Ola Electric Mobility IPO Company Profile:

Founded in 2017, Ola Electric Mobility Limited has emerged as a leading Indian electric vehicle (EV) manufacturer. Based in Bangalore, the company operates its primary manufacturing facility in Krishnagiri, Tamil Nadu, which stands as India’s largest two-wheeler EV plant. Ola Electric’s production capabilities extend beyond electric scooters to include core components such as battery packs, motors, and vehicle frames, all developed at the Ola Future factory.

The company made its market debut with the Ola S1 Pro in December 2021 and has since introduced several models including the Ola S1, S1 Air, S1 X, and S1 X+. On August 15, 2023, Ola Electric announced additional EV models like the Diamondhead, Adventure, Roadster, and Cruiser, further broadening its product range. By September 2023, the company was valued at around USD 5.4 billion. As of March 31, 2024, Ola Electric employed 959 people, including 907 permanent staff and 52 freelancers, who are dedicated to research, development, and innovation across various aspects of vehicle and software design.

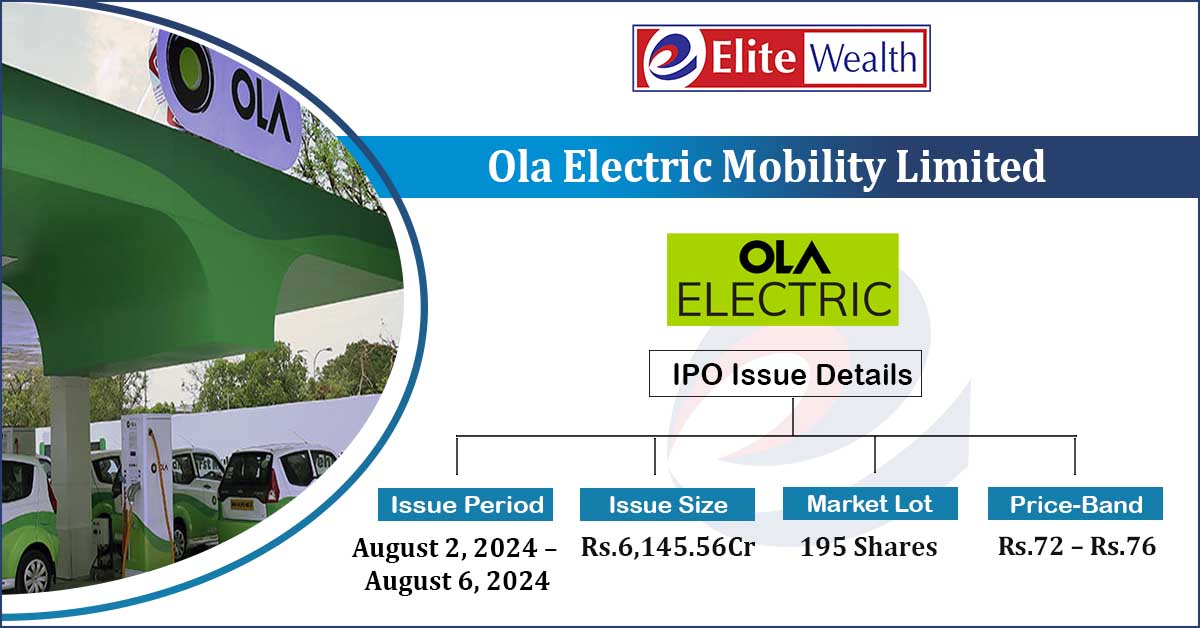

| IPO-Note | Ola Electric Mobility Limited |

| Rs.72 – Rs.76 per Equity share | Recommendation: Listing Gains |

Ola Electric Mobility IPO Details:

| Issue Details | |

| Objects of the issue |

· To fund research and development expenses · Repayment of indebtedness by subsidiary. |

| Issue Size | Total issue Size – Rs.6145.66 Cr

Fresh Issue – Rs 5500 Cr Employee discount- RS 7 |

| Face value |

Rs.10 |

| Issue Price | Rs.72 – Rs.76 |

| Bid Lot | 195 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | August 2, 2024 – August 6, 2024 |

| QIB | 75% of Net Issue Offer |

| HNI | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Ola Electric Mobility IPO Strengths:

- The Company leverages its first-mover advantage to deliver innovative technology solutions in the commuting industry. Its scalable, platform-based design and development approach enhances flexibility and growth potential.

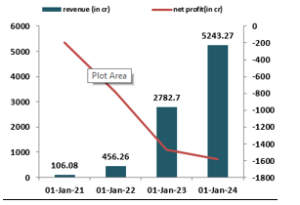

- There has been a substantial increase in demand for the company’s products, with deliveries reaching 330,000 units —an impressive 111.53% growth compared to FY 23.Revenue has surged to Rs 5009.83 crores, marking a 90% increase from FY 23.

- The Company will get benefit from incentives under the PLI scheme, which will be applicable over a five-year period following the launch of the OLA giga factory.

- OLA Electric has developed its proprietary system, Moveos. This system includes navigation powered by Olamaps, an electronic architecture for vehicle control and interface, and a versatile motor and drivetrain designed to accommodate varying power output stools & machineries.

Ola Electric Mobility IPO Risk Factors:

- Ola Electric is facing challenges due to intense competition in the automobiles market, which puts pressure on its market share.

- The Company has reported losses, with a net loss of Rs 158.44 crores for FY 24 and also has negative cash flow.

- The Company currently generates revenue from a limited range of products. This could impact its business performance in the upcoming financial years.

- The Company has net debt amounting to Rs 2,675.18 crores. Inability to manage this debt effectively could hamper its operations.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Ola Electric Mobility IPO Allotment Status

Ola Electric Mobility IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Ola Electric Mobility IPO Financial Performance:

Ola Electric Mobility IPO Shareholding Pattern:

| Particulars | Pre- Issue | |

| Promoters Group | 85.77 | |

| Others | 14.23 |

Ola Electric Mobility IPO Outlook:

Ola Electric Mobility Limited, a leading manufacturer of electric two-wheelers, holds a dominant 52% market share in India’s EV sector. Its in-house production capabilities, including battery manufacturing, vehicles and motor frames will provide a significant competitive edge, allowing the company to maintain pricing power and high profit margins. Despite reporting revenue of ₹5,009 crores for FY 23-24, the company posted a net loss of ₹158.44 crores. While the increasing demand for its products is driving revenue growth, the company faces stiff competition from rivals such as Bajaj and Hero. Additionally, the CFO’s performance and the company’s negative net profit are concerning indicators. Investors with a high risk tolerance may consider applying for the IPO, given the potential for long-term growth despite current challenges.

Ola Electric Mobility IPO FAQ:

Ans.OLA Electric IPO is a main-board IPO of 808,626,207 equity shares of the face value of ₹10 aggregating up to ₹6,145.56 Crores. The issue is priced at ₹72 to ₹76 per share. The minimum order quantity is 195 Shares.

The IPO opens on August 2, 2024, and closes on August 6, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The OLA Electric IPO opens on August 2, 2024 and closes on August 6, 2024.

Ans. OLA Electric IPO lot size is 195 Shares, and the minimum amount required is ₹14,820.

Ans. The OLA Electric IPO listing date is not yet announced. The tentative date of OLA Electric IPO listing is Friday, August 9, 2024.

Ans. The minimum lot size for this upcoming IPO is 195 shares.