JSW Cement Ltd IPO Company Profile:

JSW Cement Ltd., a part of the diversified JSW Group, is one a leading Indian manufacturer of eco-friendly cementitious products. The company focuses on producing blended cement, including Portland Slag Cement (PSC), Portland Composite Cement (PCC), and Ground Granulated Blast Furnace Slag (GGBS). It also manufactures Ordinary Portland Cement (OPC), clinker, and a broad range of allied products such as ready-mix concrete (RMC), screened slag, construction chemicals, and waterproofing compounds. Leveraging the strength and synergies of the well-established “JSW” brand, JSW Cement benefits from the Group’s extensive presence across steel, energy, infrastructure, realty, and other sectors.

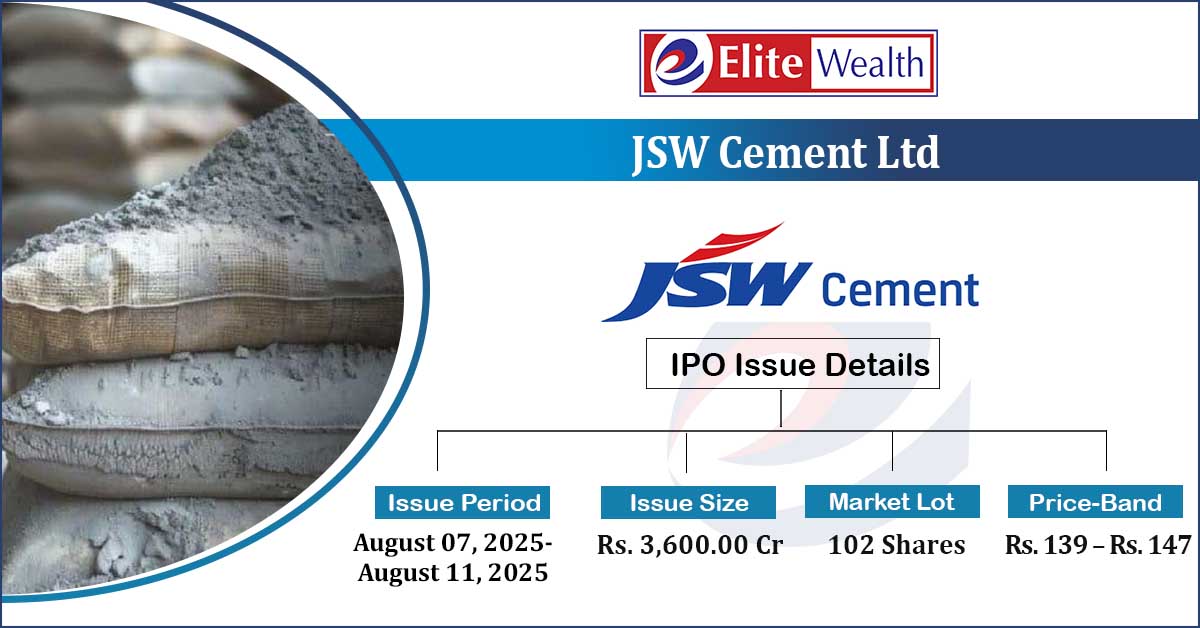

| IPO-Note | JSW Cement Ltd |

| Rs. 139 – Rs. 147 per Equity share | Recommendation: Avoid |

JSW Cement Ltd IPO Details:

| Issue Details | |

| Objects of the issue | · Funding New Manufacturing Unit

· Repayment of Borrowings · General Corporate Expenses |

| Issue Size | Total Issue Size-Rs. 3,600.00 Cr

Fresh Issue Size- Rs. 1,600.00 Cr Offer For Sale – Rs. 2,000.00 Cr |

| Face value |

Rs . 10 |

| Issue Price | Rs. 139 – Rs. 147 per share |

| Bid Lot | 102 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | August 07, 2025- August 11, 2025 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

JSW Cement Ltd IPO Strengths:

- JSW Cement is among the top three fastest-growing cement manufacturers in India in terms of increase in installed grinding capacity and sales volume between FY2015 and FY2025, as per the CRISIL Report. The company also ranks among the top 10 cement players in India by installed capacity and sales volume as of March 31, 2025. During FY2023 to FY2025, it recorded CAGRs of 12.42% in capacity and 15.05% in sales volume, surpassing industry averages.

- JSW Cement has an Installed Grinding Capacity of 20.60 MMTPA as of March 31, 2025, with 11.00 MMTPA in the southern region, 4.50 MMTPA in the western region, and 5.10 MMTPA in the eastern region. The Installed Clinker Capacity stands at 6.44 MMTPA, including capacity from JSW Cement FZC. Developed primarily through in-house expertise, the company is undertaking greenfield and brownfield expansions to reach 41.85 MMTPA grinding and 13.04 MMTPA clinker capacity, enabling a pan-India presence.

- As of March 31, 2025, JSW Cement operated seven plants across India, including one integrated unit, one clinker unit, and five grinding units in Andhra Pradesh, Karnataka, Tamil Nadu, Maharashtra, West Bengal, and Odisha. Additionally, JSW Cement FZC operates a clinker unit in the UAE.

- As of March 31, 2025, JSW Cement operated a robust distribution network comprising 4,653 dealers, 8,844 sub-dealers, 158 warehouses, and 6,559 direct non-trade customers. Backed by the JSW Group brand, the company supports retail and institutional demand through strong regional marketing and brand-building initiatives.

- JSW Cement has the lowest carbon dioxide emission intensity among its peer cement manufacturers in India and globally, as per the CRISIL Report. In FY2023, FY2024, and FY2025, the company reported emission intensities of 206 kg/tonne, 270 kg/tonne, and 258 kg/tonne, respectively—approximately 62%, 51%, and 52% lower than the Indian peer average during the same period. This reflects JSW Cement’s strong commitment to sustainable and environmentally responsible manufacturing practices.

- CRISIL Intelligence projects cement demand to grow at a CAGR of 7.5% to 8.5% during FY2026 to FY2030, slightly higher than the ~7% CAGR recorded between FY2021 and FY2025. This anticipated growth is driven by increased infrastructure investments and strong demand from the housing and industrial & commercial (I&C) segments.

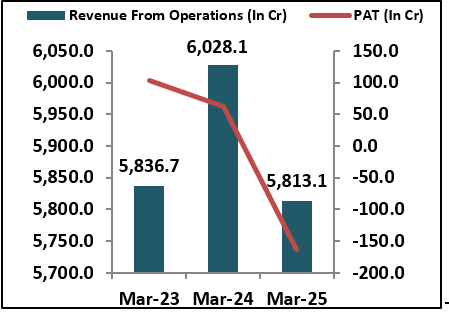

- In FY25, the company reported revenue from operations of Rs 5,813.07 crore, a decline of 3.57% from of Rs 6,028.10 crore in FY24. It recorded a net loss of Rs 163.77 crore in FY25, against a profit after tax of Rs 62.01 crore in FY24. The loss was primarily due to higher material costs and adjustments related to joint venture losses.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check JSW Cement Ltd IPO Allotment Status

JSW Cement Ltd IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select JSW Cement Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

JSW Cement Ltd IPO Risk Factors:

- The company operates in a highly competitive industry, facing significant competition from established players such as UltraTech Cement Limited, Ambuja Cements Limited, Shree Cement Limited, Dalmia Bharat Limited, JK Cement Limited, The Ramco Cements Limited, and India Cements Limited. This intense competitive environment may impact pricing flexibility, operating margins, and market share, thereby posing a potential risk to the company’s overall business performance.

- The company is reliant on the procurement of essential inputs for its operations. Any significant fluctuation in the cost or availability of these inputs may adversely impact its cost structure and profit margins, posing a risk to its overall financial performance. The recent increase in input costs has already affected profitability.

JSW Cement Ltd IPO Financial Performance:

JSW Cement Ltd IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 78.61% | 62.35% |

| Others | 21.39% | 37.65% |

Sources: Company Website, RHP.

JSW Cement Ltd IPO Outlook:

JSW Cement Ltd., a part of the diversified JSW Group, is one a leading Indian manufacturer of eco-friendly cementitious products. The company also ranks among the top 10 cement players in India by installed capacity and sales volume as of March 31, 2025. JSW Cement reported muted top-line performance and a net loss in FY25. Despite its strong historical track record, this decline is likely a one-time impact resulting from increased raw material costs and losses from a joint venture. The company benefits from the strong brand backing of the JSW Group and is well-positioned to leverage future industry growth. It remains focused on greenfield and brownfield expansions, alongside sustainability initiatives aimed at reducing carbon dioxide emissions. However, intense competition and raw material price volatility continue to pose challenges to profitability. Keeping in mind the listed factors, we recommend avoiding this issue, as we expect investors will find better opportunities in the secondary market after listing.

JSW Cement Ltd IPO FAQ:

Ans. JSW Cement IPO is a main-board IPO of 24,48,97,958 equity shares of the face value of ₹10 aggregating up to ₹3,600.00 Crores. The issue is priced at ₹139 to ₹147 per share. The minimum order quantity is 102.

The IPO opens on August 7, 2025, and closes on August 11, 2025.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The JSW Cement IPO opens on August 7, 2025 and closes on August 11, 2025.

Ans. JSW Cement IPO lot size is 102, and the minimum amount required for application is ₹14,994.

Ans. The JSW Cement IPO listing date is not yet announced. The tentative date of JSW Cement IPO listing is Thursday, August 14, 2025.