Belrise Industries Ltd IPO Company Profile:

Established in 1988, Belrise Industries Ltd is manufacturer of components for the Automotive and White Goods industries. Its diverse portfolio includes sheet metal, casting, polymer parts, suspension, and mirror systems for two-, three-, and four-wheelers vehicle. The company has expanded into e-mobility components and subsystems. With 17 manufacturing facilities across 9 Indian states and strong ties with major OEMs, Belrise exports to the U.S., U.K., Japan, and China, focusing on delivering customer success through agile, robust manufacturing.

| IPO-Note | Belrise Industries Ltd |

| Rs.85– Rs.90 per Equity share | Recommendation: Apply |

Belrise Industries Ltd IPO Details:

| Issue Details | |

| Objects of the issue |

· Repayment of Borrowings · General Corporate Expenses |

| Issue Size | Total issue Size – Rs. 2,150 Cr

Fresh Issue – Rs. 2,150 Cr |

| Face value |

Rs . 5 |

| Issue Price | Rs. 85 – Rs. 90 per share |

| Bid Lot | 166 Shares |

| Listing at |

BSE, NSE |

| Issue Opens | May 21, 2025- May 23, 2025 |

| QIB | Not More than 50% of Net Issue Offer |

| HNI | Not Less than 15% of Net Issue Offer |

| Retail | Not Less than 35% of Net Issue Offer |

Belrise Industries Ltd IPO Strengths:

- The company ranks among the top three players in India’s two-wheeler Vehicle metal components segment, holding a market share of 24% in terms of revenue as of March 31, 2024, according to the CRISIL Report.

- CRISIL Intelligence expects the auto component market to grow at 9-11% CAGR from FY2024 to FY2029, reaching Rs 12,000-13,000 billion. FY2025 will see 9-11% growth, supported by economic recovery and robust demand from OEMs and exports.

- The automotive portfolio includes over 1,000 products, such as chassis systems, exhausts, body-in-white parts, and polymer components, catering to OEMs across two-wheelers, three-wheelers, four-wheelers, commercial, and agri-vehicles.

- In March 2025, the company acquired H-One India Private Limited (“H-One”), previously a subsidiary of H-One Company Limited, a listed entity in Japan. As of March 31, 2025, the acquisition strengthens the company’s market position and expands its capabilities within the automotive sector, aligning with its strategic growth objectives.

- The company is working towards developing key proprietary components such as motors, motor controllers, and chargers to increase the content per vehicle, particularly for the electric vehicle market. Additionally, it is expanding into the renewable energy sector by developing sheet metal structures for solar applications.

- Regarding electric vehicle (EV) components, the company intends to increase its content per vehicle by manufacturing and supplying hub motors and chargers. The relevant manufacturing facility is scheduled to become operational in Q1FY26. Furthermore, the company has filed five patents related to electric motors, motor controllers, and vehicle control units for EV applications.

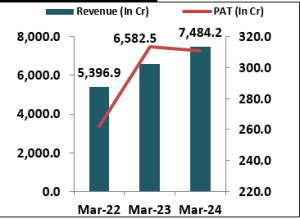

- It has reported revenue from operations of Rs 7484.24 cr in FY24 up 13.6% from Rs 6582.5 cr in FY23 and PAT for FY24 of Rs 310.9 cr declined 0.88% from Rs 313.7 cr in FY23. As of 31th Dec 2024, revenue form operations of Rs 6013.4 cr and PAT of Rs 245.5 cr.

Trade AnyTime AnyWhere With Elite Empower Mobile App

Check Belrise Industries Ltd IPO Allotment Status

Belrise Industries Ltd IPO allotment status would be available soon after the IPO closure date. Usually the allotment comes within a week from the closing date which in this IPO yet to be announced.

One can check the allotment on the given below link with PAN number or Application number or DP Client Id. All you need to do is to follow these steps:-

Belrise Industries Ltd IPO Risk Factors:

- Fluctuating raw material prices, like iron and steel, challenge cost management, with price spikes eroding profit margins. Manufacturers must absorb costs or pass them on, risking business loss. Additionally, changes in international trade policies, such as U.S. tariffs, further impact industry dynamics.

- The company faces intense competition from established players like Minda Corporation Ltd, Uno Minda Ltd, Motherson Sumi Wiring India Ltd and JBM Auto Ltd poses a significant risk to the market share of the company, pricing power, and ability to attract and retain customers in the highly competitive sector.

Belrise Industries Ltd IPO Financial Performance:

Belrise Industries Ltd IPO Shareholding Pattern:

| Particulars | Pre Issue | Post issue |

| Promoters Group | 99.81%

|

77.01% |

| Others | 0.19%

|

26.99% |

Belrise Industries Ltd IPO Outlook:

Belrise Industries is poised for growth, leveraging its strong market presence in automotive and white goods sectors. The company’s expansion into e-mobility components and renewable energy aligns with the projected 9-11% CAGR growth in the auto component market. Strategic acquisitions, such as H-One, enhance its competitive position. However, challenges like fluctuating raw material prices, intense competition from major players, and potential trade policy disruptions could impact profitability and market share. At the upper price band of ₹90 per share, the issue is priced at a P/E multiple of 18.85x based on FY24 earnings and 24.47x on estimated FY25 earnings. Given that the valuation is on the higher side, so we recommend apply to the issue purely for aggressive investors, both for listing gains and long-term investment.

Borana Weaves Ltd IPO FAQ:

Ans. Belrise Industries IPO is a main-board IPO of 238888888 equity shares of the face value of ₹5 aggregating up to ₹2,150.00 Crores. The issue is priced at ₹85 to ₹90 per share. The minimum order quantity is 166.

The IPO opens on May 21, 2025, and closes on May 23, 2025.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Ans. The Belrise Industries IPO opens on May 21, 2025 and closes on May 23, 2025.

Ans. Belrise Industries IPO lot size is 166, and the minimum amount required is ₹14,940.

Ans. TThe Belrise Industries IPO listing date is not yet announced. The tentative date of Belrise Industries IPO listing is Wednesday, May 28, 2025.

Ans. The minimum lot size for this upcoming IPO is 166 shares.