Fund Facts To generate long term capital appreciation by pursuing active management and bottom-up investing, primarily in equity and equity related instruments across sectors and market cap spectrum. The scheme will anchor to investing in growth businesses and is best suited for investors with long term investment horizon.…

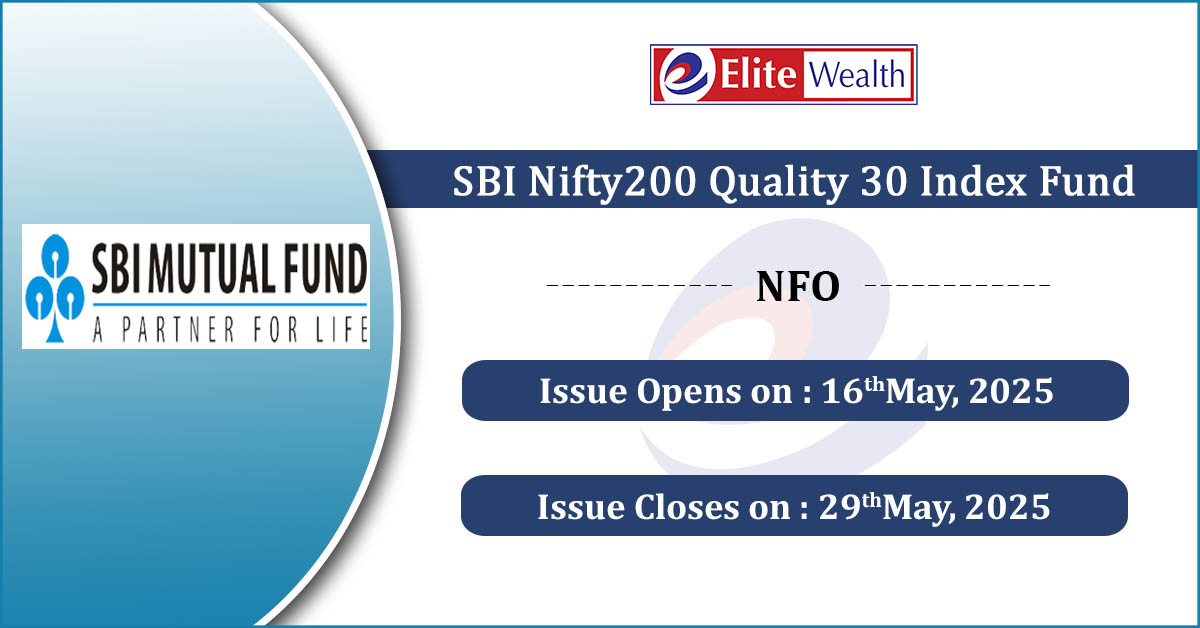

The investment objective of the scheme is to provide returns that correspond to the total returns of the securities as represented by the underlying index, subject to tracking error. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved. Product Label…

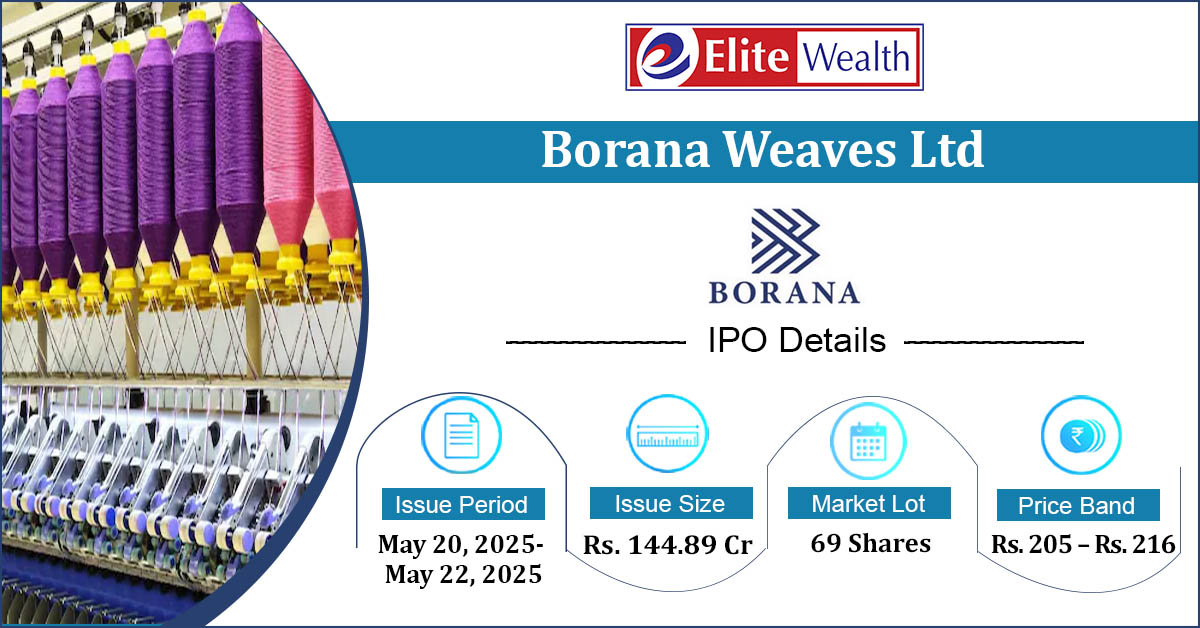

Borana Weaves Ltd IPO Company Profile: Incorporated in 2020, Borana Weaves Ltd. is manufacturer of microfilament and greige polyester woven fabrics. The company operates a fully integrated, state-of-the-art facility featuring high-speed water jet looms and manages the entire production process under one roof—from POY to PTY, including warping,…

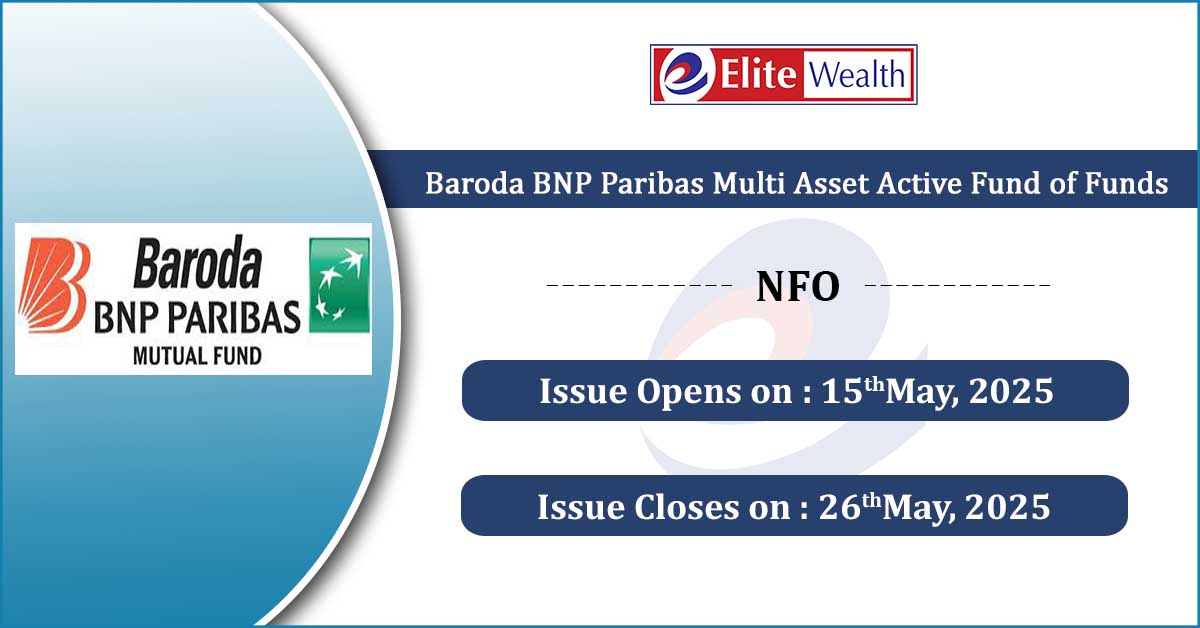

A fund of funds scheme means a mutual fund scheme that invests primarily in other schemes of the same mutual fund or other mutual funds. These funds offer diversification across various asset classes. The fund can strategically allocate assets to achieve varying investment objectives, such as focusing on…

ICICI Prudential Quality Fund India’s growth story is powered by a wide universe of companies- but only a select few demonstrate sound fundamentals. These quality businesses are characterized by robust balance sheets, consistent earnings and prudent management. In a volatile market, such companies may offer greater resilience and…

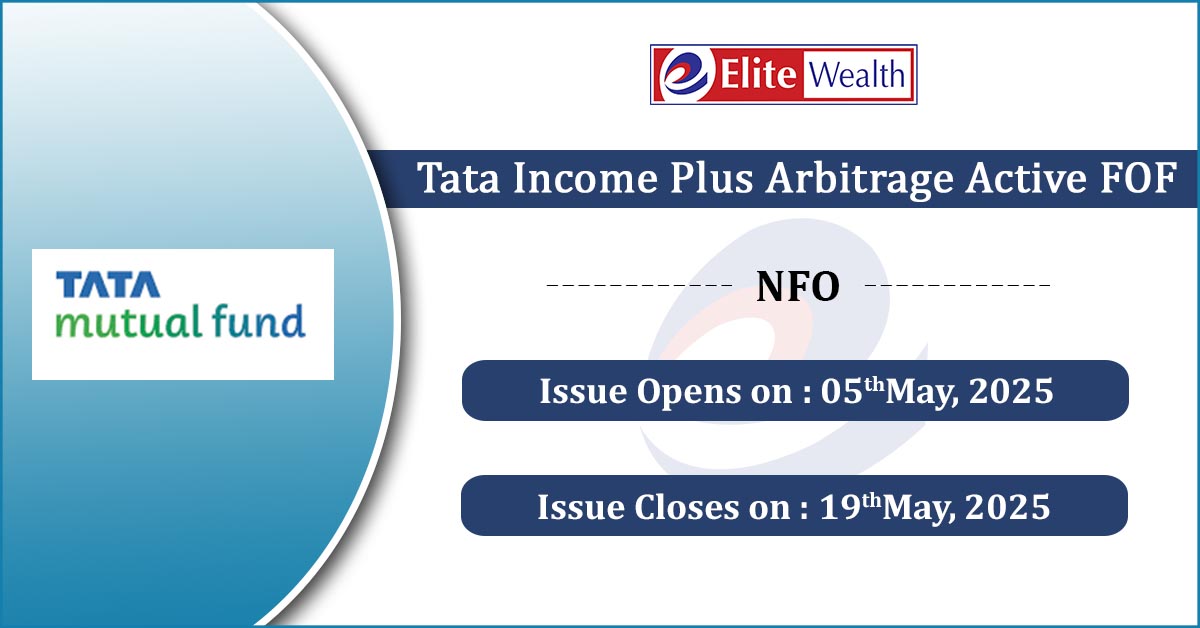

Summary An open-ended fund of fund investing in domestic mutual funds including debt oriented mutual fund schemes & arbitrage-based equity mutual fund schemes Investment Philosophy The scheme aims to provide long-term capital appreciation by investing in domestic mutual funds including debt oriented mutual fund schemes & arbitrage-based equity…

ANGEL ONE NIFTY 50 INDEX FUND NFO Details: Mutual Fund Angel One Mutual Fund Scheme Name ANGEL ONE NIFTY 50 INDEX FUND Objective of Scheme The investment objective of the Scheme is to replicate Nifty 50 Index with an aim to provide returns before expenses that track the…

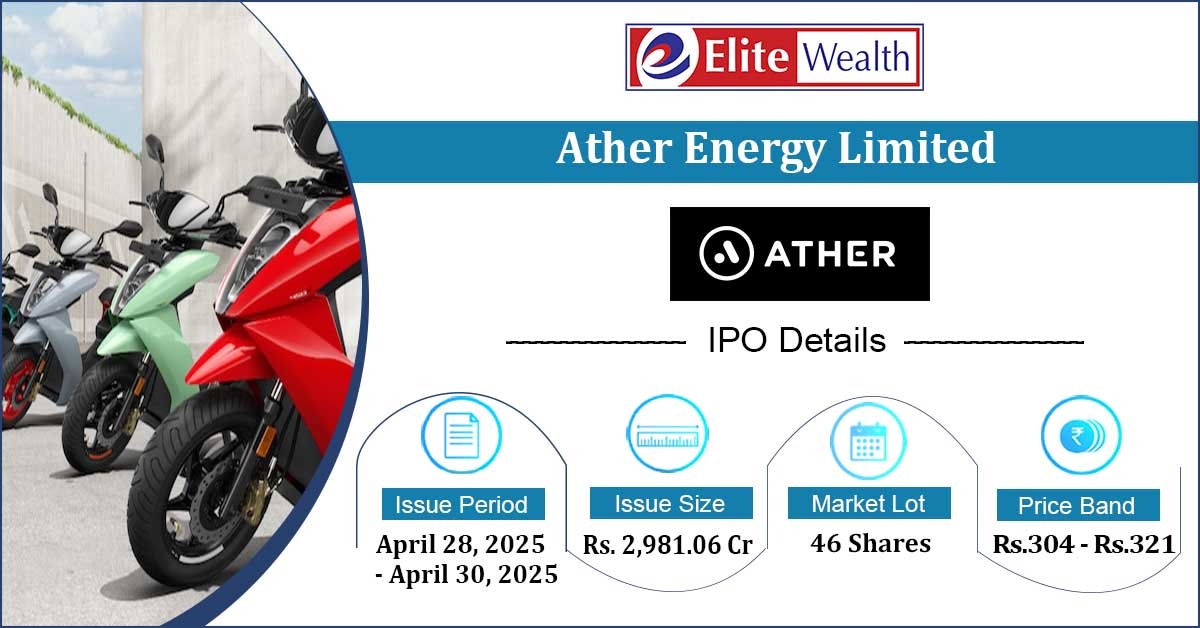

Ather Energy Limited IPO Company Profile: Ather Energy Limited, incorporated in 2013, is an Indian electric two-wheeler (E2W) company involved in the design, development, and in-house assembly of electric scooters, battery packs, charging infrastructure, and supporting software systems. The company operates as a vertically integrated EV manufacturer with…

Overview An active factor-based strategy that blends predictive modelling with our investment research expertise & capabilities. At its core lies the Factor Allocation Model, which dynamically allocates weight to four key investment factors: Momentum, Low Volatility, Quality, and Value. These factors not only represent distinct strategies but also synergize to…

Investment Objective: The primary investment objective of the scheme is to seek to generate returns by investing in units of DSP Silver ETF. There is no assurance that the investment objective of the Scheme will be achieved. (source : https://www.dspim.com/) Silver ETF Fund of Fund NFO Details: Mutual…