Quadrant Future Tek Limited IPO Company Profile:

Quadrant Future Tek Limited is involved in the KAVACH project of Indian Railways, which ensures the highest level of safety and reliability for rail passengers. They also operate a state-of-the-art specialty cable manufacturing facility, which includes an Electron Beam Irradiation Centre. The specialty cables they produce are used in railway rolling stock and the naval (defence) industry.

| IPO-Note | Quadrant Future Tek Limited |

| Rs .275.– Rs.290 per Equity share | Recommendation: May Apply |

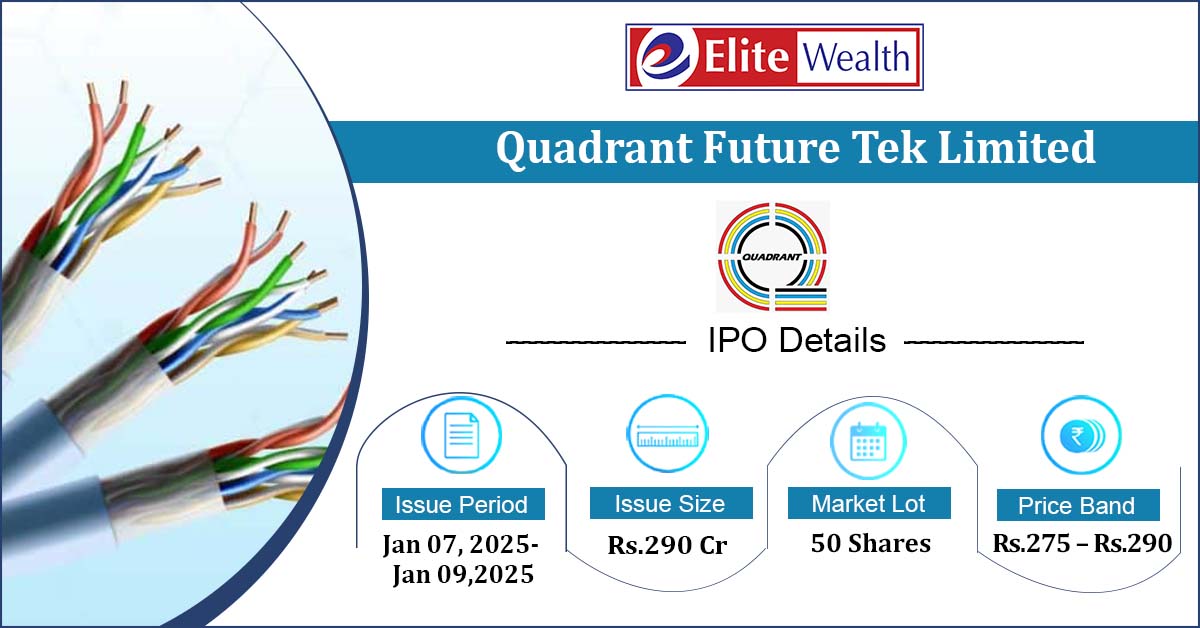

Quadrant Future Tek Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· Capital Expenditure · Repayment of Debt · Funding working capital requirement |

| Issue Size | Total issue Size – Rs.290 Cr

Fresh Issue – Rs 290 Cr |

| Face value |

Rs.10 |

| Issue Price | Rs.275 – Rs.290 per share |

| Bid Lot | 50 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | January 7, 2025– January 9, 2025 |

| QIB | Not less than 75% of Net Issue Offer |

| HNI | Not more than 15% of Net Issue Offer |

| Retail | Not more than 10% of Net Issue Offer |

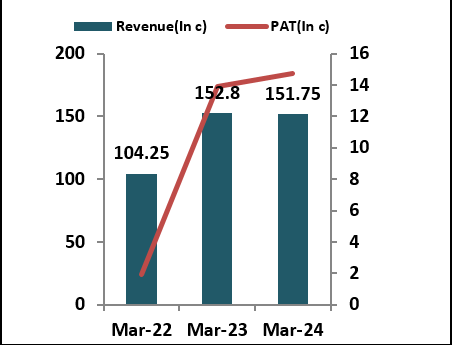

Quadrant Future Tek Limited IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Quadrant Future Tek Limited IPO Allotment Status

Quadrant Future Tek Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Quadrant Future Tek Limited IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post issue |

| Promoters Group | 93.33% | 70% |

| Others | 6.67% | 30% |

Quadrant Future Tek Limited IPO Strengths:

- The company offers a diverse range of cables for various sectors, including defense, electric vehicles, renewable energy, and railways.

- The expanding railway sector in India presents a significant opportunity for the company. With a strong focus on modernizing the Indian railways, promoting Make in India, and aiming for high-speed trains, the need for automated train safety and signaling systems has become essential.

- The company reported a revenue of Rs 151.75 crores in FY24 which was 0.71% less than FY23. During the same period, the company posted a profit after tax (PAT) of Rs 14.71 crores which was 5.53% more than FY23. The company reported loss of Rs 12.11 Cr in H1FY25.

- On May 1, 2024, the company signed a Memorandum of Understanding with RailTel Corporation of India Limited (“RailTel”), a Government of India enterprise, to establish a framework for mutual cooperation in KAVACH as an Automatic Train Protection System for Indian Railways and internationally.

- In FY24, the company achieved a Return on Equity (ROE) of 33.41% and a Return on Capital Employed (ROCE) of 26.12%. These strong financial metrics highlight the company’s efficient use of shareholder equity and overall capital in generating

Quadrant Future Tek Limited IPORisk Factors:

- The company’s revenue is primarily reliant on tenders from Indian Railways and the Naval (Defence) sector, as these two industries accounted for 69% of its total revenue in FY24.

- The products and services offered by the company are already provided by established players such as Kernex Microsystems, HBL Power Systems, and Polycab India, among others, which exposes the company to competitive risks.

Quadrant Future Tek Limited IPO Outlook:

Quadrant Future Tek Limited has positioned itself as a key player in the specialized cables and train control sectors. The industry in which the company operates is poised for growth, driven by the government’s focus on railway development, stricter safety regulations, and a rising emphasis on the naval (defense) sector. However, the company reported a loss of Rs 12.11 crores in H1FY25.Regarding valuation, the company’s post-IPO P/E ratio is 78.91 based on FY24 earnings. With expected annualized earnings of Rs -24.22 crore for FY25, the post-IPO P/E ratio will be -47.89. Considering the company’s business model and fundamentals, we recommend that investors apply for the IPO for long-term value creation.

Quadrant Future Tek Limited IPO FAQ:

Ans. Quadrant Future Tek IPO is a main-board IPO of 10000000 equity shares of the face value of ₹10 aggregating up to ₹290.00 Crores. The issue is priced at ₹275 to ₹290 per share. The minimum order quantity is 50.

The IPO opens on January 7, 2025, and closes on January 9, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Quadrant Future Tek IPO opens on January 7, 2025 and closes on January 9, 2025.

Ans. Quadrant Future Tek IPO lot size is 50, and the minimum amount required is ₹14,500.,/b>

Ans. The Quadrant Future Tek IPO listing date is not yet announced. The tentative date of Quadrant Future Tek IPO listing is Tuesday, January 14, 2025.

Ans. The minimum lot size for this upcoming IPO is 50 shares.