IRM Energy IPO Company Profile:

IRM Energy Limited is a city gas distribution (“CGD”) company in India, with operations at Banaskantha (Gujarat), Fatehgarh Sahib (Punjab), Diu & Gir Somnath (Union Territory of Daman and Diu/Gujarat), and Namakkal & Tiruchirappalli (Tamil Nadu), engaged in the business of laying, building, operating and expanding the city or local natural gas distribution network. The company is an integrated value-driven energy enterprise, developing natural gas distribution projects in the geographical areas (“GAs”) allotted to it for industrial, commercial, domestic, and automobile customers, and it has built its competency as a CGD company by the development of our existing GAs since 2017. The company focuses on meeting the energy needs of customers in its GAs through its pipelines and CNG station network at a competitive price, while maintaining high safety standards

The Petroleum and Natural Gas Regulatory Board (“PNGRB”) grants the company the authority to operate in a GA, along with an exemption from being under the purview of a ‘common carrier’ or ‘contact carrier’ for the transmission of natural gas within the GAs. Exemption from the purview of a ‘common carrier’ or ‘contact carrier’ allows the company exclusivity to operate in the GA and install the pipelines for supply of natural gas. This exemption provides the company with a ‘marketing exclusivity’ for transmission of natural gas, for a limited period prescribed by the PNGRB, within each of the GAs.

| IPO-Note | IRM Energy Limited |

| Rs.480 – Rs.505 per Equity share | Recommendation: Aggressive investors may apply |

IRM Energy IPO Details:

| Issue Details | |

| Objects of the issue | · To fund capital expenditure requirements for development of city gas distribution network

· To pay borrowings |

| Issue Size | Total issue Size – Rs.545.40 Cr.

Fresh Issue – Rs.545.40 Cr. |

| Face value | Rs.10 |

| Issue Price | Rs.480 – Rs.505 |

| Bid Lot | 29 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 18th Oct, 2023 – 20th Oct, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

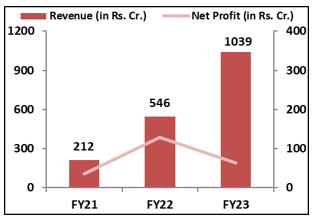

IRM Energy IPO Financial Analysis:

| Particulars | 6M of FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | FY-20(in cr.) | CAGR |

| Revenue from Operations | 504.12 | 546.14 | 211.81 | 165.66 | 48.8% |

| Other Income | 2.76 | 3.05 | 0.73 | 0.47 | |

| Cost of Goods Sold | 367.12 | 248.23 | 77.07 | 67.71 | 54.2% |

| Excise Duty on Sale of Compressed Natural Gas | 33.25 | 39.00 | 22.24 | 18.10 | |

| Employee Cost | 3.97 | 7.16 | 4.11 | 3.86 | |

| Other expenses | 38.97 | 65.33 | 35.18 | 26.28 | |

| EBITDA | 63.57 | 189.48 | 73.94 | 50.18 | 55.7% |

| EBITDA margin% | 12.61% | 34.69% | 34.91% | 30.29% | |

| Depreciation | 9.82 | 15.04 | 12.00 | 9.18 | |

| Interest | 11.40 | 22.08 | 15.86 | 9.67 | |

| PBT | 42.35 | 152.36 | 46.09 | 31.33 | 69.4% |

| Total tax | 9.23 | 38.80 | 10.96 | 10.24 | |

| PAT | 33.12 | 113.56 | 35.13 | 21.09 | 75.3% |

| PAT margin% | 6.57% | 20.79% | 16.58% | 12.73% |

Revenue Contribution from CNG and PNG:

| Particulars | Banaskantha | Fatehgarh Sahib | Diu and Gir Somnath | NG Trading | Total | |||||

| CNG% | PNG% | CNG% | PNG% | CNG% | PNG% | CNG% | PNG% | CNG% | PNG% | |

| 6M of FY-23 | 90.57% | 9.43% | 9.06% | 90.94% | 99.37% | 0.63% | 0.00% | 0.00% | 44.54% | 55.46% |

| FY-22 | 91.53% | 8.47% | 11.89% | 88.11% | 99.88% | 0.12% | 0.00% | 100.00% | 51.12% | 48.88% |

| FY-21 | 89.85% | 10.15% | 27.24% | 72.76% | 99.99% | 0.01% | 0.00% | 100.00% | 75.41% | 24.59% |

| FY-20 | 92.95% | 7.05% | 64.18% | 35.82% | 100.00% | 0.00% | 0.00% | 0.00% | 88.34% | 11.66% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check IRM Energy IPO Allotment Status

IRM Energy IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Major Shareholders of IRM Energy IPO :

| S.NO. | Name of the Investors | No. of Shares | % of shareholding |

| 1 | Cadila Pharmaceuticals Limited | 14,978,535 | 49.50% |

| 2 | Enertech Distribution Management

Private Limited |

8,670,126 | 28.65% |

| 3 | IRM Trust | 5,580,238 | 18.44% |

| 4 | Shizuoka Gas Co. Ltd. | 890,000 | 2.94% |

| Total | 7,47,03,565 | 99.53% |

IRM Energy IPO Strengths:

-

IRM Energy Limited is the sole distributor of CNG and PNG in the GAs awarded to it, for the period of exclusivity granted under the PNGRB authorizations. The company has marketing exclusivity until June 2023 for the Banaskantha GA, until September 2023 for the Fatehgarh Sahib GA, until September 2028 for the Diu & Gir Somnath GA, and until March 2030 for Namakkal & Tiruchirappalli GA, recently acquired in the eleventh round of bidding. The company has also been granted network exclusivity rights of 25 years for infrastructure creation for all the GAs, including laying down of pipelines and CNG distribution network within the GAs under the authorization received.

-

IRM Energy Limited has developed strong in-house project management capabilities, complemented by robust operation and maintenance processes. The company’s relationship with vendors, suppliers, and contractors has enabled it to expand its network in a timely and cost-efficient manner.

-

IRM Energy Limited has established strong relationships through collaborative efforts with a diverse customer base including industrial, commercial, and domestic customers. The company provides competitive offerings while maintaining a customer-centric approach and making continuous efforts to upgrade its services, by leveraging technology across all its customer operations. The company has successfully established a distribution network of CNG and PNG to customers. It served 168 industrial customers, 88 industrial customers, 96 industrial customers, 59 industrial customers, and 30 industrial customers as of September 30, 2022, September 30, 2021, March 31, 2022, March 31, 2021, and March 31, 2020, respectively.

-

IRM Energy Limited is backed by the strong parentage of an Indian multinational entity, Cadila Pharmaceuticals Limited (“Cadila Pharma”), which has a legacy of over three decades in the domestic pharmaceutical industry. Cadila Pharma holds 49.50% of the company’s Equity Shares as of the date of this Draft Red Herring Prospectus. The strategic and financial support provided by Cadila Pharma, with their experience, spanning over three decades in domestic pharmaceutical industry has significantly helped the company to overcome certain entry barriers such as the requirement of large investments, among others.

-

IRM Energy Limited has also signed a MoU with Mindra EV Private Limited on August 24, 2022, for setting up an EV charging infrastructure at DODO Stations and COCO Stations for a period of five years. This enables to further the company’s vision of transitioning towards becoming an energy-oriented company.

-

IRM Energy Limited has strategically acquired GAs with connectivity to cross-country natural gas pipelines within the GA boundary, which reduces the cost of transportation. For instance, GAIL’s Dadri-Bawana Nangal gas pipeline passes through Fatehgarh Sahib, whereas the Gujarat State Petronet Limited (“GSPL”) gas pipeline passes through Banaskantha and Diu & Gir Somnath, and the Indian Oil Corporation Limited’s Encores Tuticorin pipeline passes through Namakkal & Tiruchirappalli

-

IRM Energy Limited has grown its revenue over the years, supported by healthy year-on-year growth in volume, driven by infrastructure augmentation as well as increased penetration in the Banaskantha and Fatehgarh Sahib GAs. Ban by the National Green Tribunal (“NGT”) on the usage of polluting fuels, primarily in the Mandi Gobindgarh, Fatehgarh Sahib has spurred overall growth in volumes from the industrial segment. On account of this, the industrial customers of the company have grown from 30 to 96 from Fiscal 2020 to Fiscal 2022. The company’s strong financial position and healthy operating efficiency coupled with favorable regulations provides it with the financial flexibility to expand its network in its existing markets and expand to new markets in India.

-

The company purchases gas from governmental organizations like GAIL and RIL at fair prices. By using this procurement technique, the effects of gas availability and price fluctuation are reduced.

-

Company has established strong relationships with a diverse customer base, including industrial, commercial, and domestic customers, through its extensive CNG and PNG distribution network.

-

IRMEL has strong relationships with vendors, suppliers, and contractors enable timely and cost-efficient network expansion.

IRM Energy IPO Shareholding Pattern:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 67.94% | 50.07% |

| Others | 32.06% | 49.93% |

Source: RHP, EWL Research

IRM Energy IPO Risk Factors:

-

IRM Energy Limited is dependent on third parties for sourcing and transportation of natural gas. Any disruption in the receipt of such natural gas from these third parties, or delay or default in timely transportation of the natural gas could lead to a disruption or failure in the supply of natural gas by the company, which could adversely affect the business, reputation, results of operations and cash flows.

-

IRM Energy Limited is dependent on Government policies for the allocation of natural gas and the cost of gas supplied for its CNG and domestic PNG customers (the “Priority Sector”). Any reduction in the allocation of natural gas or any increase in the cost of gas could adversely affect the business, reputation, operations, and cash flows of the company.

-

IRM Energy Limited’s operations are restricted to defined geographical boundaries and the natural gas requirements in these regions may be affected by various factors outside the company’s control, which may adversely affect the business operations, profitability, and cash flows.

-

IRM Energy Limited’s existing GAs could be open to access for others, following the end of infrastructure and marketing exclusivity as prescribed under the PNGRB authorizations, post which period the company would no longer be the sole distributor in these regions, resulting in a potential loss of customers and decrease in the profit margins.

-

IRM Energy Limited is heavily reliant on its CNG and industrial PNG supply operations and any decrease in sales, may hurt the business, operation, financial condition, and cash flows of the Company.

-

Cadila Pharmaceuticals Limited, one of the Promoters of the company, has provided corporate guarantees to third parties for the loans availed by the Company. In the event the Company defaults on any of the loans availed, the Promoters will be liable for the repayment obligations. Further, the Company has provided corporate guarantees to third parties for the loans availed by Farm Gas Private Limited and Venuka Polymers Private Limited, IRM Energy Limited’s Associate Companies. In the event these Associate Companies default on any of the loans availed, the Company will be liable for the repayment obligations.

-

The majority of the company’s purchases are made from its top seven suppliers, who account for 100% of all purchases. Any break in the supply chain could result in a natural gas supply breakdown.

-

The company is only permitted to operate in certain geographical areas by PNGRB. Any external factors affecting these regions’ natural gas requirements could have a negative impact on business operations and profitability.

-

Government laws influence the distribution and price of natural gas for residential PNG and CNG users. Changes to these regulations could have a negative impact on the company.

Objects of the Issue:

IRM Energy Limited proposes to utilize the Net Proceeds from the Issue towards funding the following objects:

- Funding capital expenditure requirements for the development of the City Gas Distribution network in the Geographical Areas of Namakkal and Tiruchirappalli (Tamil Nadu) in Fiscal 2024, Fiscal 2025, and Fiscal 2026;

- Prepayment or repayment of all or a portion of certain outstanding borrowings availed by the Company

- General corporate purposes

IRM Energy Limited IPO Outlook:

IRMEL is a prominent urban gas distributor primarily providing CNG (Compressed Natural Gas) and PNG (Piped Natural Gas) across diverse regions in India. Their revenue stream is composed of 42.3% from CNG distribution, serving public transport vehicles like taxis, auto-rickshaws, as well as private vehicles, including cars, buses, light goods vehicles, and heavy goods vehicles. The remaining 57.6% is generated through PNG distribution. This is further divided into three categories: industrial PNG for businesses of varying sizes, commercial PNG for establishments such as hotels, restaurants, bakeries, hostels, and community halls, and domestic PNG, predominantly used for cooking. As a leading City Gas Distribution (CGD) company, IRMEL excels in serving a wide spectrum of industrial clients. They are dedicated to incorporating advanced engineering practices into their operations and stand to gain significantly from the growing shift of industries from coal to natural gas. The company is offering the P/E of 32.87x compared to the industry average of 43.93x which looks attractive. Overall the financials of the company looks good however, the business remains vulnerable to the hike in input cost due to unstable macro-environment. Considering all the factors, we recommend only aggressive investors to apply to the offering.

IRM Energy IPO FAQ

Ans.IRM Energy IPO will comprise fresh share issue and new offer share issue. The company aims to go public to accelerate its growth and expansion plan.

Ans. The company will open for subscription on <>.

Ans. The minimum lot size that investors can subscribe to is <> shares.

Ans. The IRM Energy IPO listing date is <>.

Ans. The minimum lot size for this upcoming IPO is <> shares.