ESAF Small Finance Bank IPO Details:

The Evangelical Social Action Forum (ESAF) Bank Limited is a small finance bank that was established in 1992 with the goal of providing services to underbanked and unbanked customers, particularly those living in rural and semi-urban areas. It offers a range of products including micro loans, retail loans, MSME loans, agricultural loans and loans to financial institutions. Bank has a strong presence in Kerala, with 43% of its banking outlets located there, and is expanding in other regions. As of 2023, bank is serving 7.15 million customers and manages assets worth Rs.16,331 cr. ESAF has a network of 700 banking outlets, 767 customer service centers, and 559 ATMs spread over 21 states and two union territories.

ESAF Small Finance Bank IPO Business Offerings:

- Micro Loans, which comprise Microfinance Loans and Other Micro Loans

- Retail loans, which include gold loans, mortgages, personal loans, and vehicle loans

- MSME loans

- Loans to financial institutions

- Agricultural loans

ESAF Small Finance Bank Limited has an extensive network of 700 banking outlets (including 59 business correspondent-operated banking outlets), 743 customer service centers (which are operated by its business correspondents), 20 business correspondents, 2,023 banking agents, 481 business facilitators, and 528 ATMs spread across 21 states and two union territories, serving 6.83 million customers as at March 31, 2023.

| IPO-Note | ESAF Small Finance Bank Limited |

| Rs.57 – Rs.60 per Equity share | Recommendation: Subscribe |

ESAF Small Finance Bank IPO Details:

| Issue Details | |

| Objects of the issue | · To meet bank’s capital requirements

· To gain listing benefits |

| Issue Size | Total issue Size – Rs.463 Cr.

Fresh Issue – Rs.390.70 Cr. Offer for Sale – Rs.72.30 Cr. |

| Face value | Rs.5 |

| Issue Price | Rs.57 – Rs.60 |

| Bid Lot | 250 Shares |

| Listing at | BSE, NSE |

| Issue Opens | 03st Nov, 2023 – 07th Nov, 2023 |

| QIB | 50% of Net Issue Offer |

| NIB | 15% of Net Issue Offer |

| Retail | 35% of Net Issue Offer |

ESAF Small Finance Bank IPO Financial Analysis:

| Particulars | FY-23(in cr.) | FY-22(in cr.) | FY-21(in cr.) | CAGR |

| Interest Earned | 2853.659 | 1939.925 | 1641.17 | 31.9% |

| Other Income | 287.913 | 207.583 | 127.25 | 50.4% |

| Interest Expended | 1017.319 | 792.786 | 719.58 | 18.9% |

| Operating Expenses | 1230.541 | 862.871 | 631.86 | 39.6% |

| Provisions and Contingencies | 591.379 | 437.119 | 311.59 | 37.8% |

| PROFIT | 302.33 | 54.73 | 105.40 | 69.4% |

ESAF Small Finance Bank IPO Assets Under Management:

| AUM | FY-23(in cr.) | % | FY-22(in cr.) | % | FY-21(in cr.) | % | CAGR |

| Micro Loans | 12254.88 | 75.04% | 10015.96 | 81.16% | 7145.28 | 84.80% | 31.0% |

| Retail loans | 2614.75 | 16.01% | 1464.97 | 11.87% | 960.71 | 11.40% | 65.0% |

| MSME loans | 160.06 | 0.98% | 123.31 | 1.00% | 48.35 | 0.57% | 81.9% |

| Loans to financial institutions | 613.74 | 3.76% | 409.63 | 3.32% | 262.54 | 3.12% | 52.9% |

| Agricultural loans | 687.82 | 4.21% | 326.81 | 2.65% | 9.03 | 0.11% | 772.8% |

| Total AUM | 16331.27 | 100% | 12340.69 | 100% | 8425.93 | 100% | 39.2% |

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check ESAF Small Finance Bank IPO Allotment Status

Go ESAF Small Finance Bank IPOallotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

ESAF Small Finance Bank IPO Major Shareholders:

| S.NO. | Name of the Shareholder | No. of Shares | % of pre-Offer shareholding |

| 1. | Corporate Promoter | 280,758,396 | 62.46% |

| 2. | Kadambelil Paul Thomas | 31,186,785 | 6.94% |

| 3. | ESMACO | 22,413,659 | 4.99% |

| 4. | Yusuffali Musaliam Veettil Abdul Kader | 22,413,659 | 4.99% |

| 5. | PNB MetLife India Insurance Company Limited | 21,346,993 | 4.75% |

| 6. | Muthoot Finance Limited | 18,717,244 | 4.16% |

| 7. | Bajaj Allianz Life Insurance Company Limited | 17,469,428 | 3.89% |

| 8. | George Ittan Maramkandathil | 13,333,333 | 2.97% |

| 9. | PI Ventures LLP | 8,734,714 | 1.94% |

| 10. | ICICI Lombard General Insurance Company Limited | 6,239,081 | 1.39% |

| Total | 442,613,292 | 98.48% |

ESAF Small Finance Bank IPO Offer for Sale Details:

| Particulars | Pre- Issue | Post Issue |

| Promoters Group | 74.43% | 62.67% |

| Others | 25.57% | 37.33%

|

Source: RHP, EWL Research

| S. No. | Name of the Selling Shareholder | Aggregate amount of Offer

for Sale (in ₹ crore) |

|

| 1. | ESAF Financial Holdings Private Limited | Up to 119.26 | |

| 2. | PNB MetLife | Up to 12.67 | |

| 3. | Bajaj Allianz Life | Up to 10.37 | |

ESAF Small Finance Bank IPO Strengths:

-

ESAF Small Finance Bank Limited has a strong rural and semi-urban banking franchise. As per the CRISILMI&a Report, the company had the second-highest portfolio share and third-highest share of total banking outlets in rural and semi-urban areas as of March 31, 2023, among its compared peers.

-

ESAF Small Finance Bank Limited has a fast-growing retail deposit portfolio with low concentration risk. As per the CRISIL MI&A Report, the company had the highest share of retail deposits as a percentage of its total deposits as of March 31, 2023, among its compared peers.

-

Due to ESAF Small Finance Bank’s customer-centric products, procedures, and other non-financial services for Micro Loan customers, it enjoys strong customer connections and high customer retention rates.

-

ESAF Small Finance Bank has a deep understanding of the microloan segment, which has enabled it to grow its business outside of Kerala, its home state. As of March 31, 2023, the company had over 4.88 million customers with Micro Loans, the majority of whom were women.

-

ESAF Small Finance Bank has a technology-driven model with an advanced digital technology platform. The company offers its customers various digital platforms, including an Internet banking portal, a mobile banking platform, etc. Its customers are also able to register for its savings accounts on a unified payment interface-based mobile application. Its account opening and loan underwriting processes have been digitalized.

-

ESAF have shown robust growth with Total deposits growing from Rs.89.99 cr. in FY21 to Rs.146.65 cr.in FY23 with a strong CAGR of 27.66%.

- It has deep market penetration, with 3.5 million customers across 21 states and 2 union territories. It has a deep understanding of the microloan segment, which has enabled it to grow its business outside of Kerala, its home state.

-

The bank has a strong rural and semi-urban banking franchise. As per the CRISIL MI&A Report, the company had the second-highest portfolio share and third-highest share of total banking outlets in rural and semi-urban areas as of March 31, 2023, among its compared peers.

ESAF Small Finance Bank IPO Key Highlights:

-

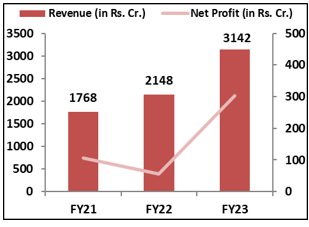

Revenue of the bank has increased from Rs.1768 cr. in FY21 to Rs.3142 cr. in FY23 with a CAGR of 21%; while profit has grown with a strong CAGR of 42% from Rs.105 cr. to Rs.302 cr. during the same period.

-

ESAFs NIM has increased from 8.45% in FY21 to 9.68% in FY23 and it stands at 2.85% for the June quarter of FY24.

-

Asset quality of the bank has improved over the years with GNPA ratio at 2.49% Vs 6.70% and NNPA at 1.13% Vs 3.88% in FY23 Vs FY21.

-

CASA ratio of the bank has grown from 19.42% in FY21 to 21.39% in FY23.

ESAF Small Finance Bank IPO Risk Factors:

-

ESAF Small Finance Bank is significantly dependent on Micro Loans and any adverse developments in the microfinance sector could adversely affect its business.

-

ESAF Small Finance Bank’s Micro Loans and some of its retail loans are unsecured and are at a higher credit risk than secured loans because they are not supported by collateral. Any failure to recover the full amount of principal and interest on unsecured advances given to its customers could adversely affect its business.

-

ESAF Small Finance Bank incurs significant operating expenses and any increase in these operating expenses without a corresponding increase in its Net Interest Income and other income combined will adversely affect its financial condition.

-

ESAF Small Finance Bank business correspondents (which include ESMACO, a Promoter Group and Group Entity, and Lahanti, a Group Entity) have sourced the majority of its advances. All of our Business correspondents work for it on a non-exclusive basis. If any of its business correspondents and in particular ESMACO prefer to promote its competitors’ loans over its loans or the agreements between them are terminated or not renewed, it would adversely affect its business.

-

ESAF Small Finance Bank could be subject to various sanctions and penalties by the RBI for failing to comply with the requirement to list the Equity Shares on a stock exchange in India before July 31, 2021. RBI may take regulatory action against it in the future.

-

ESAF Small Finance Bank is in non-compliance with certain Risk Based Supervision (“RBS”) Tranche III requirements and if the RBI imposes penalties on it for this non-compliance, it could adversely affect its reputation and business

-

As of FY23, 75% of the bank’s loans were unsecured, any inability to recover such advances would affect bank’s financial health.

-

Over 62% of ESAF’s outlets are concentrated in South India, majorly in the states of Kerala and Tamil Nadu, Any adverse change in the economy of these regions could negatively impact the bank’s operations and financial condition.

-

The bank’s rural-focused Microfinance Loan business has a number of challenges, such as high acquisition costs, a lack of product and financial knowledge among potential clients, and the susceptibility of household income to regional developments.

ESAF Small Finance Bank IPO Outlook:

ESAF is a small finance bank mainly focused on the unserved customers in the rural and semi-urban areas. It earns 81% of revenue from interest income on advances, 10% from interest income on investments, 6% from commission income and rest from the other sources. The Indian Fintech industry is expected to be the world’s third-largest at $150 billion by 2025. Innovative banking models, government initiatives like PMJDY and PMJJBY, and financial sector reforms have greatly improved financial inclusion and credit activity in India. ESAF is going to be benefited with these reforms due to its strong presence in rural and semi-urban areas. The bank intends to grow its retail lending operations and broaden its presence in rural areas, where financial inclusion is lower. Additionally, it plans to keep expanding its Micro Loans and other categories of advances. The bank is offering the P/E of 10.21x on the upper price band which is far below of the industry average of 94.74x. On the back of ESAF’s strong presence in rural areas, growing financials and attractive valuations, we recommend investors to subscribe to the offering.

ESAF Small Finance Bank IPO FAQ

Ans. ESAF Small Finance Bank IPO is a main-board IPO of 77,166,667 equity shares of the face value of ₹10 aggregating up to ₹463.00 Crores. The issue is priced at ₹57 to ₹60 per share. The minimum order quantity is 250 Shares.

The IPO opens on November 3, 2023, and closes on November 7, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The ESAF Small Finance Bank IPO opens on November 3, 2023 and closes on November 7, 2023.

Ans. ESAF Small Finance Bank IPO lot size is 250 Shares, and the minimum amount required is ₹15,000.

Ans. The ESAF Small Finance Bank IPO listing date is not yet announced. The tentative date of ESAF Small Finance Bank IPO listing is Thursday, November 16, 2023.

Ans. The minimum lot size for this upcoming IPO is 250 shares.