Jupiter Life Line Hospitals IPO Details :

Jupiter Life Line Hospitals Limited (JLLHL) is a prominent multi-specialty tertiary and quaternary healthcare provider in both the Mumbai Metropolitan Area (MMR) and the western region of India. Co. presently manages three hospitals bearing the “Jupiter” brand, situated in Thane, Pune, and Indore, and employs a team of 1,306 doctors, including specialists, physicians, and surgeons. As of March 31, 2023, it has a total of 1,194 hospital beds spread across three hospitals. With over 15 years of operation, co. has established itself as a leading corporate quaternary care healthcare service provider in densely populated micro markets within the western regions of India. Its Thane and Indore hospitals are amongst the few hospitals in the western region of India to provide neuro rehabilitation services through a dedicated robotic and computer-assisted neuro rehabilitation centre.

| IPO-Note | Jupiter Life Line Hospitals Limited |

| Rs.695 – Rs.735 per Equity share | Recommendation: Aggressive investors may apply |

Jupiter Life Line Hospitals IPO Business Offerings:

-

Specific quaternary services that are specialist and precision-based therapies including brachytherapy, radiation, robotic knee replacement, and robotic neurorehabilitation.

-

Important subspecialties such as organ transplant, cancer, orthopedics, cardiology, pediatrics, neurology, and neurosurgery.

-

Services for neurorehabilitation provided by a facility specifically designed for robotic and computer-assisted neurorehabilitation.

The company’s hospitals at Thane, Pune, and Indore have been certified by the National 187 Accreditation Board for Hospitals & Healthcare Providers (“NABH”) and have been accredited in the field of medical testing by the National Accreditation Board for Testing and Calibration Laboratories (“NABL”). In the past, our Thane hospital has also received the NABH Safe-I certification and the NABH ‘Nursing Excellence’ accreditation.

Jupiter Life Line Hospitals IPO Details:

| Issue Details | |

| Objects of the issue | · To pay borrowings

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.869.08 Cr.

Fresh Issue – Rs.542 Cr. Offer for Sale – Rs.327.08 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.695 – Rs.735 |

| Bid Lot | 20 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 06th Sep, 2023 – 08th Sep, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Jupiter Life Line Hospitals IPO Allotment Status

Go Jupiter Life Line Hospitals IPOallotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Jupiter Life Line Hospitals IPO Financial Analysis:

| Particulars | 9M of FY-23(in cr.) | FY-22

(in cr.) |

FY-21

(in cr.) |

FY-20

(in cr.) |

CAGR |

| Revenue from Operations | 650.24 | 733.12 | 486.16 | 462.95 | 25.8% |

| Other Income | 6.94 | 4.02 | 4.11 | 1.89 | |

| Cost of Goods Sold | 113.51 | 142.22 | 98.44 | 79.87 | 33.4% |

| Employee Cost | 114.47 | 133.78 | 104.36 | 92.75 | |

| Other expenses | 272.52 | 303.73 | 216.20 | 207.73 | |

| EBITDA | 156.67 | 157.41 | 71.27 | 84.49 | 36.5% |

| EBITDA margin% | 24.09% | 21.47% | 14.66% | 18.25% | |

| Depreciation | 28.58 | 36.16 | 30.74 | 25.91 | |

| Interest | 31.34 | 43.94 | 38.98 | 25.69 | |

| Profit / (loss) before tax | 96.76 | 77.32 | 1.56 | 32.89 | 53.3% |

| Exceptional Items | -0.20 | ||||

| Total tax | 39.61 | 25.99 | 3.85 | 3.26 | |

| Profit / (loss) After tax | 57.15 | 51.33 | -2.30 | 29.63 | 31.6% |

| Profit / (loss) After tax margin% | 8.79% | 7.00% | -0.47% | 6.40% |

Jupiter Life Line Hospitals IPO Revenue from Operations:

| Segment | 9M of FY-23 (in cr.) | % | FY-22 (in cr.) | % | FY-21 (in cr.) | % | FY-20 (in cr.) | % | CAGR |

| Income from Hospital services | |||||||||

| · IP Income | 517.50 | 79.59% | 576.00 | 78.57% | 397.23 | 81.71% | 357.86 | 77.30% | 26.9% |

| · OP Income | 123.66 | 19.02% | 150.19 | 20.49% | 86.20 | 17.73% | 96.10 | 20.76% | 25.0% |

| Income from Hotel | 9.08 | 1.40% | 6.93 | 0.95% | 2.73 | 0.56% | 8.99 | 1.94% | -12.2% |

| Total | 650.24 | 100.00% | 733.12 | 100.00% | 486.16 | 100.00% | 462.95 | 100.00% | 25.8% |

Jupiter Life Line Hospitals IPO Major Shareholders:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 49.79% | 37.41% |

| Others | 50.21% | 62.59%

|

| S.NO. | Name of the Shareholder | No. of Shares | % of pre-Offer shareholding |

| 1 | Dr. Ajay Thakker | 13,597,829 | 24.06% |

| 2 | Western Medical Solutions LLP | 5,703,797 | 10.09% |

| 3 | Dr. Ankit Thakker | 4,375,789 | 7.74% |

| 4 | Nitin Thakker jointly with Asha Thakker | 3,220,000 | 5.70% |

| 5 | JM Financial Products Limited | 2,240,000 | 3.96% |

| 6 | Dr. Kamini Rao(1) | 1,966,475 | 3.48 % |

| 7 | Mihir Wire Industries Private Limited | 1,410,000 | 2.49% |

| 8 | Neeta Gandhi jointly with Devang Gandhi | 1,380,000 | 2.44% |

| 9 | Dr. Navin Davda | 1,320,000 | 2.34% |

| 10 | Kirtika Thakker(2) | 1,332,750 | 2.36% |

| 11 | Devang Gandhi jointly with Neeta Gandhi | 1,310,000 | 2.32% |

| 12 | Darshana Chothani jointly with Girish Gala | 1,266,750 | 2.24% |

| 13 | Devang Vasantlal Gandhi (HUF) | 1,250,000 | 2.21% |

| 14 | J M Financial and Investment Consultancy Services Private Limited | 1,250,000 | 2.21% |

| 15 | Rajesh Vora jointly with Dr. Ajay Thakker | 1,250,000 | 2.21% |

| 16 | Ramakant Tibrewala jointly with Sushma Tibrewala | 1,225,000 | 2.17% |

| 17 | Sushma Tibrewala jointly with Ramakant Tibrewala | 1,225,000 | 2.17% |

| 18 | Brijesh Tibrewala | 1,225,000 | 2.17% |

| 19 | Mahesh Tibrewala | 1,225,000 | 2.17% |

| 20 | Dr. A.S. Arvind(3) | 968,750 | 1.71% |

| 21 | Kampani Consultants Limited | 910,000 | 1.61% |

| 22 | Kalpana Gala jointly with Girish Gala | 625,200 | 1.11% |

| Total | 50,277,340 | 88.96% |

Jupiter Life Line Hospitals IPO Offer for Sale Details:

| S. No. | Name of the Selling Shareholder | Number of Equity Shares

being offered in the Offer for Sale (Up to) |

|

| 1. | Devang Vasantlal Gandhi (HUF) | 1,250,000 Equity Shares | |

| 2. | Devang Gandhi jointly with Neeta Gandhi | 900,000 Equity Shares | |

| 3. | Nitin Thakker jointly with Asha Thakker | 1,000,000 Equity Shares | |

| 4. | Anuradha Ramesh Modi with Megha Ramesh Modi (as trustees for the benefit of Modi Family Private Trust) | 400,000 Equity Shares | |

| 5. | Bhaskar P Shah (HUF) | 400,000 Equity Shares | |

| 6. | Rajeshwari Capital Market Limited | 200,000 Equity Shares | |

| 7. | Vadapatra Sayee Raghavan (HUF) | 200,000 Equity Shares | |

| 8. | Sangeeta Ravat jointly with Dr. Hasmukh Ravat | 40,000 Equity Shares | |

| 9. | Dr. Hasmukh Ravat jointly with Sangeeta Ravat | 40,000 Equity Shares | |

| 10. | Shreyas Ravat jointly with Sangeeta Ravat | 20,000 Equity Shares | |

Jupiter Life Line Hospitals IPO Strengths:

-

Jupiter Life Line Hospitals Limited has established a track record of clinical and operational expertise, which has led it to build our reputation and brand. This is reflected in its patient volumes, which have been consistently growing over the years, and it has a very low dependence on revenue from government schemes. In Fiscals 2020, 2021, 2022, and in the nine months ended December 31, 2022, the patient volumes at its hospitals were 542,174, 447,573, 645,446, and 568,832, respectively.

-

Jupiter Life Line Hospitals Limited continuously invests in the latest medical technology and equipment and diagnostic instruments to provide the doctors, nurses, and medical staff with all the tools they need to provide quality medical care as well as provide patients with accurate diagnoses and effective treatments. The company also has an in-house 24×7 engineering team which helps in minimizing any disruption and quick repairs of its infrastructure.

-

Jupiter Life Line Hospitals Limited has delivered high operational and financial performance through high patient volumes, cost efficiency, and diversified revenue streams across hospitals. Over the last three years, it has showcased consistent growth and expanded healthcare infrastructure and services, without any investment from institutional investors.

-

Jupiter Life Line Hospitals Limited’s Pune hospital has been designed in collaboration with the Government of Switzerland under the Building Energy Efficiency Project. As part of its corporate social responsibility activities, it has served numerous patients suffering from cancer, birth defects, cardiac problems, and end-stage organ failures.

- JLLHL has built a strong reputation for clinical and operational competence, which is reflected in its steady growth in patient volume and minimal reliance on government scheme revenues.

- continuously invests in latest tech to give patients quality care, accurate diagnoses, and quick repairs.

- All of JLLHL’s facilities in Thane, Pune, and Indore are accredited by the National Accreditation Board for Hospitals & Healthcare Providers (NABH), ensuring high-quality healthcare services.

Jupiter Life Line Hospitals IPO Risk Factors:

-

Jupiter Life Line Hospitals Limited’s Thane hospital is the company’s longest-operating hospital and a significant portion of its revenue is generated from it Any significant decrease in the number of patients visiting the hospital in Thane, regulatory changes, reputational damage, or liabilities, for example, could have a negative influence on the hospital’s revenue.

-

Jupiter Life Line Hospitals Limited being a healthcare provider is subject to a wide variety of governmental, state, and local environmental and occupational health and safety and other laws and regulations. Any kind of failure to renew the approvals that have expired and obtain the required approvals may impede its operations business and financial condition.

-

The cost of medications, drugs, and surgical equipment can have an impact on Jupiter Life Line Hospitals Limited’s profitability. If the Company is unable to obtain favourable pricing, discounts, and rebates from vendors/suppliers, it could affect its profitability.

-

At any time during the development, introduction, or execution of its services, Jupiter Life Line Hospitals Limited may also encounter delays or difficulties. It cannot assure that its existing equipment and technologies are error-free and incapable of malfunctioning. The medical equipment it uses as part of our business has a limited life span and may become obsolete, including by reason of the advancement of technology.

- A significant portion of the co.’s revenue relies on its Thane hospital. Any adverse impact on this facility could have negative impact on the co.’s financials.

- It faces substantial expenses related to medical equipment, staff salaries, and infrastructure maintenance. Inability to manage these costs efficiently could impact profitability.

Jupiter Life Line Hospitals IPO Key Highlights:

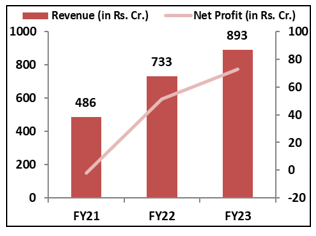

- Revenue of the co. has increased from Rs.486 Cr. in FY21 to Rs.893 Cr. in FY23 with a CAGR of 22.4%; Net Profit has significantly improved from the loss of Rs.2 Cr. to Rs.73 Cr. during the same period.

- ’s EBITDA Margin & PAT Margin stands at 23.7% & 8.2% respectively in FY23.

- As of March, 2023, ROCE and ROE ratio of the co. is 20.94% and 20.03%.

- Debt to Equity of the co. stands at 1.29 as of March, 2023.

- Average revenue per occupied bed (ARPOB) of the co. has shown consistent upward trend and is currently at Rs.50,990. Simultaneously, the Average Occupancy Rate has been increasing and now stands at 62.61% for FY23.

Jupiter Life Line Hospitals IPO Outlook:

JLLHL is an emerging healthcare provider in MMR and western region of India specialized in services like neuro-rehabilitation and multi-organ transplantation. It is equipped with over 30 specialized treatments including bariatric surgery, dermatology, cardiology, gastroenterology, haematology, neurology, gynaecology, obstetrics etc. It follows a ‘patient first’ ideology by creating the best infrastructure, technology, and innovation in the delivery of healthcare. The co. generated ~78.6% of revenue from in-patient department and ~18.9% of revenue from the out-patient department as of March, 2023. JLLHL is strategically expanding its presence in Western India, which is expected to grow at a CAGR of 14-16% from FY22 to FY27. Additionally, it is focusing on improving the quality of care and investing in the latest technology to enhance its hospitals’ offerings. P/E of the co. stands at 65.9x on the upper price band compared to the industry average of 50.47x, which seems bit expensive. The co.’s financials are strong and its key metrics are improving. JLLHL is expanding to new locations to capitalize on the growing healthcare market and plans to be debt-free after the initial offering. However, the valuation of the co. seems bit expensive, hence, we advise only aggressive investors to apply to the offering.

Jupiter Life Line Hospitals IPO FAQ

Ans. Jupiter Life Line Hospitals IPO is a main-board IPO of 11,824,163 equity shares of the face value of ₹10 aggregating up to ₹869.08 Crores. The issue is priced at ₹695 to ₹735 per share. The minimum order quantity is 20 Shares.

The IPO opens on September 6, 2023, and closes on September 8, 2023.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Jupiter Life Line Hospitals IPO opens on September 6, 2023 and closes on September 8, 2023.

Ans. The minimum lot size that investors can subscribe to is 20 shares.

Ans. The Jupiter Life Line Hospitals IPO listing date is not yet announced. The tentative date of Jupiter Life Line Hospitals IPO listing is Monday, September 18, 2023.

Ans. The minimum lot size for this upcoming IPO is 20 shares.