Samhi Hotels IPO Company Profile:

SAMHI Hotels Limited (SHL) is a prominent branded hotel ownership and asset management platform in India, with the third largest inventory of operational keys (owned and leased) in India as of March 31, 2023. Within 12 years of starting of its business operations, the company has built a portfolio of 3,839 keys across 25 operating hotels in 12 of India’s key urban consumption centers, including Bengaluru (Karnataka), Hyderabad (Telangana), National Capital Region (“NCR”), Pune (Maharashtra), Chennai (Tamil Nadu) and Ahmedabad (Gujarat), as of March 31, 2023. Pursuant to the completion of the ACIC Acquisition as on August 10, 2023, the company’s portfolio has further increased to 4,801 keys across 31 operating hotels. The Company has adopted an acquisition-led strategy, which is underpinned by its track record of acquiring and successfully turning around hotels to grow its business. The company acquires or builds primarily business hotels, and then take steps to further upgrade properties and engage with established branded hotel operators to allow the hotels to be appropriately positioned within the market.

| IPO-Note | SAMHI Hotels Limited |

| Rs.119 – Rs.126 per Equity share | Recommendation: Avoid |

Samhi Hotels IPO Business Offerings:

Samhi Hotels Limited currently categorizes its hotel portfolio into three distinct hotel segments based on brand classification-

- Upper Upscale and Upscale

- Upper Mid-scale

- Mid-scale

Within 12 years of starting business operations, Samhi Hotels Limited has built a portfolio of 3,839 keys across 25 operating hotels in 12 of India’s key urban consumption centres, including Bengaluru, Ahmedabad, National Capital Region, Hyderabad, Pune and Chennai, as of February 28, 2023.

Its hotels typically operate under long-term management contracts with established and well recognized global hotel operators such as Marriott, Hyatt and IHG. On March 30, 2023, the company entered into a binding share subscription and purchase agreement with ACIC SPVs (the “ACIC SSPA”) and Asiya Capital to acquire 962 keys across six operating hotels and a parcel of land for the development of a hotel in Navi Mumbai, Maharashtra.

Samhi Hotels IPO Details:

| Issue Details | |

| Objects of the issue | · To repay certain borrowings availed of by the Company

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.1370.10 Cr.

Fresh Issue – Rs.1200 Cr. Offer for Sale – Rs.170.10 Cr. |

| Face value | Rs.1 |

| Issue Price | Rs.119 – Rs.126 |

| Bid Lot | 119 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 14th Sep, 2023 – 18th Sep, 2023 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

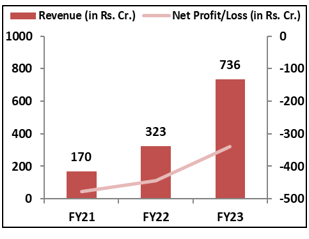

Samhi Hotels IPO Financial Analysis:

| Particulars | 6M of FY-23(in cr.) | FY-22(in cr.) | FY-22(in cr.) | FY-22(in cr.) | CAGR |

| Revenue from Operations | 343.06 | 322.74 | 169.58 | 605.62 | -27.0% |

| Other Income | 10.94 | 10.36 | 9.67 | 22.01 | |

| Cost of Goods Sold | 28.22 | 32.76 | 18.55 | 53.48 | -21.7% |

| Employee Cost | 59.20 | 90.54 | 86.54 | 130.68 | |

| Other expenses | 149.94 | 187.99 | 133.87 | 271.42 | |

| EBITDA | 116.64 | 21.81 | -59.71 | 172.05 | -64.4% |

| EBITDA margin% | 34.00% | 6.76% | -35.21% | 28.41% | |

| Depreciation | 48.09 | 100.60 | 111.79 | 126.17 | |

| Interest | 264.41 | 346.00 | 308.72 | 207.96 | |

| Profit / (loss) before tax and exceptional items | -195.86 | -424.79 | -480.22 | -162.08 | 61.9% |

| Exceptional items (gain) / loss | -11.29 | 18.40 | 1.26 | 139.51 | |

| Profit / (loss) before tax | -184.57 | -443.19 | -481.48 | -301.59 | 21.2% |

| Total tax | 0.014 | 0.028 | -3.773 | -1.744 | |

| Profit / (loss) After tax | -184.58 | -443.22 | -477.71 | -299.85 | 21.6% |

| Profit / (loss) After tax margin% | -53.81% | -137.33% | -281.70% | -49.51% |

Samhi Hotels IPO Revenue from Operations:

| Segment | 6M of FY-23(in cr.) | % | FY-22(in cr.) | % | FY-22(in cr.) | % | FY-22(in cr.) | % | CAGR |

| Sale of service | |||||||||

| Room revenue | 246.42 | 71.83% | 213.66 | 66.20% | 108.42 | 63.94% | 410.73 | 67.82% | -27.9% |

| Food and beverage revenue | 85.69 | 24.98% | 94.96 | 29.42% | 50.99 | 30.07% | 167.56 | 27.67% | -24.7% |

| Recreation and other services | 6.95 | 2.03% | 6.43 | 1.99% | 3.45 | 2.04% | 22.98 | 3.79% | -47.1% |

| Other Operating Revenues | |||||||||

| Property management and space rental | 3.97 | 1.16% | 7.68 | 2.38% | 6.70 | 3.95% | 4.34 | 0.72% | 32.9% |

| Total | 343.06 | 100% | 322.74 | 100% | 169.58 | 100% | 605.62 | 100% | -27.0% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Samhi Hotels IPO Allotment Status

Go Samhi Hotels IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Samhi Hotels IPO Major Shareholders:

| S.NO. | Name of the Shareholder | No. of Shares | % of pre-Offer shareholding |

| 1. | Blue Chandra Pte. Ltd. | 37,641,140 | 28.76% |

| 2. | Asiya Capital | Up to 39,000,000 | 29.79% |

| 3. | Goldman Sachs Investments Holdings (Asia) Limited | 22,023,692 | 16.82% |

| 4. | GTI Capital Alpha Pvt Ltd | 13,747,395 | 10.50% |

| 5. | Sarvara Investment Fund I | 8,202,419 | 6.27% |

| 6. | International Finance Corporation | Up to 6,565,230 | 5.02% |

| 7. | Ashish Jakhanwala | 878,290 | 0.67% |

| 8. | Manav Thadan | 878,290 | 0.67% |

| Total | 128,936,456 | 98.50% |

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 0% | 0% |

| Others | 100% | 100% |

Source: RHP, EWL Research

Samhi Hotels IPO Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Maximum number of

Equity Shares offered for sale |

|

| 1. | Blue Chandra Pte. Ltd. | 4,235,822 | |

| 2. | Goldman Sachs Investments Holdings (Asia) Limited | 2,478,363 | |

| 3. | GTI Capital Alpha Pvt Ltd | 1,547,018 | |

| 4. | International Finance Corporation | 738,797 | |

Samhi Hotels IPO Strengths:

-

Samhi Hotels Limited is capable of purchasing abandoned hotels and has a proven track record of improving hotel performance through renovation and/or rebranding. The company assesses multiple parameters including hotel location profile, demand / supply, competition, future business potential, product or brand profile, development cost and timelines and detailed financial analysis.

-

Samhi Hotels Limited have selected its target cities based on macro themes such as proximity to airports and premium office space. Its hotels are strategically located in high-density micro-markets, and are generally well connected to key transport infrastructure and located near social infrastructure and residential areas. The company benefits from diversification across cities, price-points and hotel operators which reduces the impact of market volatility in any of its key markets.

-

Samhi Hotels Limited augments its scale and quality of portfolio with its track record to operate hotels efficiently. Its operating efficiency enables it to maximize the impact of favourable revenue growth on its profitability and limit the impact of low revenue cycles. Its use of technology to manage hotels, space efficiencies and shared services centres enables it to achieve one of the lowest staffing ratios amongst peers.

-

Samhi Hotels Limited benefits from a cross-section of operating data that it receives on a real-time basis from its hotels. The analysis of such data helps it to continuously improve performance, identify opportunities for future growth and monitor risks that it foresee. It also helps it improve its analysis for new investments that it evaluates on an ongoing basis.

-

SHL’s hotels are located in 12 cities in India that constitute key urban consumption centers across India, which collectively accounted for approximately 70% of air passenger traffic and approximately 90% of office space in India, as of March 31, 2023.

-

Over 51.14% of SHL’s Total Income for the Financial Year 2023 was from Upper Mid-scale and Midscale hotels. The Upper Mid-scale and Mid-scale segments offer significant growth opportunities in India due to their relevant price positioning and limited dependence on international travelers.

-

SHL’s hotels typically operate under long-term management contracts with established and well recognized global hotel operators such as Marriott, Hyatt and IHG. These engagements benefit the hotels by giving them access to strong operating processes, sales and distribution experience, larger clientele and loyalty programs of such hotel operators.

Samhi Hotels IPO Risk Factors:

-

Samhi Hotels Limited was not in compliance with certain covenants under certain of its financing agreements in the past, and in case of any breach of covenants in the future, such non-compliance, if not waived, could adversely affect its business. Its indebtedness and the conditions and restrictions imposed by its financing arrangements may limit its ability to grow its business

-

Samhi Hotels Limited has entered into hotel operator services agreements and other related agreements with Marriott, Hyatt and IHG (and their affiliates) to receive operating and marketing services for its hotels. The ACIC SPVs have entered into franchise agreements and brand license agreements with Marriott for the license of Marriott’s brand name. If these agreements are terminated or not renewed, its business, results of operations and financial condition may be adversely affected.

-

Revenues for Samhi Hotels Limited come from a small number of hotels that are concentrated in a small number of areas, therefore any negative changes that affect these hotels or those areas could have a negative impact on the company’s operations.

-

Certain of Samhi Hotels Limited hotels are located in buildings which have been leased to it by third parties. If the company is unable to comply with the terms of the lease agreements, renew its agreements or enter into new agreements, its business may be adversely affected.

-

In the event that Samhi Hotels Limited is unable to take advantage of the anticipated growth prospects and synergies from the assets it buys, whether through the proposed ACIC purchase or any other purchase, its business may be adversely affected.

-

SHL has experienced restated losses and negative net worth in recent years.

- SHL’s indebtedness and the conditions and restrictions imposed by its financing arrangements may limit its ability to grow its business.

Samhi Hotels IPO Key Highlights:

-

Total Income growth of the co. has increased by 128.58% in FY23.while the adjusted EBITDA increased from Rs.21.79 cr. in FY22 to Rs.260.60 cr. in FY23.

-

SHL’s average occupancy rate also increased to 71.67% in FY23 from 45.90% in FY22 and 27.96% in FY21.

-

Net borrowings increased by 8.23% on YoY basis in FY23.

Samhi Hotels IPO Outlook:

The income increase over the previous 2 years of SHL has been robust, demonstrating the potential of this specific area of hotel property ownership and management. However, as seen by the ongoing losses and the company’s negative net worth, this venture has a long gestation period making it a very risky bet for investors. Since the company is losing money and has a negative net worth, the net margins or return on assets are mostly irrelevant. Investors must thus base their decisions only on the sector’s potential and the number of keys it intends to add over the next years. Although the IPO’s price is important in this case, the losses make it difficult to judge how much of a value play there is. Additionally, the firm has a negative net worth, so investors need to be cautious about what they invest in. On a sectoral basis, hotels appear to be following the rebound in the contact-sensitive business. On the top line, there is excellent grip, but it is unclear when there will be traction on the bottom line. Hence we recommend to avoid this particular IPO offering.

Samhi Hotels IPO FAQ

Ans. SAMHI Hotels IPO is a main-board IPO of 108,738,095 equity shares of the face value of ₹1 aggregating up to ₹1,370.10 Crores. The issue is priced at ₹119 to ₹126 per share. The minimum order quantity is 119 Shares.

The IPO opens on September 14, 2023, and closes on September 18, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The SAMHI Hotels IPO opens on September 14, 2023 and closes on September 18, 2023.

Ans. SAMHI Hotels IPO lot size is 119 Shares, and the minimum amount required is ₹14,994.

Ans. The SAMHI Hotels IPO listing date is not yet announced. The tentative date of SAMHI Hotels IPO listing is Wednesday, September 27, 2023.

Ans. SAMHI Hotels IPO lot size is 119 Shares, and the minimum amount required is ₹14,994.