DAM Capital Advisors Limited Company Profile:

DAMS Capital, one of India’s leading investment banks with a market share of 12.1% in Fiscal 2024 based on the number of initial public offerings and qualified institutional placements as the book-running lead manager, leverages its deep domain knowledge across sectors and products. With a highly experienced team, they provide strategic advisory and capital markets solutions to a diverse and prestigious clientele, including corporates, financial sponsors, institutional investors, and family offices.

| IPO-Note | DAM Capital Advisors Limited |

| Rs.269 – Rs .283 per Equity share | Recommendation: Apply |

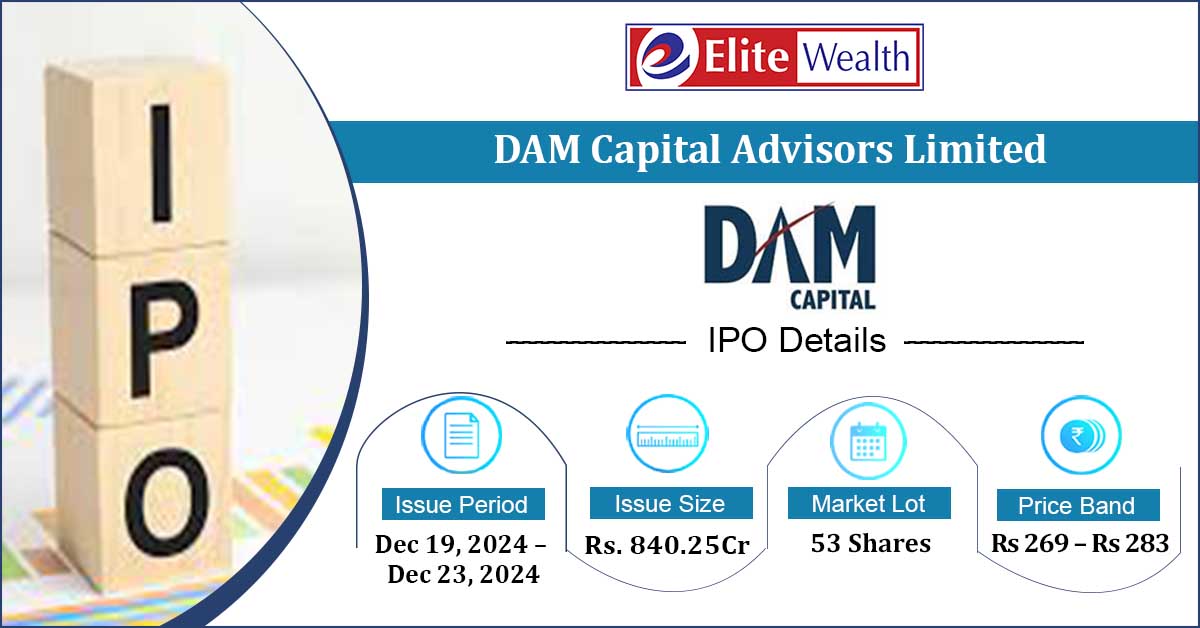

DAM Capital Advisors Limited IPO Details :

| Issue Details | |

| Objects of the issue |

· Offer for sale |

| Issue Size | Total issue Size – Rs.840.25Cr

Offer for sale- Rs 840.25 Cr |

| Face value |

Rs.2 |

| Issue Price | Rs 269 – Rs 283 |

| Bid Lot | 53 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | December 19, 2024 – December 23, 2024 |

| QIB | Not more than 50% of Net Issue Offer |

| HNI | Not less than 15% of Net Issue Offer |

| Retail | Not less than 35% of Net Issue Offer |

DAM Capital Advisors Limited IPO Strengths:

- DAMS Capital offers a comprehensive one-stop solution for merchant banking, including equity capital markets (ECM), mergers and acquisitions (M&A), private equity (PE), and structured finance advisory, along with institutional equities services encompassing broking and research.

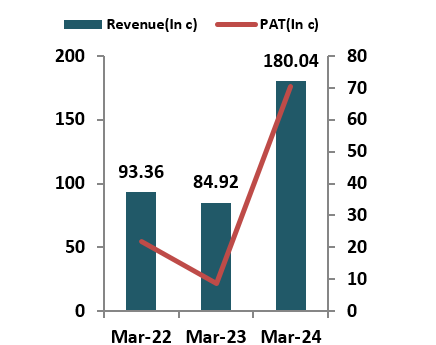

- The company reported a revenue of Rs 180 crores in FY24, reflecting a 112% increase compared to FY23. The compound annual growth rate (CAGR) of revenue from FY22 to FY24 stood at 39%.

- Till date they have successfully executed 72 ECM transactions, which include 27 initial public offerings (IPOs), 16 qualified institutional placements (QIPs), 6 offer for sale (OFS) transactions, 6 preferential issues, 4 rights issues, 8 buybacks, 4 open offers, and 1 initial public offering of units by a real estate investment trust (REIT).

- The company is led by promoter, Dharmesh Anil Mehta, with over 25 years of experience. They also have successfully recruited 121 employees from diverse backgrounds, with 45% having over 18 years of experience, who play a key role in executing business strategy, expanding client relationships, and managing service areas.

- The company achieved a return on equity (ROE) of 54.72%, in FY24 indicating its ability to generate strong returns for its existing shareholders.

DAM Capital Advisors Limited IPO Risk Factors:

- The company faces tough competition from IIFL securities, ICICI securities, JM financials and Motilal Oswal Financial services.

- The company’s business is closely tied to the economic cycle. During the contraction phase, its revenue and profitability may decrease.

DAM Capital Advisors Limited IPO Financial Performance :

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check DAM Capital Advisors Limited IPO Allotment Status

DAM Capital Advisors Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

DAM Capital Advisors Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post –Issue | |

| Promoters Group | 45.88% | 41.49% | |

| Others | 54.12% | 58.51% |

DAM Capital Advisors Limited IPO Outlook:

DAMS Capital Advisors has firmly established itself as one of India’s leading investment banks, offering a comprehensive range of services, including private equity, financial advisory, and more. The company holds a 12.1% market share as a Book Running Lead Manager. On the financial front, DAMS has demonstrated robust growth, reporting a profit of Rs. 70 crore for FY24, with Rs. 43.7 crore in profits for the half-year ended September 2024. In terms of valuation, the company’s shares are priced at a post-issue P/E ratio of 22.87, based on an expected annualized EPS of Rs. 12.37 for FY25, which appears appropriately valued. We recommend investors consider applying for this issue, anticipating potential listing gains and long-term capital appreciation.

DAM Capital Advisors Limited IPO FAQ:

Ans. DAM Capital Advisors IPO is a main-board IPO of 29690900 equity shares of the face value of ₹2 aggregating up to ₹840.25 Crores. The issue is priced at ₹269 to ₹283 per share. The minimum order quantity is 53.

The IPO opens on December 19, 2024, and closes on December 23, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The DAM Capital Advisors IPO opens on December 19, 2024 and closes on December 23, 2024.

Ans. DAM Capital Advisors IPO lot size is 53, and the minimum amount required is ₹14,999.

Ans. The The DAM Capital Advisors IPO listing date is not yet announced. The tentative date of DAM Capital Advisors IPO listing is Friday, December 27, 2024.

Ans. The minimum lot size for this upcoming IPO is 21 shares.