Crizac Limited IPO Company Profile:

Incorporated in 2011, Crizac Limited is a B2B education platform specializing in international student recruitment solutions for global institutions of higher education across the United Kingdom, Canada, USA, Republic of Ireland, Australia, and New Zealand (ANZ). The company’s core strength lies in student recruitment from India to the United Kingdom, supported by strong and long-standing partnerships with UK institutions. Powered by a proprietary technology platform, Crizac enables a global network of registered agents to efficiently source and manage student applications. For the fiscal years ending March 31, 2023, 2024, and 2025, the company facilitated applications from students in over 75 countries, reinforcing its position as a trusted partner in global education and a key enabler of scalable recruitment solutions.

| IPO-Note | Crizac Limited |

| Rs. 233– Rs. 245 per Equity share | Recommendation: May Apply |

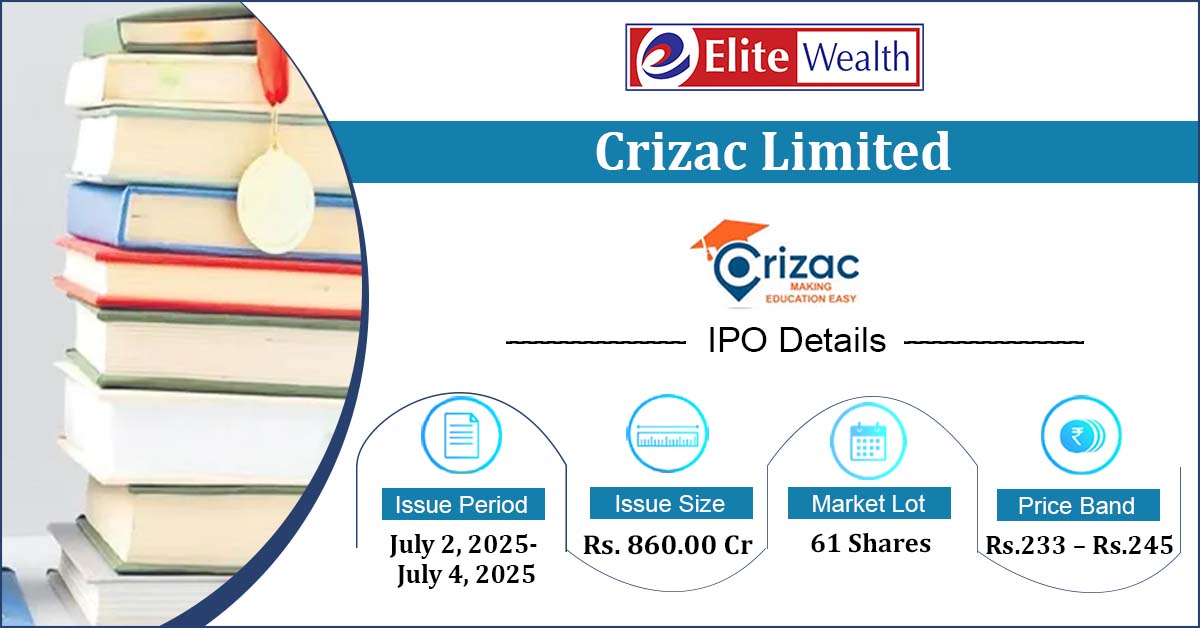

Crizac Limited IPO Details:

| Issue Details | |

| Objects of the issue | · For listing Benefits |

| Issue Size | Total issue Size – Rs. 860.00 Cr

Offer For Sale – Rs. 860.00 Cr |

| Face value |

Rs . 2 |

| Issue Price | Rs. 233 – Rs. 245 per share |

| Bid Lot | 61 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | July 2, 2025- July 4, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

Crizac Limited IPO Strengths:

- As of March 31, 2025, the company had approximately 10,362 registered agents on its proprietary technology platform, with 3,948 active agents during Fiscal 2025. This included 2,237 active agents in India and 1,711 (43.33%) across 39+ countries such as the UK, Nigeria, Pakistan, Bangladesh, Nepal, Sri Lanka, Canada, and Egypt, reflecting the company’s robust global network and reach in international student recruitment.

- The company collaborates closely with global higher education institutions to tailor recruitment strategies aligned with their unique goals. This strategic approach has driven significant growth, with revenue from operations increasing at a CAGR of 100.18% from Fiscal 2015 to Fiscal 2025 and FY23 to FY25 of 46%.

- The company plans to enhance its service offerings by providing guidance on financial aid and expanding support across key areas of the international study ecosystem. This includes student loans and foreign exchange through proposed partnerships with financial institutions, visa application assistance, and accommodation support through tie-ups with property management services and accommodation providers across its core geographies, strengthening its value proposition for international students.

- The company has over the years established long standing relationship with a global network of institutions of higher learning and for Fiscals ended March 31, 2025, March 31, 2024, and March 31, 2023 the company worked with over 173 global institutions of higher education predominantly across United Kingdom, Republic of Ireland, Canada and USA.

- Increasing globalization and the demand for quality education have significantly boosted interest in studying abroad. Students and parents are seeking global exposure, access to top institutions, and diverse cultural experiences. The global education market, valued at USD 6 trillion in 2024, is projected to reach USD 7.4 trillion by 2030. Indian students abroad are expected to grow from 1.48 million in 2023 to 2.5 million by 2030 at a 7.8% CAGR.

- The company reported revenue from operations of Rs 849.5 crore in FY25, reflecting a growth of 60.25% compared to Rs 530.1 crore in FY24. Profit after tax for FY25 stood at Rs 152.9 crore, marking an increase of 29.6% from Rs 117.9 crore in FY24. This strong financial performance underscores the company’s continued growth and operational efficiency.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Crizac Limited IPO Allotment Status

Crizac Limited IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

-

Select Crizac Ltd IPO

-

Enter your PAN Number or Application Id or DP Client Id.

Crizac Limited IPO Risk Factors:

- The company operates in a highly competitive business environment, facing competition from both Indian and international entities (listed and unlisted). Key competitors include IDP Education, ApplyBoard, SI-UK, KC Overseas, Leap Scholar, Leverage EDU, Canam, and Indiamart Intermesh. This competitive landscape may impact the company’s pricing strategies and market share, necessitating continuous innovation and differentiation to maintain its position in the international student recruitment sector.

- Changes in immigration laws, visa restrictions, or delays in student visa processing can negatively impact the flow of prospective international students. Additionally, diplomatic tensions or strained bilateral relations between countries may hinder student exchange programs or lead to more stringent visa requirements, posing potential challenges to the company’s recruitment operations and international engagement.

Crizac Limited IPO Financial Performance:

Crizac Limited IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 100.00%

|

79.94% |

| Others | 0.00%

|

20.06% |

Crizac Limited IPO Outlook:

Crizac Limited has demonstrated strong financial performance in FY25, reporting a CAGR of 100.18% in revenue from FY2015 to FY2025 and from FY23 to FY25 of 46%. The company benefits from a robust global agent network and established partnerships with leading international institutions. It also plans to expand its service offerings to include student loans, visa application assistance, and accommodation support. Crizac is well-positioned to benefit from the growing global education market. However, the company operates in a highly competitive environment, facing challenges from both listed and unlisted, domestic and international players. At the upper price band of Rs 245, the issue is priced at a P/E of 28.03x based on FY25 earnings. Considering the company’s valuations, we recommend that only aggressive investors apply for the issue, targeting listing gains and a medium to long-term investment horizon.

Crizac Limited IPO FAQ:

Ans. Crizac IPO is a main-board IPO of 3,51,02,040 equity shares of the face value of ₹2 aggregating up to ₹860.00 Crores. The issue is priced at ₹233 to ₹245 per share. The minimum order quantity is 61.

The IPO opens on July 2, 2025, and closes on July 4, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Crizac IPO opens on July 2, 2025 and closes on July 4, 2025.

Ans. Crizac IPO lot size is 61, and the minimum amount required is ₹14,945.

Ans. The Crizac IPO listing date is not yet announced. The tentative date of Crizac IPO listing is Wednesday, July 9, 2025.

Ans. The finalization of Basis of Allotment for Crizac IPO will be done on Monday, July 7, 2025, and the allotted shares will be credited to your demat account by Tuesday, July 8, 2025.