TBO Tek Limited IPO Company Details:

TBO Tek Limited TTL) is one of the leading travel distribution platforms in the global travel and tourism sector with operations in more than 100 countries. It offers buyers a thorough travel inventory tailored to their clients’ requirements and supports a large number of currencies in addition to offering forex assistance. The Company simplifies the business of travel for suppliers such as travel advisors, hotels, airlines, car rentals, transfers, cruises, insurance, rail, and others. This integrated, multi-currency, multilingual one-stop shop allows buyers (the company’s end users)—discover and book travel to destinations across the globe. TTL’s unidirectional technology platform facilitates smooth transactions between Suppliers (hotels and other travel companies) and Buyers (end users). It enables a sizable and widespread network of suppliers to list, sell, and establish pricing for a large and fragmented global buyer base. Through its platform, Co. has made more than 41,000 bookings on average per day as of FY23, selling more than 7,500 destinations across more than 100 countries. Between FY21 and FY23, the average number of bookings accepted through TTL increased dramatically, from 13,396 to 41,218. Its Gross Transaction Value increased as a result, up from Rs.3085 Cr. in FY22 to Rs.19,024 Cr. in FY23.

| IPO-Note | TBO Tek Limited |

| Rs.875 – Rs.920 per Equity share | Recommendation: Apply for Long-Term |

TBO Tek Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· To expand its business · To acquire and build synergies · To gain listing benefits |

| Issue Size | Total issue Size – Rs.1550.81 Cr.

Fress Issue – Rs.400 Cr. Offer for Sale – Rs.1150.81 Cr. |

| Face value | Rs.1 |

| Issue Price | Rs.875 – Rs.920 |

| Bid Lot | 16 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 08th May, 2024 – 10th May, 2024 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

TBO Tek Limited IPO Strengths:

-

The business model of TTL has built is asset-light and easily scalable This allows the Company to maintain its EBITDA Margins and also scale up in the coming years.

-

With interconnected flywheels, company’s platform generates a network effect that improves partners’ value proposition.

-

The company has created a scalable and flexible proprietary platform that enables the addition of new product categories, markets, and travel-related services.

-

It acquired Europe-based Bookabed, a B2B lodging provider catering to the UK and Ireland markets, on March 31, 2022. The business will keep making these kinds of acquisitions to bolster its platform.

TBO Tek Limited IPO Risk Factors:

-

TTL’s revenue is heavily dependent on hotel and ancillary reservations, which accounted for 68% of total revenue in FY23.

-

Top five suppliers and Top 10 suppliers of the co. contribute to 57% & 68% respectively for the period of 9MFY24. Co. is also exposed to pricing presuure set by suppliers.

-

The Joint Managing Directors of TTL have received a show cause notice from the Enforcement Directorate. Co. may be subject to regulatory actions and penalties/compounding fees for such non-compliance which may adversely impact its business.

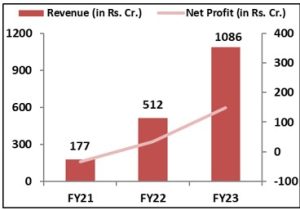

TBO Tek Limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check TBO Tek Limited IPO Allotment Status

TBO Tek Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

TBO Tek Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 51.26% | 37.69% |

| Others | 48.74% | 62.31% |

Source: RHP, EWL Research

TBO Tek Limited IPO Outlook:

TTL is the leading Travel distribution platform with impressive growth over the years. Company’s strengths include a capital-efficient approach, a scalable two-sided platform, and data-driven insights. However, regulatory issues against promoters is a key risk. The PE of TTL stands at 67x on the upper price band which seems reasonable compared to its peers’ average of 118x. As the global travel industry is growing, co. has bright prospects going ahead. Considering the company’s fundamentals and future growth prospects, we recommend investors to apply to the offering for the long term perspective.

TBO Tek Limited IPO FAQ:

Ans. TBO Tek IPO is a main-board IPO of 16,856,623 equity shares of the face value of ₹1 aggregating up to ₹1,550.81 Crores. The issue is priced at ₹875 to ₹920 per share. The minimum order quantity is 16 Shares.

The IPO opens on May 8, 2024, and closes on May 10, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The TBO Tek IPO opens on May 8, 2024 and closes on May 10, 2024.

Ans. TBO Tek IPO lot size is 16 Shares, and the minimum amount required is ₹14,720.

Ans. The TBO Tek IPO listing date is on May 15, 2024.

Ans. The minimum lot size for this upcoming IPO is 16 shares.