Mukka Proteins IPO Company Details:

Fish protein products are produced and supplied by Mukka Protein. They provide fish soluble paste, fish oil, and fish meal—all necessary components in the production of pet food, aqua feed, and poultry feed. By introducing insect oil and meal into the pet food and aqua feed industries, it is a trailblazer in the fish oil sector. The fish oil produced by Mukka is also used in the paint, soap, leather tanning, and pharmaceutical sectors. They export their goods to more than ten Asian nations. Of the six production sites under its operation, four are situated in India. The overseas subsidiary of the company runs the other two facilities, which are situated in Oman. In addition, the company has five storage facilities and three blending facilities in India. To facilitate effective logistics, all of the facilities are situated close to the shore. India is among the world’s top producers of animal feed, and the country’s compound animal feed industry is expanding quickly. Between FY22 and FY26, it is anticipated to increase at a value-based compound annual growth rate (CAGR) of 3.5–4.0%. Since fish meal is a crucial component of the compound feed business, there will likely be a significant market for it in the future. Aqua feed is anticipated to increase at the quickest rate in the animal feed industry over that time, with a 9–10% CAGR (value terms). This will propel the expansion of feeds rich in protein, such fish meal and fish oil.

| IPO-Note | Mukka Proteins Limited |

| Rs.26 – Rs.28 per Equity share | Recommendation: Apply for Listing Gains |

Mukka Proteins IPO Details:

| Issue Details | |

| Objects of the issue | · Funding working capital requirements

· Investment in the Associate, viz. Ento Proteins Private Limited, for funding its working capital requirements |

| Issue Size | Total issue Size – Rs.224.00 Cr.

Fresh Issue – Rs.224.00 Cr. |

| Face value | Rs.1 |

| Issue Price | Rs.26 – Rs.28 |

| Bid Lot | 535 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 29th Feb, 2024 – 04st Mar, 2024 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Mukka Proteins IPO Strengths:

-

Top producer and exporter of items containing fish protein: The Ministry of Commerce has certified the company as a Three Star Export House. With an 18% market share in fish meal exports from India, it is a leading manufacturer.

-

A well-established customer base with solid relationships: 19.61% of the company’s revenue comes from clients who have been doing business with it for at least five years. This indicates that the company has good ties. Both domestic and international markets continue to bring in new clients for the company.

-

Facilities that are strategically positioned: Because the company produces fish oil, pelagic fish is a major supply of raw materials. Because of this, it can save money on shipping and exporting because it is located along the shore.

Mukka Proteins IPO Risk Factors:

-

Legal action: The Company is a party to an action pertaining to an alleged environmental standard breach by the Company. Following an inspection of Mukka’s manufacturing facility, the Karnataka Pollution Control Board was mandated by the high court to submit a report. The use of Mukka’s largest facility can be delayed by a court decision against them, even though the case has been postponed without a new hearing.

-

Risk of Revenue Concentration: In FY23, the Company’s top two customers accounted for roughly 37% of its revenue, while its top five customers brought in 53%. This illustrates the influence of revenue on a single client.

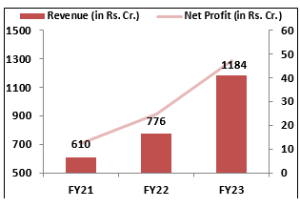

Mukka Proteins IPO Financial Performance:

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Mukka Proteins IPO Allotment Status

Mukka Proteins IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Mukka Proteins IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 100.00% | 63.64% |

| Others | 0.00% | 36.36% |

Source: RHP, EWL Research

Mukka Proteins IPO Outlook:

In summary, Mukka Protein has a well-established position as a top producer and exporter of fish protein products. Over the past few years, it has had healthy growth in both revenues and profits. Mukka’s primary market, the animal feed sector, is anticipated to grow rapidly in the future, increasing demand for fish oil and meal. Nonetheless, the company’s profit margins continue to be severely constrained, making vertical integration imperative. Given the significant premium on the gray market, Mukka Proteins’ IPO may provide large listing returns. Nonetheless, investors ought to hold off on making significant investments until they have a better understanding of the company’s long-term performance.

Mukka Proteins IPO FAQ

Ans. Mukka Proteins IPO is a main-board IPO of 80,000,000 equity shares of the face value of ₹1 aggregating up to ₹224.00 Crores. The issue is priced at ₹26 to ₹28 per share. The minimum order quantity is 535 Shares.

The IPO opens on February 29, 2024, and closes on March 4, 2024.

Cameo Corporate Services Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Mukka Proteins IPO opens on February 29, 2024 and closes on March 4, 2024.

Ans. Mukka Proteins IPO lot size is 535 Shares, and the minimum amount required is ₹14,980.

Ans. The Mukka Proteins IPO listing date is not yet announced. The tentative date of Mukka Proteins IPO listing is Thursday, March 7, 2024.

Ans. The minimum lot size for this upcoming IPO is 535 shares.