Shringar House of Mangalsutra Limited IPO Company Profile:

Shringar House of Mangalsutra Ltd is one a leading and specialized designer and manufacturer of Mangalsutras in India. The company is engaged in the design, manufacturing, and marketing of an extensive range of Mangalsutras, incorporating stones such as American diamonds, cubic zirconia, pearls, mother of pearl, and other semi-precious stones, in 18k and 22k gold. Its products are primarily sold to business-to-business (B2B) clients, serving a broad segment of the jewelry market. In CY23, Shringar House of Mangalsutra Ltd accounted for approximately 6% of India’s organized Mangalsutra market, reflecting its strong market presence and brand recognition.

| IPO-Note | Shringar House of Mangalsutra Limited |

| Rs. 155 – Rs. 165 per Equity share | Recommendation: Apply |

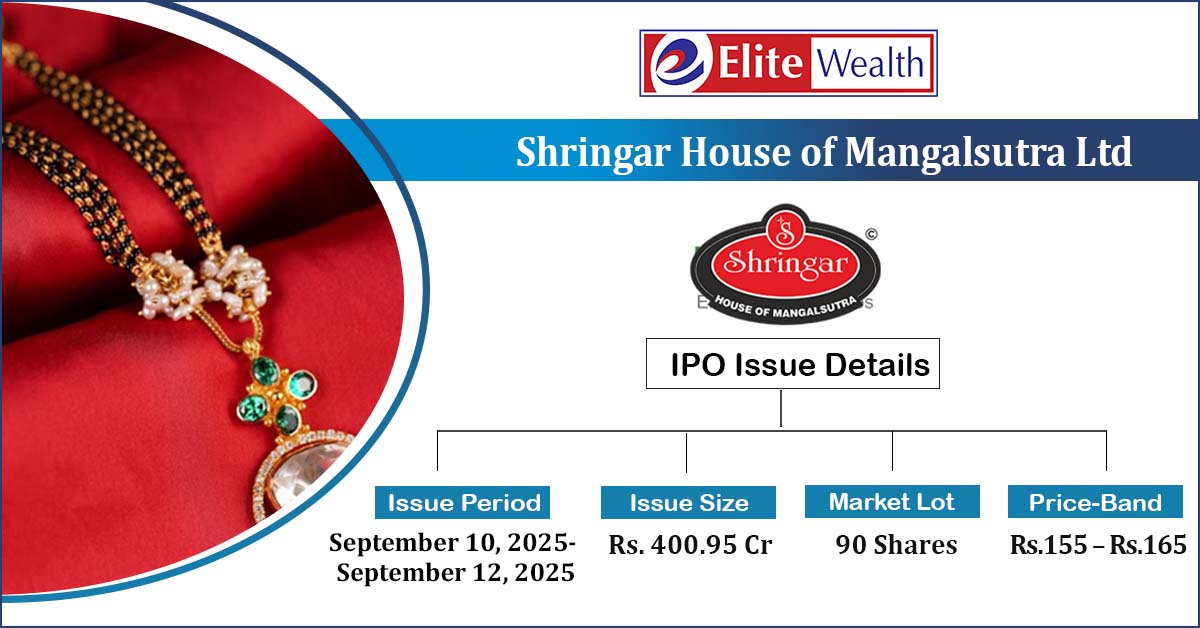

Shringar House of Mangalsutra Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Funding Working Capital Requirement.

· General Corporate Expenses |

| Issue Size | Total Issue Size-Rs. 400.95 Cr

Fresh Issue Size- Rs. 400.95 Cr |

| Face value |

Rs . 10 |

| Issue Price | Rs. 155 – Rs. 165 per share |

| Bid Lot | 90 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | September 10, 2025- September 12, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

| Employee Discount | Rs. 15 |

Shringar House of Mangalsutra Limited IPO Strengths:

- It offers an extensive portfolio of Mangalsutras, comprising over 15 collections and more than 10,000 active SKUs. Its designs cater to special occasions such as weddings, festivals, and anniversaries, as well as daily-wear preferences, spanning antique, bridal, traditional, contemporary, and Indo-western styles, demonstrating its commitment to addressing diverse consumer tastes and occasions.

- It follows an integrated, end-to-end business model, encompassing conceptualization, designing, manufacturing, and distribution of its products. Its state-of-the-art manufacturing facility, spread across 8,300 sq. ft., enables streamlined operations, cost efficiency, and consistent quality control. This integrated approach not only enhances scalability but also strengthens the company’s ability to deliver innovative and customized designs, ensuring a competitive edge in the organized Mangalsutra market.

- The company sells its products to a diverse clientele, including corporate clients, wholesale jewellers, and retailers across India, with a presence in 24 states and 4 union territories. In addition to its domestic operations, the company has expanded internationally, serving clients in the United Kingdom, New Zealand, UAE, USA, and the Republic of Fiji, reflecting its growing global footprint and commitment to catering to a wide-ranging customer base.

- It has integrated advanced technologies into its manufacturing processes, including CNC paramachines, laser soldering equipment, and 3D printing, to enable precision manufacturing and support the production of complex designs.

- The company has recently launched an e-catalogue, providing retail clients with seamless access to its collection and extensive design portfolio, while enabling them to place orders conveniently at their discretion.

- It has entered into agreements with 11 third-party facilitators to present its design portfolio to existing and prospective clients, thereby enhancing penetration in current markets and supporting expansion into new geographies.

- The Indian mangalsutra market was valued at Rs 178 billion, reflecting a YoY growth of approximately 16%. In CY24, the market is projected to grow by 8% YoY to Rs 192 billion. Over the next decade, it is expected to expand at a compounded annual growth rate (CAGR) of 5.8%, reaching Rs 303 billion by CY32.

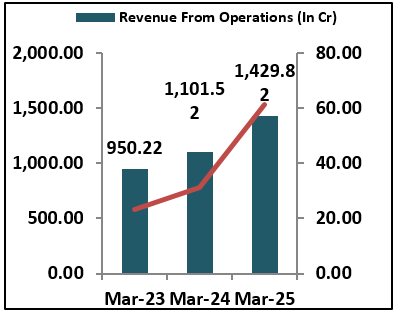

- Shringar House of Mangalsutra Ltd reported revenue from operations of Rs 1,429.82 crore in FY25, representing a growth of 30% compared to Rs 1,101.52 crore in FY24. Profit after tax stood at Rs 61.11 crore in FY25, reflecting a robust growth of 96.47% over Rs 31.11 crore in FY24.

- In CY24, the Indian jewellery market is expected to grow by 12.8% YoY to Rs. 5,610 billion. The market is expected to grow at a compounded annual growth rate (CAGR) of 8.8% in the next 9 years to Rs 11,044 billion in CY32.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Shringar House of Mangalsutra Limited IPO Allotment Status

Shringar House of Mangalsutra Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Shringar House of Mangalsutra Limited IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Shringar House of Mangalsutra Limited IPO Risk Factors:

- The company faces intense competition from established listed players such as Utssav CZ Gold Jewels Ltd, RBZ Jewellers Ltd, Sky Gold & Diamonds Ltd, Titan Company Ltd, Kalyan Jewellers, P. N. Gadgil Jewellers, and Thangamayil Jewellery Ltd. These competitors possess stronger brand recognition, wider distribution networks, and greater financial resources, which may limit the company’s market share, pricing flexibility, and overall growth potential.

- The availability and cost of raw materials pose a key risk for the company. Since a significant portion of raw materials is imported due to limited domestic supply, any fluctuations in global prices or geopolitical developments may adversely impact production costs and, in turn, the company’s profitability.

Shringar House of Mangalsutra Limited IPO Financial Performance:

Shringar House of Mangalsutra Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 99.999% | 74.80% |

| Others | 0.001% | 25.20% |

Sources: Company Website, RHP.

Shringar House of Mangalsutra Limited IPO Outlook:

Shringar House of Mangalsutra Ltd is one a leading specialized designer and manufacturer of mangalsutras in India. In FY25, it delivered strong performance with 30% YoY revenue form operations growth and 96.47% growth in PAT. The company serves corporate clients, wholesalers, and retailers across 24 states, 4 union territories, and international markets. With over 15 collections and 10,000+ SKUs, it operates an integrated business model supported by advanced technologies. While industry growth offers opportunities but raw material price fluctuations and intense competition remain key risks. At the upper price band of Rs 165 per share, the issue is valued at a P/E of 19.48x (pre-IPO) and 26.04x (post-IPO) based on FY25 earnings. Considering the valuations and industry dynamics, we recommend subscribing to the issue for both potential listing gains and medium- to long-term investment opportunities.

Shringar House of Mangalsutra Limited IPO FAQ:

Ans. Shringar House of Mangalsutra IPO is a main-board IPO of 2,43,00,000 equity shares of the face value of ₹10 aggregating up to ₹400.95 Crores. The issue is priced at ₹155 to ₹165 per share. The minimum order quantity is 90.

The IPO opens on September 10, 2025, and closes on September 12, 2025.

MUFG Intime India Pvt.Ltd. is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Shringar House of Mangalsutra IPO opens on September 10, 2025 and closes on September 12, 2025.

Ans. Shringar House of Mangalsutra IPO lot size is 90, and the minimum amount required for application is ₹14,850.

Ans. The Shringar House of Mangalsutra IPO listing date is not yet announced. The tentative date of Shringar House of Mangalsutra IPO listing is Wednesday, September 17, 2025.