Indogulf Cropsciences Limited IPO Company Profile:

Indogulf Cropsciences Limited, established in 1993, is a leading Indian manufacturer and marketer of crop protection products, plant nutrients, and biologicals, serving both domestic and international markets. The company operates through three core business verticals and offers an extensive range of formulations, including WDG, SC, CS, ULV, EW, SG, and FS, in powder, granule, and liquid forms. It was among the first indigenous manufacturers of Pyrazosulfuron Ethyl (97% purity) and Spiromesifen (96.5% purity), commencing production in 2018 and 2019, respectively. Recognized as a ‘Two Star Export House’ by the Government of India, the company exports to over 34 countries. Its product portfolio supports cereals, pulses, oilseeds, fibre crops, plantations, and horticulture. Indogulf currently operates four manufacturing facilities across approximately 20 acres in Jammu & Kashmir and Haryana.

| IPO-Note | Indogulf Cropsciences Limited |

| Rs. 105– Rs. 111 per Equity share | Recommendation: Apply |

Indogulf Cropsciences Limited IPO Details:

| Issue Details | |

| Objects of the issue | · Funding Working capital requirement

· Repayment of Borrowings · Capital Expenditure for setup Plant · General Corporate Expenses |

| Issue Size | Total issue Size – Rs. 200.00 Cr

Fresh Issue – Rs. 160.00 Cr Offer For Sale – Rs. 40.00 Cr |

| Face value |

Rs . 10 |

| Issue Price | Rs. 105 – Rs. 111 per share |

| Bid Lot | 135 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | June 26, 2025- June 30, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not More than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

Indogulf Cropsciences Limited IPO Strengths:

- As of April 30, 2025, the company distributes its products through a robust distribution network comprising 192 institutional (B2B) partners and 6,916 active domestic distributors (B2C), supported by 17 stock depots and 6 sales/branch offices across India. Additionally, the company collaborates with 143 overseas business partners, enabling efficient product distribution to more than 34 countries globally.

- Over the past three decades, the company has significantly diversified its product portfolio, evolving into a multi-product manufacturer of crop protection products, plant nutrients, and biologicals in India. The product range has expanded from 198 products in Fiscal 2022 to 262 products as of December 31, 2024. This growth is driven by the company’s in-house innovative manufacturing processes, enabling it to serve a broad customer base across both domestic and international markets.

- As part of its mid-term strategic planning, the Company focuses on product upgradation through strategic partnerships and collaborations. By leveraging technology transfers and knowledge-sharing initiatives, it aims to enhance its existing product portfolio and introduce innovative variants. This approach has facilitated the successful development of over 600 products and significantly strengthened the Company’s market presence across both domestic and international markets.

- As of April 30, 2025, the Company operates four manufacturing facilities with an aggregate installed capacity of 19,620 KL for liquid suspension concentrates, 27,930 MT for granules, and 1,980 MT for powder formulations. Additionally, the Company’s technical plant has a total installed capacity of 1,360 TPA for the production of insecticides, fungicides, and herbicides.

- India holds a 14% share of the global crop protection market, playing a vital role in enhancing agricultural productivity. Demand for agrochemicals is expected to rise from 61,097 tonnes in FY20 to 89,170 tonnes by FY36. The sector’s shift toward sustainable practices and innovation supports food security and environmental balance. A normal monsoon forecast with no El Niño impact is expected to boost agricultural activity, driving higher demand for crop protection products.

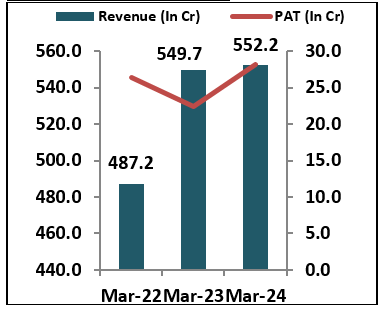

- In FY24, the Company reported revenue from operations of Rs 552.2 crore, reflecting a 26.3% increase from Rs 413.4 crore in FY23. PAT for FY24 stood at Rs 28.2 crore, marking a growth of 25.89% from Rs 22.4 crore in the previous year. For the nine months ended December 31, 2024, the Company reported revenue from operations of Rs 464.2 crore and PAT of Rs 21.7 crore.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Indogulf Cropsciences Limited IPO Allotment Status

Indogulf Cropsciences Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Indogulf Cropsciences Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Indogulf Cropsciences Limited IPO Risk Factors:

- The company faces intense competition from established players like Bayer Crop Sci., Sumitomo Chemi., P I Industries Ltd, UPL Ltd Aries Agro Ltd, Basant Agro Tech India Ltd, Best Agrolife Ltd, Bhagiradha Chemicals & Industries Ltd, Heranba Industries Ltd, India Pesticides Ltd, and Dharmaj Crop Guard Ltd poses a significant risk to the market share of the company, pricing power, and ability to attract and retain customers in the highly competitive sector.

- R&D is vital for innovation, but developing new molecules involves high costs and long timelines—averaging around nine years—making it a resource-intensive process that can limit the pace and scale of new product development.

Indogulf Cropsciences Limited IPO Financial Performance:

Indogulf Cropsciences Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 96.87%

|

69.07% |

| Others | 3.13%

|

30.39% |

Indogulf Cropsciences Limited IPO Outlook:

Indogulf Cropsciences Limited is well-positioned to capitalize on the growing demand for agrochemicals, supported by its diversified product portfolio, strong distribution network, and export presence in over 34 countries. The company’s focus on R&D, strategic partnerships, and manufacturing expansion enhances its competitiveness in both domestic and international markets. Favorable industry trends, including increased emphasis on sustainable agriculture, further strengthen its growth potential. While competition and high R&D costs remain challenges, Indogulf’s innovation-driven strategy and operational scale provide a solid foundation for long-term value creation. At the upper price band of Rs 111 per share, the issue is valued at a P/E of 19.18x based on FY24 earnings and 24.27x on projected FY25 earnings. Considering the valuation, growth prospects, and industry positioning, we recommend subscribing to the issue for both listing gains and a medium to long-term investment horizon.

Indogulf Cropsciences Limited IPO FAQ:

Ans. Indogulf Cropsciences IPO is a main-board IPO of 1,80,18,017 equity shares of the face value of ₹10 aggregating up to ₹200.00 Crores. The issue is priced at ₹105 to ₹111 per share. The minimum order quantity is 135.

The IPO opens on June 26, 2025, and closes on June 30, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Indogulf Cropsciences IPO opens on June 26, 2025 and closes on June 30, 2025.

Ans. Indogulf Cropsciences IPO lot size is 135, and the minimum amount required is ₹14,985.

Ans. The Indogulf Cropsciences IPO listing date is not yet announced. The tentative date of Indogulf Cropsciences IPO listing is Thursday, July 3, 2025.

Ans. The finalization of Basis of Allotment for Indogulf Cropsciences IPO will be done on Tuesday, July 1, 2025, and the allotted shares will be credited to your demat account by Wednesday, July 2, 2025.