Firstcry IPO Company Profile:

The company was founded in 2010 as Brainbees Solutions Limited, operating through its online platform and offline platform, FirstCry. It provides a wide range of products for mothers, babies, and kids, aiming to be a comprehensive destination for parental retail, content, community engagement, and education needs. FirstCry caters to children from infancy to 12 years old, offering products such as apparel, footwear, baby gear, nursery essentials, diapers, toys, and personal care items.

The company has expanded internationally in select markets, establishing a presence in UAE and KSA in 2019 and 2022 respectively, where they aim to replicate the India playbook. It features products from Indian and global brands, as well as its own proprietary brands. The company’s strong brand awareness and customer trust are exemplified by Baby Hug, one of its house brands. According to a Red Seer report, Baby Hug was the largest multi-category brand for mother, baby, and kids’ products in India by GMV for the year ending December 2023.

| IPO-Note | Brainbees Solution Limited |

| Rs.440 – Rs.465 per Equity share | Recommendation: Listing Gains |

Firstcry IPO Details:

| Issue Details | |

| Objects of the issue | · To establish new stores and warehouses

· Expenditure on lease payments. · Sales and marketing initiatives. |

| Issue Size | Total issue Size – Rs.4193.73 Cr

Fresh Issue – Rs 1666 Cr Offer for sale- Rs 2527.73Ccr |

| Face value | Rs.2 |

| Issue Price | Rs.440 – Rs.465(employee discount Rs44 per share) |

| Bid Lot | 32 Shares |

| Listing at | BSE, NSE |

| Issue Opens | August 6, 2024 – August 8, 2024 |

| QIB | 75% of Net Issue Offer |

| HNI | 15% of Net Issue Offer |

| Retail | 10% of Net Issue Offer |

Firstcry IPO Strengths:

- FirstCry provides an extensive range of products, including diapers, baby food, newborn accessories, gear (like strollers and high chairs), nursery furniture, clothing, footwear, toys, and school supplies. These diverse offerings are tailored to meet the needs of parents shopping for their children. The store features a broad selection of baby and kids’ items from leading manufacturers.

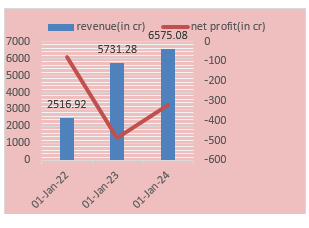

- A 14% rise in revenue year-over-year is impressive. For the year ended FY24, the revenue of 64,808.56 crores indicates strong performance and growth for the company.

- Concepts such as “gift boxes,” which are delivered to new mothers in partnership with hospitals, aid in customer acquisition. To date, over 600,000 FirstCry boxes have been delivered.

Firstcry IPO Risk Factors:

- The company’s financial health is weak, having reported a loss of 321.51 crores for the financial year 2023-2024. Additionally, the return on net worth is negative, standing at -8.65%.

- The company net borrowings have also risen by 286.25 crores. Inability to manage this debt effectively could hamper its operations.

- FirstCry’s products are priced higher compared to competitors. The company focuses on a niche market segment in India that is still emerging.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Firstcry IPO Allotment Status

Firstcry IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Firstcry IPO Financial Performance:

Firstcry IPO Shareholding Pattern:

| Particulars | Pre- Issue | |

| Promoters Group | 6.29% | |

| Funds holdings | 76.35% |

Firstcry IPO Outlook:

Brainbees Solutions Limited holds the largest market share in India for the sector producing clothing and other items for babies and children. The company enjoys strong brand value in the market, allowing it to sell its products at a premium due to high brand recognition. Currently, there are no direct competitors in the same segment. With e-commerce growing at an annual rate of 11.45%, the company is poised for future expansion. The wide range of products offered by Brainbees consolidates multiple needs for new parents in one place, reducing the need to visit different websites. Company revenue has increased by 14% as compared to FY23.

The company has reported losses for FY24, which stands at Rs 321.51cr which has decreased by 33% as compared to FY23. Additionally, the company’s market reach is limited due to the higher pricing of its products. Despite these challenges. Profitability remains uncertain, and it may take some time for the company to achieve positive turnaround.

There is potential for increased demand as Brainbees plans to open new stores and invest in growth. Investors with a long-term perspective and higher risk tolerance are encouraged to consider applying for the IPO.

Firstcry IPO FAQ:

Ans.

Brainbees Solutions (Firstcry) IPO is a main-board IPO of 90,187,690 equity shares of the face value of ₹2 aggregating up to ₹4,193.73 Crores. The issue is priced at ₹440 to ₹465 per share. The minimum order quantity is 32 Shares.

The IPO opens on August 6, 2024, and closes on August 8, 2024.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Brainbees Solutions (Firstcry) IPO opens on August 6, 2024 and closes on August 8, 2024.

Ans. Brainbees Solutions (Firstcry) IPO lot size is 32 Shares, and the minimum amount required is ₹14,880.

Ans. The Brainbees Solutions (Firstcry) IPO listing date is not yet announced. The tentative date of Brainbees Solutions (Firstcry) IPO listing is Tuesday, August 13, 2024.

Ans. The minimum lot size for this upcoming IPO is 32 shares.