Shanti Gold International Limited IPO Company Profile:

Shanti Gold International Limited is one of the leading manufacturers of high-quality 22kt CZ casting gold jewellery in India, distinguished by its significant installed production capacity. Established in 2003, the company specializes in the design and manufacture of a wide range of gold jewellery, including bangles, rings, necklaces, and complete sets. Its product portfolio caters to diverse customer needs and price points, ranging from everyday wear to festive and bridal collections. Known for its intricate craftsmanship and attention to detail, Shanti Gold combines traditional aesthetics with contemporary designs, offering jewellery that meets the evolving preferences of its clientele.

| IPO-Note | Shanti Gold International Limited |

| Rs. 189– Rs. 199 per Equity share | Recommendation: Avoid |

Shanti Gold International Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Repayment of Borrowings

· Capital Expenditure · Working Capital Requirement · General Corporate Expenses |

| Issue Size | Total Issue Size – Rs. 360.11 Cr

Fresh Issue Size- Rs. 360.11 Cr |

| Face value |

Rs . 10 |

| Issue Price | Rs. 189 – Rs. 199 per share |

| Bid Lot | 75 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | July 25, 2025- July 29, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

Shanti Gold International Limited IPO Strengths:

- The company’s manufacturing facility in Andheri East, Mumbai, spans 13,448.86 square feet and is equipped to produce a wide range of jewellery with precision and efficiency. As of March 31, 2025, the facility had an installed capacity of 2,700 kg per annum, with actual production reaching 1,566.05 kg. To support future growth, the company plans to establish a new 1,200 kg facility in Jaipur, expanding total capacity to 3,900 kg on a 50,000 sq. ft. leasehold plot.

- Many of the company’s jewellery pieces feature intricately studded gemstones in CZ casting gold, designed using advanced computer-aided design (CAD) technology. As of May 31, 2025, the company employs a team of 79 in-house CAD designers who collectively develop over 400 unique designs per month, ensuring a continuous pipeline of innovative and trend-aligned jewellery offerings.

- As of May 31, 2025, the company has a presence across 15 states and 2 union territories in India, with operations spanning key cities such as Mumbai, Bengaluru, Chennai, and Hyderabad. It also maintains branch offices in Tamil Nadu, Andhra Pradesh, Karnataka, Telangana, Gujarat, and Madhya Pradesh. Internationally, the company has established a footprint in the USA, UAE, Singapore, and Qatar, reflecting its growing global presence.

- In calendar year 2024 (CY24), the Indian jewellery market is projected to grow by 13.1% YoY, reaching a market size of Rs 4,653 billion. Looking ahead, the market is expected to expand at a CAGR of 9.7% between CY2023 and CY2029, reaching an estimated Rs 7,162 billion by the end of the forecast period.

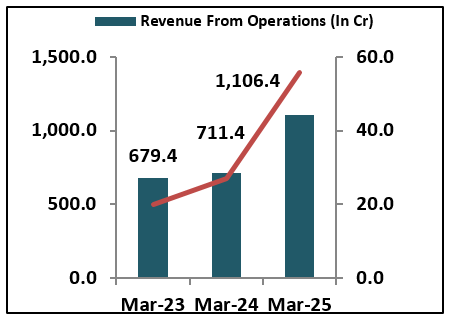

- The company reported revenue from operations of Rs 1,106.41 crore in FY25, reflecting a growth of 55.51% compared to Rs 711.43 crore in FY24. Profit after tax stood at Rs 55.84 crore in FY25, marking a significant increase of 109% from Rs 26.87 crore reported in FY24, demonstrating strong operational performance and improved profitability.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Shanti Gold International Limited IPO Allotment Status

Shanti Gold International Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Shanti Gold International Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Shanti Gold International Limited IPO Risk Factors:

- The company faces intense competition from Key competitors include Utssav CZ Gold Limited, RBZ Jewellers Limited, Sky Gold Limited, Titan Company Ltd, Kalyan Jewellers India Ltd, PC Jeweller Ltd, and Utssav CZ Gold Ltd. This competitive landscape may impact pricing and market share, necessitating continuous innovation, operational efficiency, and differentiated service offerings to maintain and strengthen the company’s position in both domestic and global markets.

- The company’s primary raw materials comprise gold bars, stones, alloys, and wax. Variations in the prices of these inputs, particularly gold, can significantly impact the overall production cost. As a result, such fluctuations may affect the pricing strategy, profit margins, and competitiveness of the company’s product offerings.

- Ongoing tariff regulations and geopolitical tensions also influence the company’s cost structure. These external factors can lead to increased import/export duties, supply chain disruptions, and volatility in raw material prices, ultimately affecting production costs and the pricing of finished products.

Shanti Gold International Limited IPO Financial Performance:

Shanti Gold International Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 99.98% | 74.89% |

| Others | 0.02% | 25.11% |

Shanti Gold International Limited IPO Outlook:

Shanti Gold International Limited is one of India’s leading manufacturers of 22kt CZ casting gold jewellery, reporting strong growth in both revenue and profitability. The company has an installed production capacity of 2,700 kg per annum and is developing a new manufacturing facility in Jaipur to enhance capacity. It has a growing international presence in the USA, UAE, Singapore, and Qatar. The Indian jewellery industry is expected to grow at a CAGR of 9.7% from CY23 to CY29. However, the company faces challenges such as rising raw material costs, tariff-related pressures, and intense industry competition. At the upper price band of Rs 199, the issue is valued at a P/E of 19.24x (pre-IPO) and 25.69x (post-IPO). Keeping in mind the listed factors and the company’s valuation, and as other players in the market are available at more reasonable valuations, thus we recommend avoid the issue.

Shanti Gold International Limited IPO FAQ:

Ans. Shanti Gold International IPO is a main-board IPO of 1,80,96,000 equity shares of the face value of ₹10 aggregating up to ₹360.11 Crores. The issue is priced at ₹189 to ₹199 per share. The minimum order quantity is 75.

The IPO opens on July 25, 2025, and closes on July 29, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Shanti Gold International IPO opens on July 25, 2025 and closes on July 29, 2025.

Ans. Shanti Gold International IPO lot size is 75, and the minimum amount required for application is ₹14,925.

Ans. The Shanti Gold International IPO listing date is not yet announced. The tentative date of Shanti Gold International IPO listing is Friday, August 1, 2025.

Ans. The finalization of Basis of Allotment for Shanti Gold International IPO will be done on Wednesday, July 30, 2025, and the allotted shares will be credited to your demat account by Thursday, July 31, 2025.