integrated transportation, logistics operation centers, in-plant logistics operations, finished goods, aftermarket fulfillment, and supply chain consulting.

- Network solutions (“NS”):

It includes global forwarding solutions (“GFS”), which involves managing end-to-end freight forwarding and distribution across the ocean, air and land, warehousing and at port storage and value-added services, and time-critical final mile solutions (“TCFMS”) which involve closed-loop logistics and support including spares logistics, break-fix, refurbishment and engineering support, and courier and consignment management.

Globally, TVS Supply Chain Solutions Limited provided integrated supply chain solutions to 8,956 customers during the six months that ended September 30, 2021, while in India, the company provided solutions to 827 customers in the same period. The company’s customers span across numerous industries such as automotive, industrial, consumer, tech and tech infra, rail and utilities, and healthcare. The company has developed long-term relationships with a number of its clients, which has provided resilience to revenue and profitability. Some of the customers with whom the company has had long-term relationships include:

| · Mahindra & Mahindra Limited (17 years) | · Sony India Private Limited (11 years) | · Hyundai Motor India Limited (12 years)

|

| · Ashok Leyland Limited (16 years) | · TVS Motor Company Limited (16 years) | · Johnson Controls-Hitachi Air Conditioning India Limited (2 years) |

| · Lexmark International Technology Sarl (5 years) | · Diebold Nixdorf (7 years) | · TVS Srichakra Limited (9 years) |

| · VARTA Microbattery Pte Ltd (6 years) | · Daimler India Commercial Vehicles Private Limited (11 years) | · Hero MotoCorp Limited (7 years) |

| · Modicare Limited (6 years)

· Electricity North West Limited (4 years) |

· Panasonic Life Solutions India Private Limited (11 years) | · Dennis Eagle Limited (16 years) |

TVS Supply Chain Solutions IPO Details:

| Issue Details | |

| Objects of the issue | · To pay the borrowings of the co. and its subsidiary

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.880 Cr.

Fresh Issue – Rs.280 Cr. Offer for Sale – Rs.280 Cr. |

| Face value | Rs.1 |

| Issue Price | Rs.187 – Rs.197 |

| Bid Lot | 76 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 10th Aug, 2023 – 14th Aug, 2023 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

TVS Supply Chain Solutions IPO Financial Analysis:

| Particulars | 6M FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR (FY-20 to FY-22) |

| Revenue from Operations | 5419.23 | 9249.79 | 6933.60 | 6604.55 | 11.9% |

| Other Income | 37.02 | 50.15 | 66.09 | 188.21 | |

| Operational Cost | 658.87 | 1170.92 | 933.22 | 904.41 | |

| Employee Cost | 1055.40 | 1889.13 | 1805.03 | 1809.64 | |

| Other expenses | 3372.75 | 5577.17 | 3808.66 | 3647.01 | |

| EBITDA | 369.24 | 662.71 | 452.78 | 431.70 | 15.4% |

| EBITDA margin% | 6.81% | 7.16% | 6.53% | 6.54% | |

| Depreciation | 254.22 | 461.05 | 443.28 | 444.50 | |

| Interest | 87.26 | 154.95 | 175.60 | 231.19 | |

| Exceptional Items | 2.31 | -33.17 | 49.67 | 2.19 | |

| Profit / (loss) before tax | 30.08 | 13.55 | -116.43 | -241.80 | |

| Total tax | -7.97 | 58.43 | -42.52 | 6.23 | |

| Profit / (loss) After tax | 38.05 | -44.88 | -73.90 | -248.03 | |

| Profit / (loss) After tax margin% | 0.70% | -0.49% | -1.07% | -3.76% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check TVS Supply Chain Solutions IPO Allotment Status

TVS Supply Chain Solutions IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

TVS Supply Chain Solutions IPO Revenue from Operations:

| Segment | 6M FY-23(in cr.) | % | FY-22(in cr.) | % | FY-21(in cr.) | % | FY-20(in cr.) | % | CAGR (FY-20 to FY-22) |

| Sale of products | 781.43 | 14.42% | 1392.87 | 15.06% | 1018.66 | 14.69% | 1105.71 | 16.74% | 8.0% |

| Sale of services | 4635.87 | 85.54% | 7855.01 | 84.92% | 5910.17 | 85.24% | 5496.33 | 83.22% | 12.6% |

| Income from supply chain management services | 4562.98 | 84.20% | 7726.11 | 83.53% | 5821.76 | 83.96% | 5391.13 | 81.63% | 12.7% |

| Income from telecom services | 72.89 | 1.35% | 128.90 | 1.39% | 88.40 | 1.27% | 105.20 | 1.59% | 7.0% |

| Other operating revenue | 1.93 | 0.04% | 1.90 | 0.02% | 4.77 | 0.07% | 2.51 | 0.04% | -8.8% |

| Total | 5419.23 | 100.00% | 9249.79 | 100.00% | 6933.60 | 100.00% | 6604.55 | 100.00% | 11.9% |

TVS Supply Chain Solutions IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 46.65% | 40.15% |

| Others | 53.35% | 59.85% |

Source: RHP, EWL Research

TVS Supply Chain Solutions IPO Strengths:

-

TVS Supply Chain Solutions Limited operates at the forefront of a rapidly expanding logistics industry in India that is expected to grow to US$365 billion by Fiscal 2026 at a CAGR of 15% from US$180 billion in Fiscal 2021. India has an inefficient logistics system, with total logistics spending in India accounting for approximately 14% of GDP in Fiscal 2020, which is significantly higher than developed countries like the United States.

-

TVS Supply Chain Solutions Limited acts as a complete ‘one-stop’ solution for customers from sourcing to distribution through its end-to-end capabilities, which include sourcing and procurement, integrated transportation, logistics operating center, in-plant logistics operations, finished goods, and aftermarket fulfillment, import and export freight, closed-loop logistics and support, and secondary transportation.

-

TVS Supply Chain Solutions Limited is strongly differentiated by its technology as an innovative provider of logistics solutions that enhance visibility, speed, accuracy, and cost-effectiveness for the customers, and by the company’s ability to customize its technology-enabled services to cater to each customer’s requirements

-

TVS Supply Chain Solutions Limited has an established track record of successful inorganic growth through strategic acquisitions that supplement our operations. Over the years, the company has made more than 20 acquisitions in the last 15 years for growth across Europe, the United Kingdom, the United States, and Asia Pacific (including India).

-

TVS Supply Chain Solutions Limited operates an asset-light business wherein the warehouses and vehicles are operated through leases with the network partners. While the company does not have ownership of these assets, it has control over the capacity and fleet, and the scheduling, routing, storing, and delivery of goods are managed by the company.

-

TVSSCSL serves as a comprehensive ‘one-stop’ provider, managing the entire process from sourcing to distribution. Its full capabilities span sourcing, transportation, logistics, in-plant operations, aftermarket fulfillment, import/export, closed-loop logistics, and secondary transportation.

-

The company’s asset-light model and long-term contracts enable it to adapt throughout the economic cycle, lowering expenses during recessions and positioning it to grow swiftly in developing regions.

-

By utilising cutting-edge technology, co. stands out as a leading provider of logistics solutions that improve customers’ visibility, speed, accuracy, and cost-effectiveness.

TVS Supply Chain Solutions IPO Key Highlights:

-

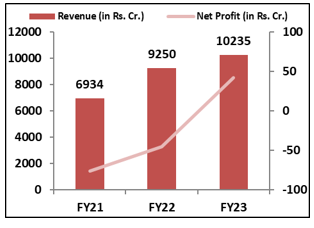

Revenue of the co. has increased from Rs.6,934 Cr. in FY21 to Rs.10,235 Cr. in FY23 with a CAGR of 13.9%.

-

In FY21 and FY22, the co. had loss of Rs.76 cr. and Rs.46 cr., respectively. However, it recovered in FY23, posting a profit of Rs.42 cr.

-

Co.’s’s EBITDA Margin & PAT Margin stands at 6.9% & 0.4% respectively in FY23.

-

As of March, 2023, ROCE and ROE ratio of the co. is 7.64% and 5.50% respectively.

-

Total borrowings of the co. has increased from Rs.1,548 cr. in FY21 to Rs.1989.6 cr. in FY23.

TVS Supply Chain Solutions IPO Risk Factors:

-

TVS Supply Chain Solutions Limited typically enters into long-term agreements with customers and if its key customers do not renew their agreements with the company, or expand the scope of services, the company provides to them, or if the long-term relationships with the key customers are impaired or terminated, the business, financial condition, results of operations and cash flows could be adversely impacted.

-

TVS Supply Chain Solutions Limited has undertaken and may continue to undertake strategic acquisitions in the future, which may be difficult to integrate and manage. These may expose the company to uncertainties and risks, any of which could materially adversely affect the business, financial conditions, results of operations and cash flows.

-

TVS Supply Chain Solutions Limited derives a significant portion of its revenue from certain industries, and a loss of, or a significant decrease in business from customers in these industries could adversely affect the business, results of operations, financial condition, and cash flows of the company

-

TVS Supply Chain Solutions Limited depends on network partners and other third parties in certain aspects of the operations and unreliable or unsatisfactory services provided by them or failure to maintain relationships with them could result in a disruption in the operations, which could have an adverse effect on the business, financial condition, results of operations, and cash flows.

-

TVS Supply Chain Solutions Limited is highly reliant on its technology infrastructure and software suite in the business operations, and any disruption or failure of the technology infrastructure could materially and adversely affect the growth prospectus, reputation, business, results of operations, financial condition, and cash flows

-

Top 20 customers accounted 38.88% of the total revenue in FY23, any loss of such customers may adversely affect company’s business.

-

generates an average of 73% of revenue from exports that are denominated in foreign currencies and this arises significant risk of currency fluctuations.

-

The co. mainly depends on network partners and outside parties for warehousing and transportation because of its asset-light strategy. Any one of these partners’ loss might seriously affect the company’s operations.

TVS Supply Chain Solutions IPO Outlook:

TVSSCSL is an Indian multinational corporation that originated the growth of the supply chain solutions sector in India. For more than 16 years, the company has used specialized tech-enabled solutions to handle massive and complicated supply chains in a variety of industries in India and certain international markets. Co.’s robust presence and cutting-edge technology in India’s logistics business are favorable. However, concerns exist regarding prior losses, currency fluctuations, and over-dependence on a small number of significant clients. TVSSCSL is offering the P/E of 206x on the upper price band compared to the industry average of 43x. The IPO is highly overpriced, and even the funds raised might not be of much use to the company as it would be used to pay off debt. So, taking into account all of these factors, we advise to avoid the offering.

TVS Supply Chain Solutions IPO Objects of the Offer:

TVS Supply Chain Solutions Limited proposes to utilize the Net Proceeds towards funding the following objects:

- Prepayment or repayment of all or a portion of certain outstanding borrowings availed by the Company and its Subsidiaries, TVS LI UK and TVS SCS Singapore

- Purchasing minority stake from existing shareholders of our Subsidiary, Rico Logistics Limited, UK;

- Capitalisation of strategically important step-down Subsidiaries TVS SCS Germany, TVS LI USA and TLM Thailand;

- Inorganic growth initiatives and general corporate purposes.

TVS Supply Chain Solutions Limited IPO Prospectus:

- TVS Supply Chain Solutions Limited IPO DRHP –

- TVS Supply Chain Solutions Limited IPO RHP –

TVS Supply Chain Solutions IPO

Ans. TVS Supply Chain Solutions IPO is a main-board IPO of 44,670,051 equity shares of the face value of ₹1 aggregating up to ₹880.00 Crores. The issue is priced at ₹187 to ₹197 per share. The minimum order quantity is 76 Shares.

The IPO opens on Aug 10, 2023, and closes on Aug 14, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The TVS Supply Chain Solutions IPO opens on Aug 10, 2023 and closes on Aug 14, 2023.

Ans. TVS Supply Chain Solutions IPO lot size is 76 Shares, and the minimum amount required is ₹14,972.

Ans. The TVS Supply Chain Solutions IPO listing date is not yet announced. The tentative date of TVS Supply Chain Solutions IPO listing is Wednesday, 23 August 2023.

Ans. The minimum lot size for this upcoming IPO is 76 shares.