Hexaware Technologies Limited IPO Company Profile:

Hexaware Technologies Limited is one of the global digital and technology services company focused on AI-driven innovation and digital transformation. It integrates artificial intelligence into its solutions, offering platforms like RapidX™ for transformation, Tensai® for automation, and Amaze® for cloud adoption. The company operates across six key sectors: Financial Services, Healthcare and Insurance, Manufacturing, Hi-Tech, Banking, and Travel. Hexaware’s offerings include Design & Build, Secure & Run, Data & AI, Optimize, and Cloud Services, all aimed at helping businesses adapt, innovate, and optimize in the AI-first era. With a global footprint across the Americas, Europe, Asia-Pacific, and the Middle East, Hexaware supports organizations in their digital journeys, enabling success in an AI-driven world.

| IPO-Note | Hexaware Technologies Limited |

| Rs.674– Rs.708 per Equity share | Recommendation: Apply |

Hexaware Technologies Limited IPO Details:

| Issue Details | |

| Objects of the issue |

· The issue is fully offered for sale so they get listing benefits. |

| Issue Size | Total issue Size – Rs. 8750 Cr

Offer for sale- Rs. 8750 Cr |

| Face value |

Re.1 |

| Issue Price | Rs.674 – Rs.708 per share

Employee Discount – Rs. 67/share |

| Bid Lot | 21 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | February 12, 2025- February 14, 2025 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

Hexaware Technologies Limited IPO Strengths:

- Hexaware is one of the global digital and technology Services Company, with AI at its core. AI-driven solutions across industries—Financial Services, Healthcare, Manufacturing, Hi-Tech, Banking, and Travel—empower digital transformation. Through platforms like RapidX™, Tensai®, and Amaze®, deliver innovative, tailored services that optimize and drive success in the AI-first era.

- Hexaware serves a diverse portfolio of clients, including 31 Fortune 500 organizations across various industries. Notable clients include 11 of the top 50 global asset management firms, 3 of the top 10 life sciences firms, 5 of the top 20 insurers, 3 of the top 5 manufacturers, 4 of the top 50 retailers, 6 of the top 20 hi-tech companies, as well as leading audit, legal, banking, and airline firms globally.

- Hexaware’s extensive intellectual property portfolio, with 20 granted patents, 119 trademarks, and 45 patents pending, underscores its innovation leadership. Operating 39 delivery centers and 16 offices across the Americas, Europe, and APAC, and employing 32,536 professionals in 28 countries, Hexaware’s global presence ensures seamless, efficient service delivery, reinforcing its competitive advantage and leadership in digital transformation.

- Global enterprise technology market spending, encompassing IT services, business process services, software, and hardware, is projected to grow at a compound annual growth rate (CAGR) of approximately 7.3% from CY2024 to CY2029. This growth will drive the total market size to approximately ₹630.7 trillion (US$7,552.7 billion), according to estimates by the Everest Group.

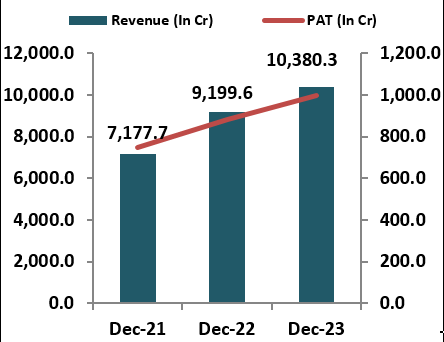

- The company reported a revenue from operations of Rs 10,380.3 crore in CY23, reflecting a growth of 12.83% compared to CY22. The profit after tax for CY23 stood at Rs 997.6 crore, representing a growth of 12.82% compared to Rs 884.2 crore in CY22. In the past nine months, the company has already achieved a profit after tax of Rs 853.3 crore, marking a 6.02% increase compared to the same period in CY23.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Hexaware Technologies Limited IPO Allotment Status

Hexaware Technologies Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Hexaware Technologies Limited IPO Risk Factors:

- The company faces intense competition from established players like Persistent Systems Limited, Coforge Limited, LTIMindtree Limited and Mphasis Limited poses a significant risk to the market share of the company, pricing power, and ability to attract and retain customers in the highly competitive sector.

- The company’s revenue is heavily concentrated in the Americas and Europe, exposing it to risks from unfavorable economic or geopolitical conditions in these regions. Tariff impositions, particularly by the United States, could also negatively impact operations and profitability.

Hexaware Technologies Limited IPO Financial Performance:

Hexaware Technologies Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 95.05%

|

74.71% |

| Others | 4.95%

|

25.29% |

Hexaware Technologies Limited IPO Outlook:

Hexaware Technologies Limited is one the global digital and technology Services Company focused on AI-driven innovation and digital transformation. According to the Brand Finance 100 2024 report, Hexaware was recognized as the ‘Fastest Growing Brand,’ advancing from 75th to 50th in the overall India rankings and from 9th to 7th among Indian IT firms. With strong financial performance and the industry poised for significant growth, the company presents promising opportunities. At the upper price band of Rs 708, the company has offered at a P/Ex of 36.4 based on its expected CY25 earnings. Keeping in mind the product profile and industry opportunity, we feel the company is expected to do better, but the price seems slightly on the higher side; thus, we advise Investors only apply for a long-term point of view and buy from the secondary market.

Hexaware Technologies Limited IPO FAQ:

Ans. Hexaware Technologies IPO is a main-board IPO of 123587570 equity shares of the face value of ₹1 aggregating up to ₹8,750.00 Crores. The issue is priced at ₹674 to ₹708 per share. The minimum order quantity is 21.

The IPO opens on February 12, 2025, and closes on February 14, 2025.

Kfin Technologies Limited is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Hexaware Technologies IPO opens on February 12, 2025 and closes on February 14, 2025.

Ans. Hexaware Technologies IPO lot size is 21, and the minimum amount required is ₹14,868.

Ans. The Hexaware Technologies IPO listing date is not yet announced. The tentative date of Hexaware Technologies IPO listing is Wednesday, February 19, 2025.

Ans. The minimum lot size for this upcoming IPO is 21 shares.