Lenskart Solutions Limited IPO Company Profile:

Lenskart Solutions Limited is a technology-driven eyewear enterprise, offering integrated operations across design, manufacturing, branding, and retailing. Lenskart primarily markets prescription eyeglasses, sunglasses, contact lenses, and eyewear accessories through multiple in-house and sub-brands. Core markets include India, Southeast Asia, Japan, and the Middle East. Lenskart forces advanced frame and lens design, with manufacturing centers in India, complemented by regional facilities in Singapore and the United Arab Emirates.

| IPO-Note | Lenskart Solutions Limited |

| Rs. 382 – Rs. 402 per Equity share | Recommendation: Avoid |

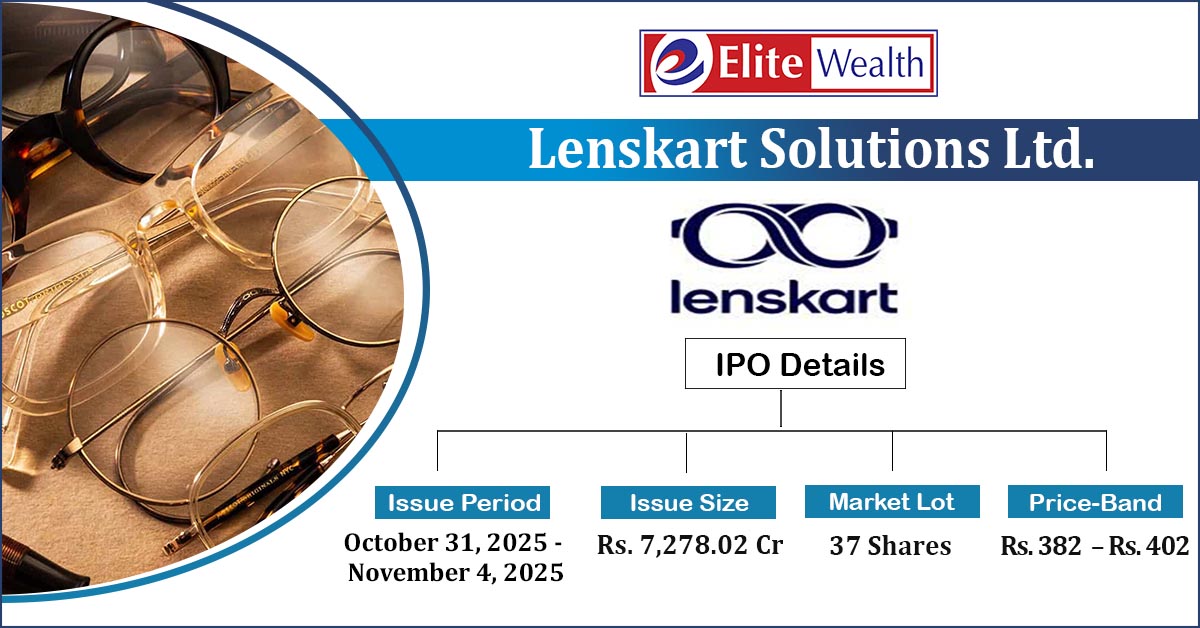

Lenskart Solutions Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Capital Expenditure

· For Marketing Expenses · General Corporate Purpose · Investing in technology and cloud infrastructure |

| Issue Size | Total Issue Size-Rs. 7,278.02 Cr

OFS Size- Rs. 5,128.02 Cr Fresh Issue- Rs. 2,150.00 Cr |

| Face value |

Rs . 2 |

| Issue Price | Rs. 382 – Rs. 402 per share |

| Bid Lot | 37 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | October 31, 2025- November 04, 2025 |

| QIB | Not Less than 75% of Net Issue Offer |

| HNI | Not More than 15% of Net Issue Offer |

| Retail | Not More than 10% of Net Issue Offer |

| Employee Discount | Rs. 19 |

Lenskart Solutions Limited IPO Strengths:

- During Q1FY26 and FY25, the company launched 42 and 105 new in-house designed and engineered collections globally, including collaborations with top brands and celebrities.

- As of June 30, 2025, Lenskart operated a total of 2,806 stores worldwide, including 2,137 in India and 669 across international markets. The network comprised 2,311 company-owned stores (1,823 in India and 488 overseas) and 495 franchise-operated stores (314 in India and 181 overseas), reflecting the company’s strong global expansion and balanced retail strategy.

- The company’s mobile applications had achieved over 100 million cumulative downloads, highlighting its strong omnichannel strategy and balanced growth across both physical retail and digital platforms.

- As of June 30, 2025, the company offered next-day delivery of single vision prescription eyeglasses in 58 cities and three-day delivery in 49 cities across India, reflecting its strong supply chain efficiency and commitment to enhancing customer experience through faster, reliable fulfillment.

- Lenskart’s vertically integrated model, supported by a centralized supply chain, enables complete end-to-end control over product quality, shorter manufacturing lead times, and enhanced cost efficiency compared to traditional eyewear retailers. This structure allows Lenskart to offer products at lower prices and faster delivery times, with frame and lens costs in FY2025 estimated to be 35–40% below the industry average.

- Lenskart offers various customer membership programs, including its paid loyalty initiative, “Lenskart Gold,” launched in 2018. As of June 30, 2025, the program had 7.12 million members, with 0.35 million new members added in the quarter ended June 30, 2025, and 0.95 million during FY2025.

- Lenskart is actively developing and piloting advanced smart eyewear products that integrate emerging technologies, including Bluetooth-enabled audio eyewear (its Phonic range) and camera-enabled eyewear. The company also plans to continue investing in product innovation and related hardware and software technologies for Smart Glasses, both organically and inorganically.

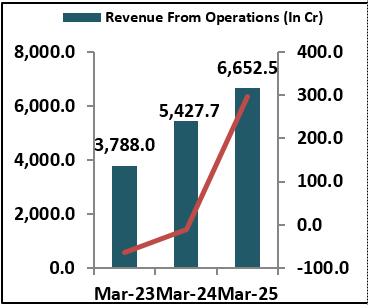

- Lenskart reported FY25 revenue of ₹6,652.52 crore, a 22.56% rise from FY24’s ₹5,427.70 crore. The company turned profitable with a PAT of ₹297.34 crore versus a loss of ₹10.1 crore previously. Q1 FY26 revenue hit ₹1,894.46 crore with PAT of ₹99.72 crore. The average store generates ₹2.37 crore annually.

- The Indian eyewear market is projected to grow at a CAGR of approximately 13%, reaching ₹1,483 billion (around US$17.2 billion) by FY2030. Prescription eyeglasses are expected to remain the dominant segment, accounting for approximately 73% of the total market value.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Lenskart Solutions Limited IPO Allotment Status

Lenskart Solutions Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Lenskart Solutions Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Lenskart Solutions Limited IPO Risk Factors:

- The company faces intense competition from both local vendors and listed and unlisted players such as Titan Eye Plus, GKB Opticals, Coolwinks, and Specsmakers, which may impact its revenue growth and profitability.

- With eyewear increasingly viewed as a fashion statement, Lenskart faces the risk of rapid shifts in consumer preferences and style trends. Failure to consistently innovate in design, branding, or influencer engagement may result in outdated inventory, reduced customer engagement, and potential loss of market competitiveness.

Lenskart Solutions Limited IPO Financial Performance:

Lenskart Solutions Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 19.85% | 17.67% |

| Others | 80.15% | 82.33% |

Sources: Company Website, RHP.

Lenskart Solutions Limited IPO Outlook:

Lenskart Solutions Limited is a technology-driven eyewear enterprise, offering integrated operations across design, manufacturing, branding, and retailing. The company recorded 22.56% revenue growth and a 3028% rise in PAT in FY25. With the launch of new in-house collections, increasing store presence across domestic and international markets, and over 100 million mobile app downloads, Lenskart continues to enhance accessibility and customer experience. Its efficient delivery network across major cities and favorable industry growth trends are likely to support further expansion and improved financial performance in the coming years. At the upper price band of ₹402 per share, the issue is valued at a P/E of 227.27x (pre-IPO) and 235.13x (post-IPO) based on FY25 earnings. The company’s valuation is on the higher side, so we recommend avoiding the issue. However, investors seeking short-term listing gains or aggressive investors with a higher risk appetite may consider applying, keeping in mind the elevated valuation and associated risks.

Lenskart Solutions Limited IPO FAQ:

Ans. Lenskart Solutions IPO is a main-board IPO of 18,10,45,160 equity shares of the face value of ₹2 aggregating up to ₹7,278.02 Crores. The issue is priced at . The minimum order quantity is 37.

The IPO opens on October 31, 2025, and closes on November 4, 2025.

MUFG Intime India Pvt.Ltd. is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Lenskart Solutions IPO opens on October 31, 2025 and closes on November 4, 2025.

Ans. Lenskart Solutions IPO lot size is 37, and the minimum amount required for application is ₹14,874.

Ans. The Lenskart Solutions IPO listing date is not yet announced. The tentative date of Lenskart Solutions IPO listing is Monday, November 10, 2025.