R K SWAMY IPO Company Details:

R K SWAMY Limited (RKSL) is one of the leader in marketing services provider, offering one-stop shopping for media, creative, data analytics, and market research services. Based on operating revenue, the company ranks eighth among India’s major integrated marketing communications groups. Serving well-known companies including Aditya Birla Sun Life AMC, Himalaya Wellness Co., Cera Sanitary ware Ltd., Dr. Reddy’s Labs, Hawkins Cookers, Royal Enfield, and many more, the Group has over 50 years of experience in the business. The Company’s wide variety of services can be broken down into the following segments:

-

Integrated Marketing Communications: Customer data analytics, customer experience delivery and management, online reputation management, campaign and loyalty management are all included under this segment.

-

Full Service Market Research: This includes Consumer surveys, brand equity and customer happiness, customer intelligence, and customer/audience segmentation.

Hansa Research, a subsidiary of the company, focused in market research, customer happiness, and brand equity. From 2003 to 2012, it carried out the Indian Readership study for ten years, conducting more than twenty lakh in-person interviews.

| IPO-Note | R K SWAMY Limited |

| Rs.270 – Rs.288 per Equity share | Recommendation: Apply |

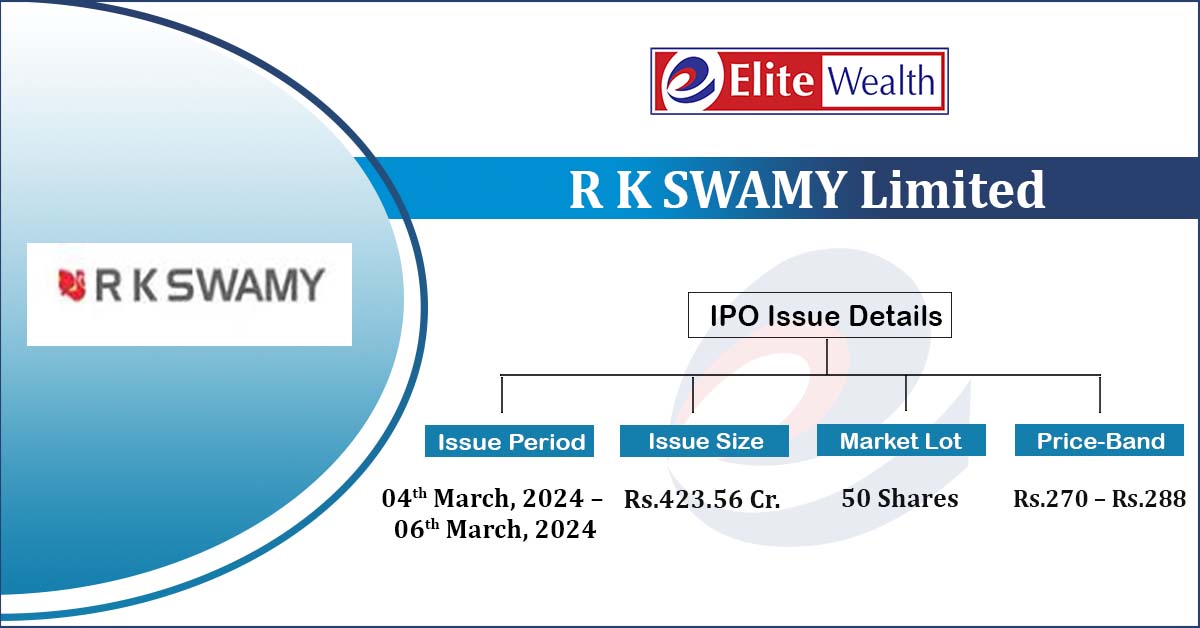

R K SWAMY IPO Details:

| Issue Details | |

| Objects of the issue | · To fund working capital requirements

· To fund Capital expenditure requirements · To fund investment in IT infrastructure |

| Issue Size | Total issue Size – Rs.423.56 Cr.

Fresh Issue – Rs.173 Cr. Offer for Sale – Rs.250.56 Cr. |

| Face value | Rs.5 |

| Issue Price | Rs.270 – Rs.288 |

| Bid Lot | 50 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 04th March, 2024 – 06th March, 2024 |

| QIB | 75% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

R K SWAMY IPO Strengths:

-

RKSL is an integrated service provider with an experience of 5 decades; it offers single window solution for data analytics, media, creative and market research services.

-

It possesses the knowledge and experience needed to create content for well-known businesses. Company has created more than 2828 videos and 18 languages of digital content for client-owned and paid digital channels.

-

A diversified clientele with enduring connections: RKSL has worked with more than 4000 client groups over the years. These clientele are spread throughout a wide range of industrial sectors, including consumer durables, automotive, FMCG, BFSI, and NGOs affiliated with the central government.

-

Company has well experienced promoter and management team.

R K SWAMY IPO Risk Factors:

-

Competition Risk: In order to successfully and efficiently comprehend the market for its clients, RKSL must continuously advance its technological skills. Insufficient data or outdated technology may have an impact on client satisfaction and ultimately result in losses for the company.

-

Risk of client concentration: During the final half of FY24, the company provided services to over 380 clients. Even though the company has a wide clientele, 42% of its income comes from its top 10 customers.

-

The company requires high working capital as the Indian Newspaper Society passed a resolution in March 2021, which mandates marketing companies to make payments within 60 days.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check R K SWAMY IPO Allotment Status

R K SWAMY IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

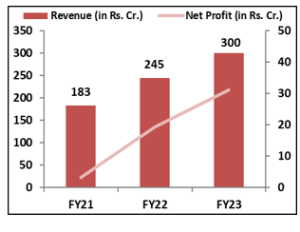

R K SWAMY IPO Financial Performance:

R K SWAMY IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 83.04% | 55.91% |

| Others | 16.96% | 44.09% |

Source: RHP, EWL Research

R K SWAMY IPO Outlook:

RKSL is leading the Indian marketing services industry with more than 5 decades. It has strong expertise across industry verticals serving many well-known businesses. In the upcoming years, the marketing service sector is anticipated to increase significantly particularly in the digital advertising area; which presents more growth avenues for RKSL considering its strength in digital content creation and data analytics. The PE of RKSL stands at 46.50x on the upper price band which seems reasonable when compared to its peer’s average of 69.50x. Hence, we recommend investors to apply to the offering.

R K SWAMY IPO FAQ

Ans. R K SWAMY IPO is a main-board IPO of 14,706,944 equity shares of the face value of ₹5 aggregating up to ₹423.56 Crores. The issue is priced at ₹270 to ₹288 per share. The minimum order quantity is 50 Shares.

The IPO opens on March 4, 2024, and closes on March 6, 2024.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The R K SWAMY IPO opens on March 4, 2024 and closes on March 6, 2024.

Ans. R K SWAMY IPO lot size is 50 Shares, and the minimum amount required is ₹14,400.

Ans. The R K SWAMY IPO listing date is not yet announced. The tentative date of R K SWAMY IPO listing is Tuesday, March 12, 2024.

Ans. The minimum lot size for this upcoming IPO is 50 shares.